11 December 2018

What happens if you die without a will?

;)

Guest article written by Wills and probate expert and solicitor Victoria Lee, TEP.

A will is a crucial document for setting out what you want to happen to your wealth when you pass away. But it’s a document many British adults are neglecting. With this in mind, how would your assets be distributed without one?

According to a survey carried out by Will Aid, more than half of British adults don’t have a will in place. This means they risk their assets being distributed according to Intestacy Rules, rather than their wishes. Furthermore, without taking the time to decide who should deal with their estate on death, there may be disagreement and uncertainty about who is legally entitled and responsible for looking after assets in the estate before they can be distributed.

The Intestacy Rules

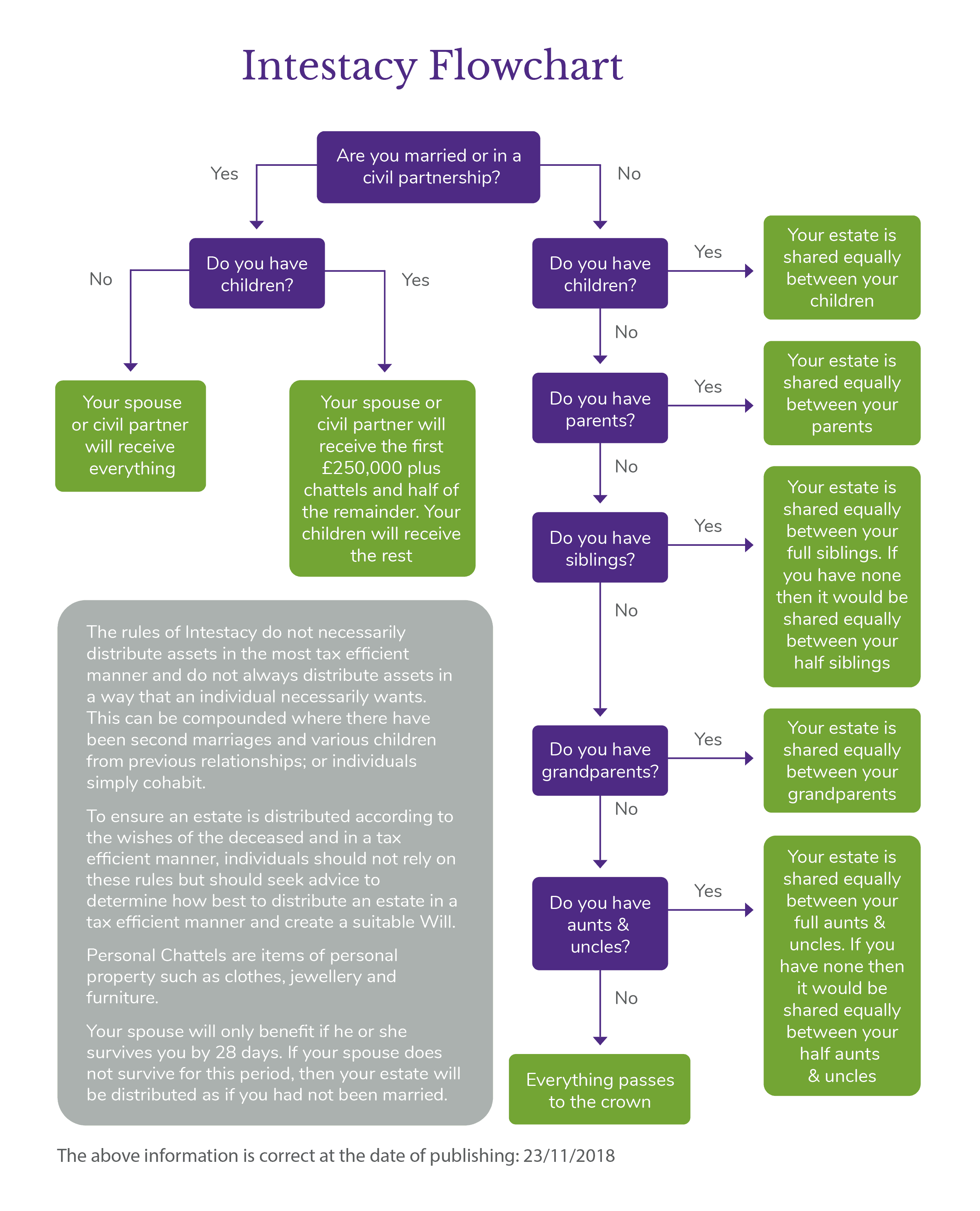

If you die without a valid will, all your assets are distributed according to Intestacy Rules. These set out a strict process for who wealth passes to, starting with a spouse or civil partner and then children.

For many families, the Intestacy Rules don’t align with what they want or offer the most tax-efficient way to pass on wealth. It could mean that some of your loved ones are excluded, as well as charities or other organisations you wanted to benefit. This is particularly true for modern families. If you’ve remarried and have children from a previous relationship, for example, it’s possible they would effectively be disinherited without a will in place. If you have chosen not to get married, and instead live with your partner and your children, your partner will receive no benefit under the Intestacy Rules.

Often when thinking about distributing wealth, people want multiple beneficiaries. You may want to leave the bulk of your wealth to your children but also provide something for grandchildren, for instance. Intestacy Rules don’t allow for this, clearly defining an order of inheritance. You may also have certain items you want to pass on to loved ones, these may have sentimental rather than monetary value. However, without a will, you risk them being passed on to another person.

The infographic below can help you understand how your wealth would be distributed if you were to die without a will.

When you think about how you’d like your wealth distributing, it’s unlikely that the Intestacy Rules perfectly match what you had in mind. This is where a will is crucial for ensuring that your wishes are carried out.

In addition, if your estate is over £250,000, your children will be guaranteed a benefit from your estate. This is the case even if the value they receive is over the inheritance tax threshold of £325,000, meaning that if you have a large value estate there will be no means of mitigating the inheritance tax payable on the first death.

What can you do if Intestacy Rules don’t suit you?

The only way to ensure your estate is distributed according to your wishes is to write a will. While it’s a task many British adults are neglecting, in most cases it’s straightforward. Having a will in place can help give you peace of mind and your loved ones some certainty.

If you’re a parent to young children, there’s another reason to write a will too. Within a will, you can name a guardian for them should the worst happen. It’s not something anyone wants to think about but is important, nonetheless. If you’d be leaving your wealth to young children, you can also name someone to control their inheritance for them until they reach adulthood.

Writing a will gives you an opportunity to set out what you’d prefer for your funeral, such as a burial or cremation. This part of a will isn’t legally binding, but it can help your loved ones make decisions during what is already a difficult time for them.

Another essential requirement of a will is the appointment of people to handle your estate after your death, called executors. Appointing trusted friends or family members to deal with this burdensome administration gives them the ability to act immediately after you have passed away, instead of having to wait until a Grant has been applied for. If you die without a will, the order of entitlement to apply for a Grant follows the Intestacy Rules and is not necessarily representative of the most ideally placed person to deal with your estate after you die.

Assessing your estate

The first step to writing a will should be to assess your estate and what your wishes are. It can be a daunting task but one that can be broken down into manageable steps.

- Decide on your beneficiaries: The first step is to think who you’d like to benefit from your will. This may include family and friends, as well as charities or organisations.

- Look at your assets: Getting an understanding of your assets, and their worth, is important for setting out how you’d like your assets to be distributed. Writing down a list of assets and their value can help make the process clearer. Be sure to include all your assets, such as savings, property, investments and pensions. Not all these assets can be gifted away in a will, but it is important to have an understanding of your financial situation before you can decide who receives what.

- Distributing your assets: Next, you’ll need to decide how you want your wealth distributing, this is also the time to think about whether there are specific items you want to bequeath. There are several ways you can leave loved ones an inheritance. For instance, a pecuniary bequest means you leave someone a fixed sum of money, while a residuary bequest will leave a percentage of your estate.

This step can be difficult, as there are many different options and you may have to consider your wider situation. For example, if you want to leave your home to your child but ensure your partner can continue living in the property until they pass away. This is where seeking expert guidance can make the process easier.

Making a valid will

Once you’ve planned how you want your wealth to be distributed, it’s a good idea to talk about your decisions with family. From here, you should then get your will drawn up.

There are DIY options available but for a will to be valid certain conditions will need to be met. Seeking the support of a solicitor can help ensure mistakes don’t occur. Working with a STEP qualified Solicitor (a ‘TEP’) is particularly important if your situation or wishes are more complex, for instance, if your estate may be liable for Inheritance Tax, you need to appoint guardians, or you have a complex family situation. A TEP must adhere to a strict Will Writing Code which guarantees a certain standard of service which will give you confidence and security in the advice you receive.

Remember: Keeping your will updated is as important as writing one. Your life and wishes may change dramatically. As a result, it’s advisable to review your will every five years and after big life events, such as getting divorced, starting a family or receiving an inheritance. You can either make a new will, explaining all previous wills are revoked or add an official alteration, known as a codicil, when necessary.

Victoria Lee is a full STEP member and associate solicitor at Bird Belderbos & Mee Solicitors, dealing with all private client matters. You can contact Victoria on 01664 498 999.

Category: News