The third quarter of 2021 resulted in a consolidation in the value of many markets as the previous year’s strong gains were digested. However, there was still some progress, even as the headwinds faced by investors have increased, giving many a pause for thought.

The global index increasing by +2.9%. The American market increased by +4.1% and the UK market gained +3.3%. The outlier was the Chinese market which suffered heavy falls and lost -19.2% over the quarter as the Chinese Communist Party appeared to fall out of love with capitalism and curtailed the business activities of many leading Chinese companies. The Nation’s largest property developer, Evergrande, also faces collapse, which could trigger a recession as other similar companies face a similar fate.

The emergence of supply bottlenecks, a surge in oil and gas prices, labour shortages and the re-emergence of inflation crimped market growth, with September proving to be quite a volatile month.

The UK commercial property market continued to make steady gains as investors returned to the asset class, driving up valuations. We support L&G the Property fund which has grown by a very respectable +4.3% over the quarter.

Fixed interest securities lost a little value as the expectations of higher inflation caused prices to ease.

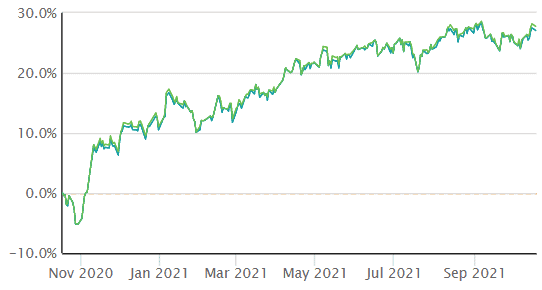

Here is a chart of the FTSE All-share Index for the previous 12 months:

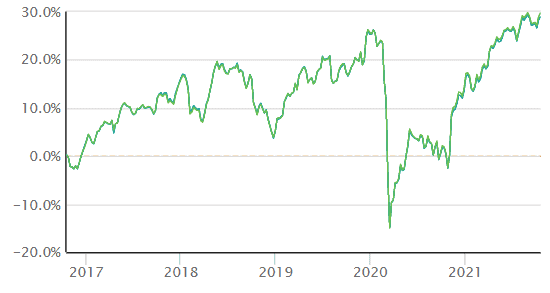

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 30 September 2021;

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 30 September 2021 |

One year Performance to the 30 September 2021 |

|---|---|---|

| Cautious Portfolio | +0.8% | +10.8% |

| Average Mixed Investment fund (20-60% shares) | +0.7% | +12.2% |

| Balanced Portfolio | +1.5% | +18.7% |

| Average Mixed Investment fund (40-85% shares) | +1.3% | +16.6% |

| Adventurous Portfolio | +1.4% | +22.3% |

| Average Flexible Investment Fund | +1.2% | +18.3% |

| FTSE all share index | +2.2% | +27.8% |

| FTSE world index ex UK (£) | +2.0% | +23.9% |

| IBOX Gilt Index | -1.8% | -6.8% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 30 September 2021 |

Ten year Performance to the 30 September 2021 |

|---|---|---|

| Cautious Portfolio | +28.9% | +102.4% |

| Average Mixed Investment fund (20-60% shares) | +25.6% | +76.0% |

| Balanced Portfolio | +49.7% | +143.5% |

| Average Mixed Investment fund (40-85% shares) | +39.4% | +116.2% |

| Adventurous Portfolio | +60.5% | +186.5% |

| Average Flexible Investment Fund | +43.5% | +120.5% |

| FTSE all share index | +29.8% | +119.8% |

| FTSE world index ex UK (£) | +89.7% | +301.3% |

| IBOX Gilt Index | +6.0% | +43.3% |

PORTFOLIO REVIEW

All Portfolios

All portfolios made modest gains during the third quarter of 2021. Markets continued to make progress as economic activity normalized, in spite of rising commodity prices and the emergence of bottlenecks.

Fixed interest securities lost small sums and commercial property valuations improved considerably.

Cautious Portfolio

The Cautious Portfolio gained +0.8% over the quarter, just outperforming its benchmark (the average mixed investment (20-60% shares) fund) which gained +0.7%.

UK growth shares and commercial property produced the strongest returns with gains of around 4%. Our modest exposure to Asia and the Emerging Markets lost around 8% in value due to the dramatic fall in the Chinese stock market.

No changes were made to this portfolio over the quarter.

Balanced Portfolio

The Balanced Portfolio gained +1.5% over the quarter, just outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.3%.

UK growth shares and commercial property produced the strongest returns with gains of around 4%. Our exposure to Asia and the Emerging Markets lost around 8% in value due to the dramatic fall in the Chinese stock market.

No changes were made to this portfolio over the quarter.

Adventurous Portfolio

The Adventurous Portfolio gained +1.4% over the quarter, just outperforming its benchmark (the average Flexible fund) which gained +1.2%.

UK growth shares and commercial property produced the strongest returns with gains of around 4%. Our exposure to Asia and the Emerging Markets lost around 8% in value due to the dramatic fall in the Chinese stock market.

No changes were made to this portfolio over the quarter.

OUTLOOK

- Investors now face a long list of negative factors which could hinder returns over the coming months. I’ll try to list them in order of importance;

- Concerns that the sharp rise in the price of many commodities, including oil and gas, will cause more than a temporary spike in inflation. Anything more than a blip will result in interest rates increasing, which is bad for markets.

- Fears that global supply chain disruption and bottlenecks add fuel to the fire.

- Worries that the consequences of the collapse of Evergrande in China is so severe that it creates a recession in the country which spills over into Asia.

- Fears that the Chinese government are throwing the baby out with the bathwater in their regulatory crackdown on Chinese tech companies.

- Concerns that there is a global shortage of skilled labour, which will add to companies cost pressures.

- …and of course, there’s always a worry about a new COVID variant as we move into the winter!

As you can tell, the author is not feeling very optimistic at the moment. It all feels a bit like the 1970’s winter of discontent to me.

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner