October has once again lived up to its reputation as the Bogey month for investors. This year investors globally have taken fright due to;

- A steady rise in US bond yields that broke through the psychologically sensitive 3.0% barrier in September.

- This change in borrowing conditions fed through into the price of US equities – especially high-flying technology stocks that had previously led the market upwards.

- Trade tensions rumble on the background with the Trump inspired US/China trade war.

- Rising short-term interest rates making cash more attractive.

- Worries that Corporate earnings will not grow as strongly as they have in the past.

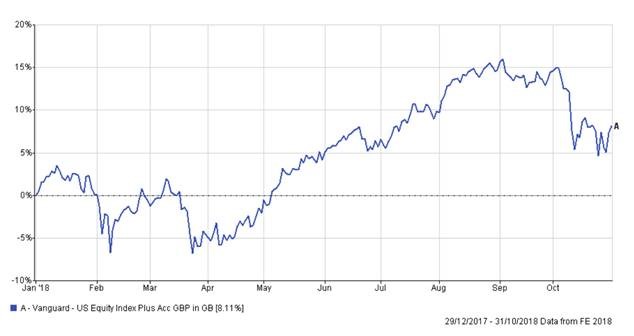

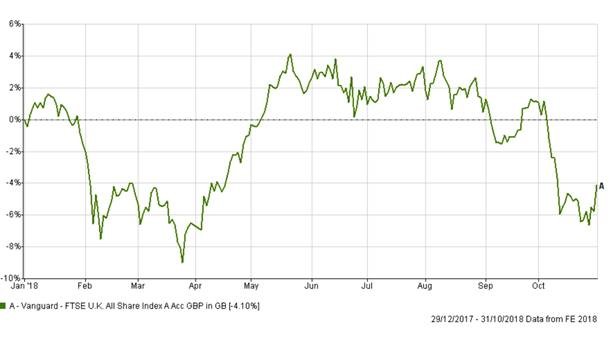

A gradual decline in the US market turned into a rapid slide on the 10th October, when the S&P500 index suffered a 3.3% one-day decline. After this computer powered trading strategies resulted in more selling across the board both in the US and round the globe, including the UK. Here, our market was already weak due to ongoing Brexit worries and remains the least favoured western market at present.

The US S&P500 index year to date

The UK FT All share index year to date

What of the future?

Whilst the outlook is starting to look cloudy the majority of US corporates are producing record profits and are paying lower rates of tax. The US economy is strong. Whilst the falls have been sharp and worrying fund managers report few signs of panic. Most fund managers had already taken a defensive stance and some are buiying some stocks on weakness. We utilised some of the cash we hold in portfolios to buy UK equities this Monday, thinking that our own market looks very good value at current levels.