A group of pension trustees recently lost a High Court review into government pension changes.

Trustees of the schemes for workers at BT, Ford, and Marks & Spencer represent around 450,000 scheme members with £83 billion of assets.

The ruling – which gives the go-ahead for the government to replace the Retail Prices Index (RPI) with the Consumer Price Index (CPI) – could affect millions of pensioners.

If you have a defined benefit (DB) or “final salary” pension, it could affect you too.

Keep reading to find out what the proposed changes are, what the failed judicial review means, and how the government’s changes could reduce the pension you receive.

Understanding your DB scheme

DB pensions are often seen as the gold standard of pensions. Unlike a defined contribution (DC) scheme – in which you contribute into a pot that is used to “buy” a retirement income – DB schemes are based on your employment record.

The occupational scheme pays out based on your salary, years of service, and the accrual rate (an agreed proportion of your earnings that you’ll receive as a pension for each year you were in the scheme).

The pension you receive will be “revalued” from the date you leave the company to the date you start taking your pension. Your income will probably also rise (be “indexed”) by a certain percentage each year.

Both revaluation and indexation are intended to counter the effects of inflation. Historically, they have used RPI but this is about to change.

The government plans to replace RPI with the generally lower inflation measure CPIH

Back in 2011, David Cameron’s government announced that the Retail Prices Index (RPI) was to be scrapped as a measure of UK inflation.

The Office for National Statistics (ONS) stated that RPI was “a very poor measure of general inflation”. It was soon replaced by the Consumer Price Index (CPI), and then by CPI including housing (CPIH).

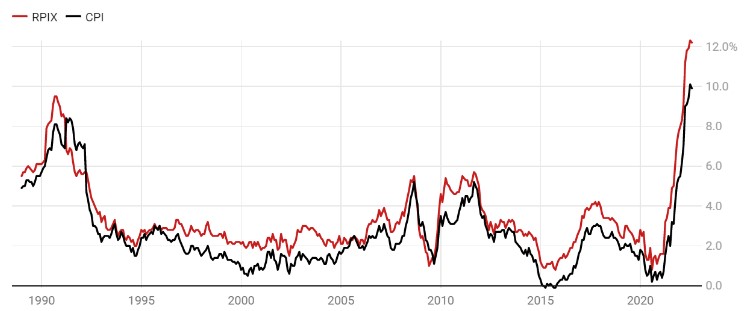

CPI (and more recently CPIH) have tended to be lower than RPI, as this chart shows.

Source: MoneyWeek

Back in July, when inflation measured by CPI reached a 40-year high of 10.1%, RPI stood at 12.3%.

A switch from RPI to CPIH could have a huge bearing on your DB pension scheme. If it does, you won’t be alone; the changes could affect more than 10 million pensioners.

FTAdviser, reporting on the change back in 2020, suggested that the hit to pensions could total more than £120 billion.

The change is due to come into effect in 2030

When the plans to replace RPI with CPI were first announced, the change was expected to occur in 2025.

Following the 2011 announcement, RPI became a “legacy index” in 2013 when it was removed as a recognised national statistic.

Then, in 2020, the government reaffirmed its wish to replace RPI with CPI. It was at this point that complaints were raised.

Millions of pensioners will likely see lower payments, with no requirement for compensation to be given. The change is now expected to come into force in 2030.

But why did the trustees’ legal challenge fail?

Critics of the RPI believe that it overestimates the cost of living.

Both RPI and CPI measure inflation by tracking the change in prices of goods and services. CPI includes high-earner households and pensioners while the RPI does not. Many believe that this makes the latter unrepresentative.

Complaints were raised in three separate areas and each was rejected. This is despite the judge conceding that around 10.5 million pensioners would receive a reduction of around 4% to 9% using CPIH compared to sticking with RPI.

Women are expected to be the worst off, due to their longer life expectancy.

Staying focused on robust, long-term plans is key

While the decision has been met with disappointment from within the pension industry, a firm focus on your retirement goals is the best way to mitigate the change.

The ruling isn’t due to take effect until 2030 and your pension plans remain a long-term proposition. If your overall goals haven’t changed then your plan shouldn’t need to either.

Your final salary scheme remains a valuable retirement asset and we at HA&W are still on hand to help you make the most of your retirement. Whether that means helping you to save, ensuring you select the right option for you, or managing your tax-efficient withdrawals, be sure to contact us.

Get in touch

Recent government announcements might have fanned the flames of economic uncertainty caused by the pandemic and Russia’s invasion of Ukraine, but instability is generally short-lived.

If you have any concerns about your pensions or investments, or any other aspect of your long-term financial plans, contact us now to find out how our Chartered financial planners could help you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.