This year’s US presidential race has so far delivered shock announcements, foiled assassination attempts, and an eleventh-hour candidate change.

In July, with Joe Biden seemingly struggling with ailing health, Donald Trump was ahead in the polls. It was a lead that only grew when he survived an assassination attempt at a rally in Pennsylvania later that month.

With the news that Biden was stepping down from the race, and endorsing his vice president Kamala Harris, though, the mood of the election changed. Harris delivered a strong performance in the ABC News live debate and surged to a lead in the polls. More importantly, she appeared to gain ground in several key swing states.

The race continues to make for compelling viewing and is tightly poised ahead of the 5 November polling day.

More widely, you might be wondering what the result of the election – whichever way it goes – might mean for world markets, global security, and your own money.

Keep reading to find out.

Over the long term, markets don’t care who wins

The first thing to note is that over the long term, markets are nonpartisan. They trend upwards, albeit with periods of short-term volatility, and this will most likely remain the case in the final run-up to the election and in the years that follow.

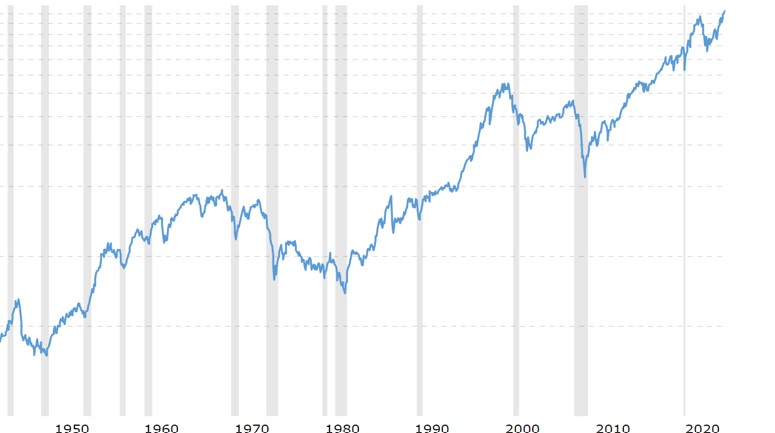

Here’s a look at the S&P 500 over the last 80 years.

Source: Macrotrends

This period covers – among other things – several wars, the assassination of JFK, and 9/11. It also, of course, covers many presidential elections. And the upward trend is clear.

We know that markets hate uncertainty, and it’s possible volatility might increase in the run-up to the election and in its immediate aftermath. It’s also true that markets will react differently depending on the eventual winner.

Investors appear to see emerging markets and certain sectors, like renewable energy, for example, as safer under Kamala Harris. Tech and AI, meanwhile, remain a hugely important sector for both candidates.

In terms of your investments, though, the same message as always applies: Don’t panic and stay invested!

Your investments are long-term for a reason

Your investment portfolio is aligned to your goals, your capacity for loss, and your attitude to risk. That means that if your long-term goals haven’t changed then your plans don’t need to either.

A long investment term gives your money plenty of time to ride out periods of short-term volatility, and our regular reviews ensure that you always remain on track.

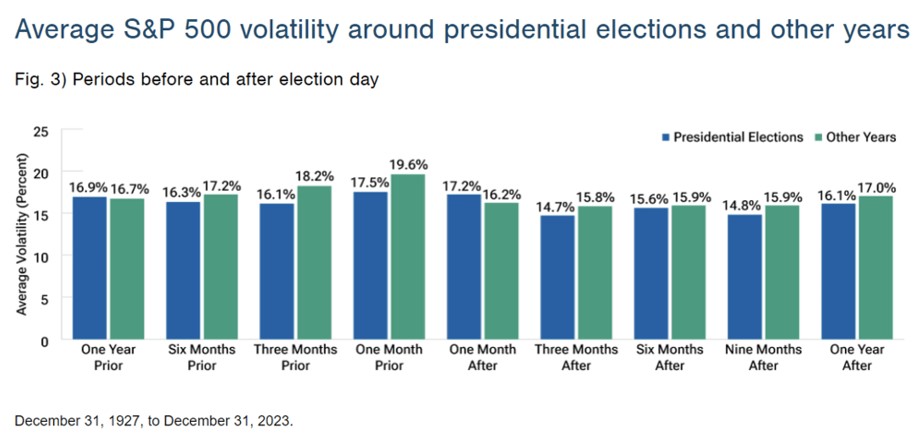

If you still need reassurance that US markets tend to take election results in their stride, here’s a look at average S&P 500 volatility data back to 1927.

It suggests that volatility remains largely unchanged no matter where in the election cycle it occurs.

It does, though, suggest that volatility is highest in the month before an election, so it’s more important than ever that you take heed of some important investment lessons.

3 important points to remember

1. Stay calm

As we have seen, markets generally trend upward and remain largely unaffected by election results over the long term. That means that if markets fall, or you fear the fallout of a win for either party, staying unemotional is key.

Don’t make decisions based on your preferences or allow eye-catching headlines to panic you into knee-jerk reactions.

2. Stay invested

Stock market falls happen all the time – just look at the Japanese market’s one-day drop back in August – but staying calm and invested is key.

By panicking and selling shares during a market fall you cement a paper loss. Worse still, there’s an opportunity cost too.

By selling shares (at a deflated price) your money isn’t invested when the market recovers, meaning you don’t benefit from rising prices.

3. Stay focused on your goals

Your goals and your plan are personal to you. What happens in the wider markets doesn’t need to impact your portfolio if you remain on track and within your risk tolerance.

Remember what you are investing for and focus on that. And if you feel yourself wavering, we’re always on hand to offer guidance and reassurance. Be sure to get in touch.

Get in touch

HA&W’s combined years of expertise and experience in the markets can help to reassure you, whatever the future brings. If you’d like to discuss any aspect of your investment portfolio or long-term financial plans, get in touch. Contact us now to find out how our Chartered financial planners could help you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.