Back in March, as the extent of the coronavirus pandemic became understood, asset managers suspended dealings in their UK commercial property funds, effectively ‘trapping’ almost £22 billion of investor money.

Six months on, the commercial property market is reopening.

Here’s your guide to the property market so far this year, and what the future might hold.

UK property funds halt trading amid coronavirus uncertainty

As the coronavirus pandemic took hold earlier this year, market uncertainty led to the suspending of UK property funds as valuers found themselves unable to provide accurate or reliable prices for the funds’ underlying assets.

Among those funds to suspend trading in March were Columbia Threadneedle’s and Legal & General’s UK property funds.

A fund suspension means putting a halt on all processing of buys, sells, transfers, and switches, into and out of the funds, in this case ‘until further notice.’

Commercial property isn’t easily bought and sold and that makes managing commercial property funds difficult. Investing in bricks and mortar, although popular, is time-consuming, labour-intensive, and expensive.

When performance is good, and with many looking to invest, it can take months to buy suitable properties. Similarly, poorer outlooks force managers to sell properties to give investors their money back.

Fund managers can adjust the pricing of their funds or as happened earlier in the year, stop investors trading altogether.

The impact of reopening funds isn’t yet clear

In September, six months after the initial suspension, UK property funds started to reopen again.

While this show of confidence in UK commercial property, and the part it still has to play in diversified investment portfolios is good news, many funds remain suspended for now.

The main worry for those yet to reopen is the sheer volume of possible redemption requests on reopening, and fears over their ability to cope.

It was this issue that hit Columbia Threadneedle’s UK property fund last month. Estimates from Morningstar suggested that more than £68 million had been withdrawn from the fund in September – more than double the £25 million withdrawn during the height of the panic in March.

The benefits of diversified portfolios

Diversification is a way of spreading investment risk and it is something we often speak about.

This was especially the case in March as the stock market tumbled. Our advice: ‘Don’t panic.’ Long-term investment in a diversified portfolio is intended to weather short-term storms. Remaining invested gives you the best chance of reaping the benefits of an increase in price when markets begin to recover.

A diversified portfolio will invest in different asset classes across different industries and sectors, in different parts of the world, and with different risk profiles.

By spreading risk, we hope to lessen it – a fall in one area, offset by a rising price elsewhere.

There are four main asset classes; equities, bonds, cash, and property and diversification can occur within individual asset classes too.

The Legal & General UK Property Feeder Fund

Legal & General (L&G) reopened its property funds earlier this month (October 13th), seven months after halting trading. L&G Investment Management stated that the board would reopen the funds at noon on 13 October but would ‘continue to monitor investor intentions.’

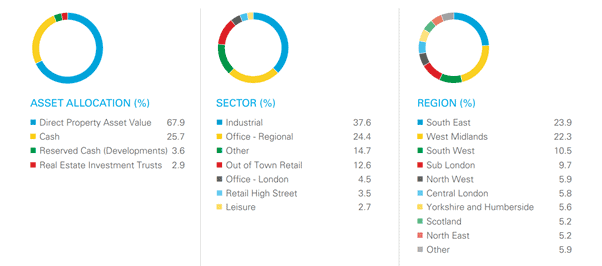

The fund is particularly diverse, and L&G will be hoping they don’t see the exodus witnessed by Columbia Threadneedle. The following graphic illustrates the diverse nature of the L&G fund. Note how little exposure there is to High Street retail, which really is a disaster.

Source: L&G

The FCA has proposed that investors in open-ended property funds wait up to six months before accessing their money. Despite their intention to combat the mismatch in liquidity, a more immediate consequence might be a mass exodus before the new rules come into force.

The public consultation is open until November 3, with final rules expected to be published as soon as possible in 2021.

The HA&W view

It’s been a difficult year for UK commercial property funds, but as they slowly reopen, the news is far from all bad.

It is understandable to have concerns if you have investments in commercial property, either ‘trapped’ in suspended funds or those reopening.

We continue to review the market as we determine what our advice to you will be. It’s reassuring to note, that at the time of writing the value of the L&G fund is appreciating.

Get in touch

In the meantime, please contact us if you’d like to discuss your commercial property investments, any other aspect of your portfolio, or long-term financial plans.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.