A recent report by Open Money looked at the financial advice gap. It found that only 7% of UK adults have paid for advice in the last two years. Of those that had, 90% found it helpful. And while the under-25s are the most likely to seek paid advice in the future, there is also a growing tendency for this group to turn to social media.

The advice available on platforms such as TikTok, Facebook, and Twitter often includes unregulated firms and is delivered by people not qualified to advise. This could put your child or grandchild’s future financial stability in danger.

Keep reading for a closer look at the survey results, and what can be done to keep your loved ones safe from social media scams.

Figures suggest the advice gap is widening but there is increased understanding around the costs involved too

One in fourteen people paid for advice in the last two years. This compares to 1 in every 10 when the same research was conducted in 2020.

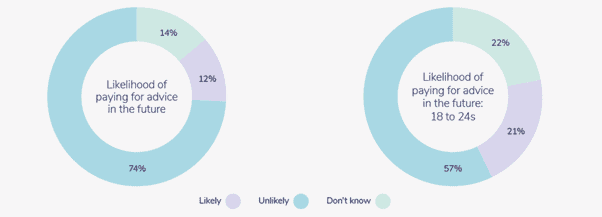

Of those who did pay for advice, just 12% said they were likely to pay for it again in the future. This number, though, rises to 21% among the 18 to 24 age group.

Source: Open Money

There also appears to be an increased understanding among this demographic of the value of professional advice. Last year, 25% of 18- to 24-year-olds were concerned about the cost of advice. This year, the figure was just 11%.

This is in the context of the coronavirus pandemic, which saw the under-25s among those financially hit the hardest.

If you have children or grandchildren in this age category, the figures seem encouraging. But professional advice has competition.

Under 25s are more likely to get advice from TikTok than a financial adviser

Figures published by Action Fraud in May 2021 confirm that victims lost over £63 million to investment fraud scams on social media in 2020. And yet 9% of respondents aged 18 to 24 confirmed that they use social media platforms such as TikTok and Instagram for financial advice.

There are several reasons why this is a bad idea. Here are three of them:

1. The “advice” they receive could be unregulated

Back in March 2021, the FCA warned of increasing numbers of high-risk investors among the under-25s. It suggested that an over-reliance on social media could be partly responsible for the rise among largely inexperienced investors who can ill-afford to lose their money.

Social media “tips” promoted on sites like TikTok and Instagram include investing in cryptocurrencies, foreign exchange trading, and other high-risk products. They often come with celebrity endorsements and many of the “opportunities” are not regulated by the FCA.

They are also unlikely to contain disclaimers that would make the risks they pose clear.

A recent BBC report found finance-related TikTok videos that failed to explain the risks attached or the need for professional advice. Some used past market performance to indicate future growth and one video used an astrologer with more than 1 million followers to explain how the position of the planets could affect the price of cryptocurrency.

2. Their investments could see losses through chasing trends

Back in January 2021, users of social media platform Reddit disrupted short-sellers buying into struggling US retailer GameStop. While the disruption cost many large-scale investors dear, it also affected the Redditors who joined too late and who bought in just as the price began to fall.

Cryptocurrency is another area susceptible to wild swings in value. SpaceX founder Elon Musk caused the value of Dogecoin to drop by 35% back in May. The drop followed a single joke Musk made on the US comedy show Saturday Night Live.

3. They could be opening themselves up to potential scams

Some stars are lending their faces (and followers) to potential investment scams, without understanding the risks involved.

Stars from The Only Way is Essex and Geordie Shore have used their accounts to promote investments in foreign exchange (Forex) funds, for example, which are not FCA-registered.

Other stars including Holly Willoughby, Phillip Schofield, and Martin Lewis, have found their faces attached to advertisements without their knowledge or consent, as reported by the Guardian earlier this year.

There are some key financial lessons that professional advice can teach

At HA&W we can help you to teach your loved ones the value of professional financial advice.

Investment should only ever be a long-term proposition based on an understanding of the risks involved and with a clear end goal. It also requires patience.

The general trend of the market is upward and therefore remaining invested – even during periods of volatility – is likely to see better returns overall than short-term trend-chasing.

Get in touch

If you have loved ones that could benefit from financial advice, or you are worried about the effects of social media on their future financial stability, contact us now to find out how we could help.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.