Back in February 2023, the FTSE 100 broke 8,000 for the first time. You might have felt worried about investing at that moment, concerned that an all-time high leaves just one direction of travel.

But a recent report from Schroders confirms that market all-time highs occur more often than you might think.

Keep reading for your look at why you should embrace record-breaking markets, and why diversification and a long-term strategy are key.

The general upward trend of markets means all-time highs might be more common than you imagine

Schroders recently looked at stock market returns since 1926, a span of 98 years. Of the 1,176 months during that period, analysis found that the market was at an all-time high in 354 of them. Put another way, markets are at an all-time high 30% of the time.

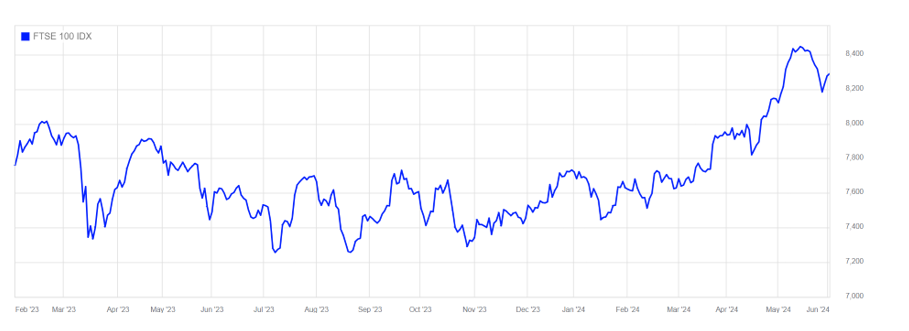

As we have already mentioned, the FTSE 100 topped 8,000 for the first time in 2023. Here’s a look at the index since:

Source: London Stock Exchange (LSE)

Individual stock prices are in a constant state of flux, rising and falling by the minute. You can see that after the record high, the index fluctuated (without ever dropping below 7,200) until April 2024, when it topped 8,000 again.

FTAdviser reports that the index closed at 8,023.87 on Monday 22 April and 8,067.44 the next day. These records were followed by a series of all-time highs in early May, topping out at 8445.80 on the 15th.

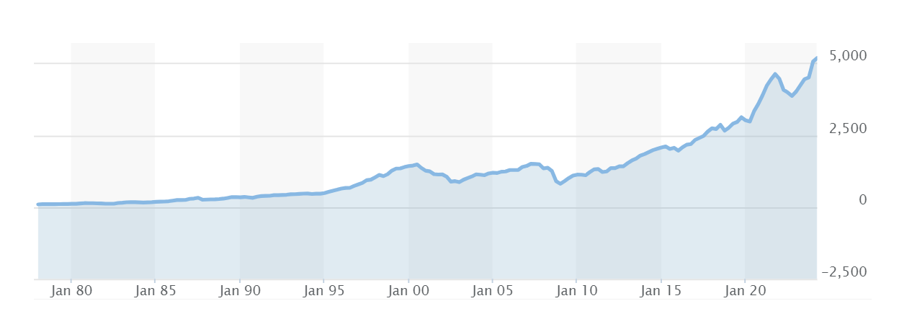

And, while past performance is no guarantee of future success, a longer-term look at the FTSE 100 suggests that this high might be beaten in the future too:

Source: LSE

When viewed since its inception in 1984, the index’s general upward trend is clear.

It’s a trend that’s not limited to the FTSE 100. Here’s the S&P 500 over a similar period:

Source: Market Watch

Again, the series of all-time highs is clear. But what does this mean for your investments?

Focusing on your long-term goals and avoiding emotional reactions might be a better approach than trying to time the markets

Whatever your overall financial goal, it’s important to remember that investment is a long-term proposition. Whether you’re looking for capital growth or an income, it’s time in the market not timing the market that counts.

Largely, that means ignoring the noise of market movements and acknowledging that both short-term dips and all-time highs will occur throughout your investment journey.

This is why it’s so important that you take time at the beginning of your investment period to think carefully about:

- Your exact timescales

- The level of risk you take

- Your capacity for loss.

The investment strategy we put in place at HA&W will be aligned to your goals, and designed to take only a level of risk that you are comfortable with.

This allows you to sit back and relax, avoiding the knee-jerk and emotional reaction that can throw your plans off course. Hesitancy when markets are high, or panic-selling when markets fall, could have a huge effect on the value of your investment over the long term.

Diversification and avoiding home bias help to spread risk

Market all-time highs are great news for investors but it’s important not to focus too much on an individual index.

A rise in the FTSE 100 might not be matched by a similar increase in the S&P 500 or the Japanese market. This is exactly why your investment portfolio is diversified.

Diversification occurs across asset classes, sectors, and geographical regions. It’s the reason why a 5% drop in the FTSE 100 won’t automatically mean a 5% drop in the value of your portfolio.

A fall in one area will hopefully be balanced by a rise elsewhere.

This also helps you to avoid certain behavioural biases. Home bias, for example, can mean you favour domestic stocks that you have heard of while potentially missing better opportunities elsewhere. With decades of experience in markets, we’re always on hand to help.

Get in touch

If you’d like to discuss any aspect of your investment portfolio or long-term financial plans, get in touch. Contact us now to find out how our Chartered financial planners could help you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.