Apologies for the delay in issuing this report – I have been away from work due to illness.

The third quarter of 2023 was dismal, with the global index falling -5.3%. Year to date the index is down -1.1%. Here in the UK, the FTSE All-Share Index only fell by -0.5% with the index being down -4.6% for the year to date. The US market, which has proved more resilient this year, fell by -3.6% over the quarter but was up +8.3% year to date. It’s a dismal time.

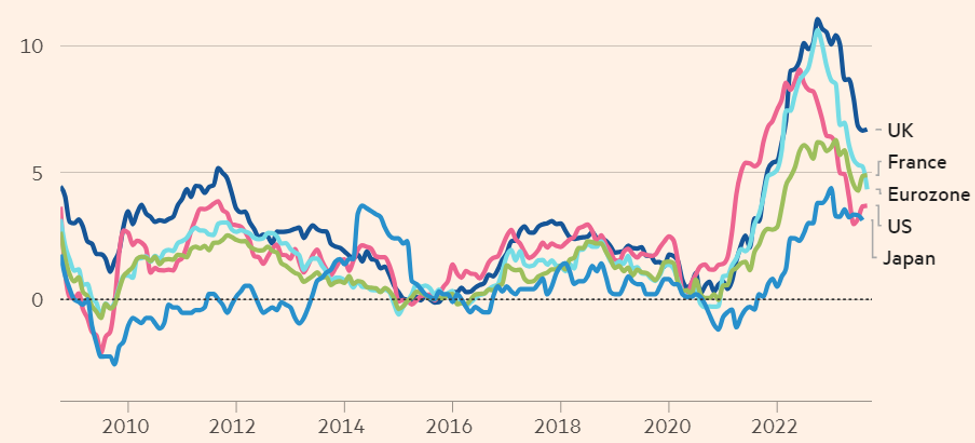

The main issue causing the gloom is the realisation that interest rates are likely to be higher for longer, and at least at their current elevated level for a sustained period, while inflation is squeezed out of the system. This is despite the fact that the rate of inflation is now falling significantly around the world.

Global Inflation Rates

Source: FT

Believe it or not, the Japanese government actually wants higher inflation as it has been so low for many decades – a sign of economic stagnation.

The key to all things investment-wise is what’s going on in the US economy. While interest rates in America may well have topped out at 5.5%, the economy has been amazingly strong, even in the face of steadily increasing interest rates. This reflects the confidence of the US consumer who has not reduced spending one iota, so economic growth continues unabated. The thought that interest rates will stay elevated for longer affects the bond markets, which have weakened, and where the bond markets lead the equity markets follow.

It’s a similar story in all Western markets, except economic growth doesn’t look nearly as robust as that seen in the US. Inflation is certainly stickier here in the UK, reflecting our tight labour market and propensity to import manufactured goods.

Straying into October, we now have the Israel-Hamas conflict which is also sapping sentiment and has caused a spike in the price of oil which feeds into energy prices. The good news (as of today) is that the price of oil has fallen significantly and is now just over $80 a barrel, having peaked at $94 a barrel just after the war broke out. This reflects market sentiment that there will not be a wider regional conflict.

Here is a chart of global markets over one year:

Source: Google Finance

…and over 5 years.

Source: Google Finance

Fixed interest securities also had a poor third quarter with the global index dropping by -3.7%. In the UK, the gilt index also fell by -3.2%. At least bonds now yield in the region of 4.0% to 5.0% depending on the issuer and duration.

The UK commercial property market is stabilising with values falling a modest -0.8% over the quarter.

Outlook

We live in a doom-laden world where there seems to be very little to cheer about. Even the boisterous US market, which was very strong earlier this year, has now dropped by 10% from its recent highs with the bulk of the fall occurring in October. Investor sentiment outside the US is very poor.

Both the US Fed, the European Central Bank and the Bank of England are holding rather than increasing rates, which is encouraging. We may well be at peak rates.

Discussion with investment managers reveals that there is tremendous value to be had in both the UK and European markets. Even in the US markets, when the “Magnificent Seven” large tech stocks are excluded, there is value to be found. This value will start to be appreciated once interest rates are reduced around the world. Timing is key, and for the present, interest rates are likely to stay elevated for longer than previously thought, even if there are no more rate increases on the way. The key metric to follow is the rate of inflation, where positive surprises (i.e., lower rates) are likely, I think.

A combination of great value and interest rate cuts, when they arrive, will be very positive for the markets. Write off 2023, but 2024 has the potential to be much better.

MARKET PERFORMANCE

I enclose tables showing the performance of the main indices over various time periods to the end of September 2023. The performance of your portfolio will reflect your risk grade and portfolio style.

Short-term performance

| Parmenion Portfolio/Index | Three months performance to the 30 September | One year performance to the 30 September |

|---|---|---|

| Average Mixed Investment fund (20-60% shares)/Cautious | -0.1% | +4.1% |

| Average Mixed Investment fund (40-85% shares)/Balanced | -0.1% | +5.1% |

| Average Flexible Investment Fund/Adventurous | 0.0% | +4.2% |

| FTSE All-Share Index | +1.8% | +13.8% |

| FTSE World Index ex UK (£) | +0.6% | +12.0% |

| FTSE UK Gilts Index | -0.6% | -2.4% |

Long Term Performance

| Parmenion Portfolio/Index | Five-year Performance to the 30 September | Ten year Performance to the 30 September |

|---|---|---|

| Average Mixed Investment fund (20-60% shares)/Cautious | +7.4% | +38.3% |

| Average Mixed Investment fund (40-85% shares)/Balanced | +14.5% | +61.4% |

| Average Flexible Investment Fund/Adventurous | +16.6% | +66.0% |

| FTSE All-Share Index | +19.7% | +71.7% |

| FTSE World Index ex UK (£) | +55.0% | +210.1% |

| FTSE UK Gilts Index | -18.2% | +2.1% |

MARKET POSITIONING

Our main investment partner Parmenion, has become more cautious and has increased their cash weightings by reducing their allocations to the European and UK markets. They have, however, increased allocations to both UK and international fixed-interest securities. Their thinking is that these could withstand any recession better than the equity markets and offer the prospect of capital appreciation once interest rates start to fall.

The investment manager is, however, overweight in Japanese equities due to the economic and governance reform that is underway in the financial sector, which augurs well for company share prices. They are also overweight in emerging market equities on valuation grounds; these markets are very cheap and thus represent great value.

Best wishes,

Jim

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.