The Lifetime Allowance (LTA) is a cap on the amount of pension benefits you can withdraw without triggering an extra tax charge. It is due to rise by 0.5% in April 2021, up to £1,078,900.

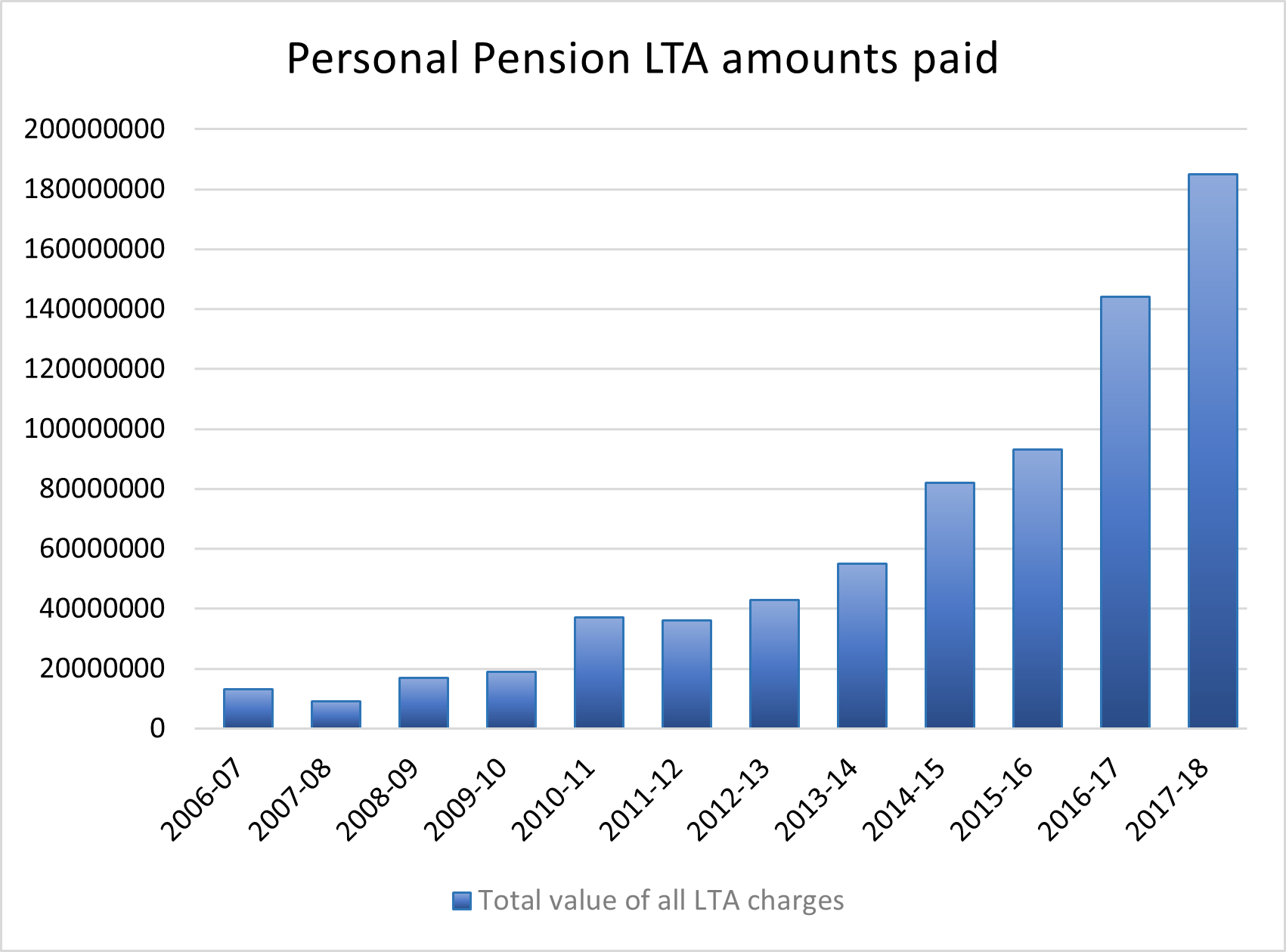

A million pounds might sound like a large pension fund, but it could amount to income in retirement of around £30,000 a year, about the same as the current average UK salary. HMRC figures show a sharp rise in LTA charges over recent years.

Understanding the LTA, the types of events that will see your pension tested against it, and the amount you might have to pay if you fall foul of it, is a crucial part of your retirement planning. Luckily, we’re here to help.

Here’s everything you need to know about the pensions LTA.

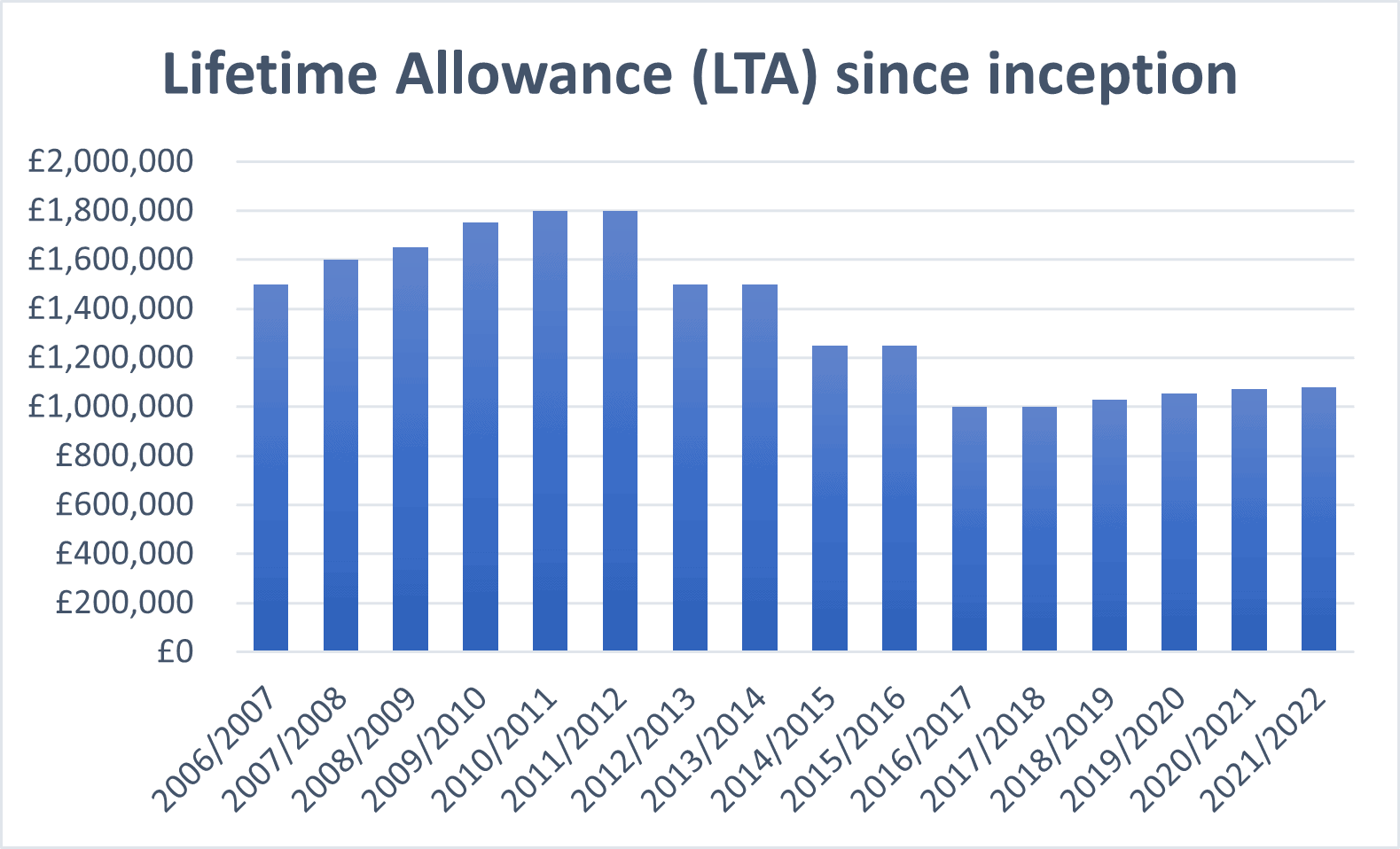

The LTA rises in line with the Consumer Prices Index (but it hasn’t always)

When it was introduced in 2006, the LTA stood at £1.5 million. It rose as high as £1.8 million between 2010 and 2012 and then dropped back to £1 million by 2016. From 2018 it began to increase annually with the Consumer Prices Index (CPI).

The rise in 2021 means that you should be entitled to an extra £1,450 in tax-free cash.

You’ll be tested against the LTA when you take (or crystalise) pension benefits in certain ways. You may have to pay a charge of up to 55% depending on how you are accessing your fund.

Benefit Crystallisation Events and the LTA charge

When you take benefits from your pension a test is conducted to ensure you have not exceeded the LTA. A test is carried out each time a Benefit Crystallisation Event (BCE) occurs.

There are currently thirteen BCEs including taking the whole of your fund as a lump sum under Pension Freedom rules (a so-called Uncrystallised Fund Pension Lump Sum), moving Defined Contribution (DC) funds into drawdown and reaching age 75 with uncrystallised funds remaining.

When a BCE occurs, any pension benefits that exceed the LTA become liable for the LTA charge. If you take the excess amount as a lump sum the charge is 55%. If you access it as income the charge is 25%.

Understanding the different BCEs and how they apply to you can be tricky, but it could affect how you opt to take your pension. Our chartered financial planners can help you get to grips with this, so speak to us if you’re unsure about any aspect of the LTA, or whether a fund withdrawal constitutes a BCE.

You will always have been tested against the LTA by age 75

You’ll always have had your benefits tested against the LTA by at least your 75th birthday. This is because even if you have not yet triggered a BCE by this age, all your uncrystallised pension funds are tested at this point.

Your benefits will be tested against the Lifetime Allowance if you die before crystallising any benefits and before you reach age 75.

If you have taken drawdown, there is a second test at age 75 that checks investment growth against the LTA.

Regular financial advice can help mitigate and manage a large LTA charge

Back when it was introduced, the LTA of £1.8 million might have seemed a long way off for many. As HMRC figures show though, the amount and value of LTA charges being paid have risen quickly in the last decade.

From a low during the 2007/08 tax year when £9 million was paid in LTA charges, in 2017/18 the figure rose to £185 million.

Source: HMRC

We can help you put a financial plan in place for your retirement that considers the likelihood of an LTA charge becoming payable. Regular reviews enable us to check on the progress of your retirement funds so that the advice we give you is always up to date.

There are many factors to consider, from how you want to access your retirement fund, your age and life expectancy, and how you plan to distribute your wealth on death. We can talk through your options.

It might not be possible – or indeed preferable – to avoid an LTA charge altogether but with Income Tax and IHT to consider we can help ensure the outcome is as tax-efficient as possible and aligns with your long-term plans and aspirations.

Get in touch

With the LTA set to increase in April 2021, now is a great time to take steps to understand it. Being aware of the LTA and its implications is the first step in putting a plan in place to mitigate its impact.

Please contact us if you’d like to discuss the potential impact of an LTA charge or any aspect of your long-term retirement plan.