Inflation fell slightly in September but remains well above the Bank of England’s (BoE’s) own target. Meanwhile, the central bank has opted to keep its base rate at a historic low of just 0.1%.

While inflation dropped to 3.1% for September (down from 3.2% in August), the BoE has predicted that the figure could rise as high as 4% by December, a figure twice its inflation target.

All of which is bad news for savers, already reeling from a decade of poor rates in the wake of the global financial crisis of 2008.

If you have large sums held in cash with your bank, you might consider it “safe”. However, the combination of low interest rates and high inflation means that your money is effectively losing value. Now might be the right time to turn to investment.

First, though, you’ll need to understand the risks attached and your own risk profile. Remember that the biggest risk to your funds might be not taking enough risk.

You’ll need to be sure you have an emergency fund in place

Money held in your bank account might not be earning any interest at the moment, but your funds are protected by the Financial Services Compensation Scheme (up to a value of £85,000) and they are easily and quickly accessible.

This makes them perfect for an emergency fund. And yet, despite the economic warnings of the pandemic, a recent survey has found that 46% of UK retirees don’t have a sufficient emergency fund in place.

Accidents, illness, or a sudden job loss can occur at any time but knowing you have a rainy day fund in place puts you back in control if the worst happens.

Ideally, your emergency fund should be big enough to cover around three to six months’ worth of household income. If you don’t have that much put aside, start building your fund now, by making monthly payments of whatever you can afford.

Taking a level of risk that you are comfortable with could provide inflation-beating returns

An estimated £246.5 billion is currently sitting in savings accounts earning no interest. That amounts to around 8.6 million savers, each holding more than £10,000. As the cost of living continues to rise, the effective value of these funds is falling. The answer could be investing.

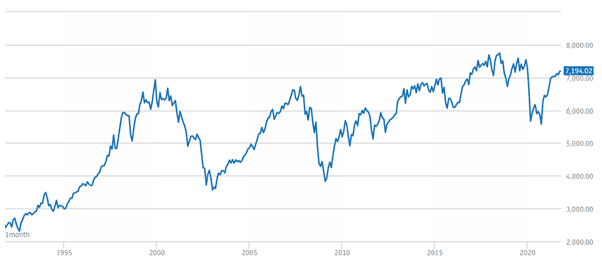

Looking at the FTSE 100 over the last 30 years shows the general upward trend of the market, albeit with short-term dips including the 2008 financial crisis and the recent economic impact of coronavirus.

Source: London Stock Exchange

Research from IG released last year shows that between 1984 and 2019, the FTSE 100 produced an annualised return of 7.75%, far higher than the current average for fixed-rate savings accounts.

There are some key things you’ll need to consider before you invest:

- What is your investment goal?

- How long is your proposed investment term?

- How much risk are you willing to take?

Your investment goals

This is the reason you are investing. Whether it’s building a retirement fund for yourself or saving a deposit for your child’s first house, your ultimate goal will impact your term and risk profile so your endpoint must be fixed and understood.

Your proposed investment term

Investment is a long-term proposition, so you should only invest if your goal is at least five years away. This allows time for your fund to grow and also to recover from any short-term market dips such as that caused by the pandemic.

Your risk profile

The level of risk you are willing to take will depend on several factors, including the length of the term, your ultimate goal, and your capacity for loss.

While your attitude to risk might be fluid, changing over time or dependant on an individual investment, your capacity for loss is calculable. We can use cashflow modelling and an understanding of your expenditure to help quantify your capacity for loss and incorporate that into the investment portfolio we build for you.

We will then manage your risk, spreading it through diversification, careful asset allocation, and – if necessary – rebalancing your investments.

This can be a complex juggling act, so be sure to get in touch if you are considering investing.

Get in touch

With the cost of living rising and savings rates remaining low, investing might be the best way to combat the effects of inflation and ensure your money holds its value.

Please contact us to find out how we can help you, whether you’re investing for the first time or are looking for advice on managing an existing portfolio. Our team of dedicated Chartered Financial Planners can work with you to ensure your investments align with your long-time financial goals.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.