In September 2023’s draw, your odds of a Premium Bonds win were the highest they’ve been in 15 years. Changes to the prize fund mean you currently have a 1 in 21,000 chance of a win, odds not seen since September 2008.

Keep reading for a look at the latest prize breakdown, the pros and cons of holding money in Premium Bonds and other National Savings and Investment (NS&I) products you might consider.

Money held in Premium Bonds is 100% safe

We’ve spoken before about NS&I and the reasons why your money is safe, but here’s a quick reminder.

NS&I is more than 160 years old with around 25 million customers and more than £202 billion invested.

While the Financial Services Compensation Scheme (FSCS) can protect your money up to an £85,000 limit, with NS&I you are effectively lending money to the UK government.

That means that your savings and investments are Treasury-backed and 100% secure.

And because NS&I offer a wide range of products, you can choose the right one for you, from ISAs to Guaranteed Growth Bonds, as well as the chance of a £1 million prize through Premium Bonds.

Recent changes to the prize fund make Premium Bonds more tempting than ever

Premium Bonds allow you to take advantage of NS&I’s treasury-backed security with the added possibility of a big win.

If you are over the age of 16, you can pay a minimum of £25 into Premium Bonds. If you want to open a Premium Bond account for a child you can do that too, paying in on their behalf. As a parent or guardian, you will be in charge of looking after the account until the holder turns 16.

Each £1 bond you buy is a single entry into the prize draw with a chance to win up to £1 million. The maximum you can hold in a Premium Bond is £50,000, although this limit is individual to you. So, as a couple, you and your partner could save £100,000.

You don’t receive any interest on the amount you hold in Premium Bonds but any wins are paid tax-free.

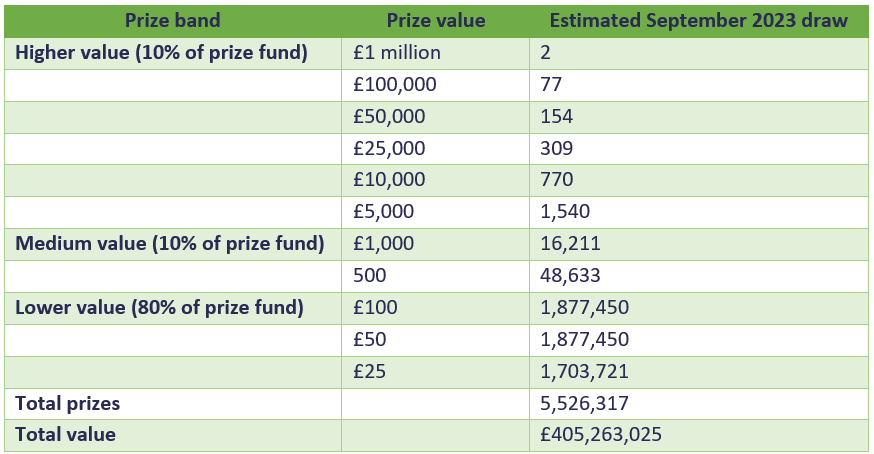

Currently, the monthly prize draw pays out as follows:

Source: National Savings and Investments (NS&I)

These figures represent the best chance of a win since 2008.

As each £1 Bond represents one entry into the draw, now might be a great time to securely increase your chances of a tax-free win.

There are other great value NS&I products available

NS&I offers a range of products alongside its flagship Premium Bond. These include the Green Savings Bond and the Direct Saver.

Green Savings Bond

Launched in his March 2021 Budget, Rishi Sunak introduced NS&I’s Green Savings Bond in the summer of that year.

The product is a great way to align your money with your values on environmental issues. The product is intended to help the government support “green” projects in the UK.

The three-year fixed-rate bond was launched with a rate of just 0.65% but this was soon increased. The product was relaunched in February 2022 with a new rate of 1.3%.

Since then, it has continued to rise and currently stands at 5.7%.

You can put anything from £100 to £100,000 aside, but you can’t withdraw the money until the end of the three-year term.

The NS&I Green Bond is open to anyone over the age of 16 who holds a UK bank account.

Direct Saver

The NS&I Direct Saver is an easy access savings account.

You can save between £1 and £2 million and access your money whenever you like, with no charge. As it’s an NS&I product, you know that however much you choose to put aside, it’s 100% safe.

The current interest rate is 3.65%.

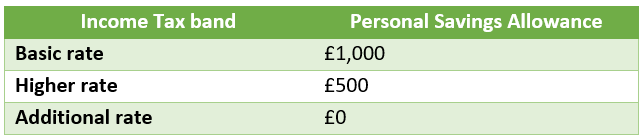

Be aware that there may be tax to pay on the interest you earn. If you exceed your “Personal Savings Allowance” you’ll pay tax based on your Income Tax band, as follows:

Source: HMRC

Rising rates mean you might need to think about the amount you hold in a Direct Saver.

Get in touch

Premium Bonds might not be right for everyone, but they do give you the chance of a once-in-a-lifetime prize win.

At HA&W, our holistic approach to your finances means we can help you find exactly the right balance of savings and investments for you. This will help you to make your long-term dreams a reality, with or without a £1 million Premium Bonds prize.

Contact us now to find out how our Chartered financial planners could help you.

Please note

The Financial Conduct Authority does not regulate NS&I products.