The second quarter of 2023 was rather peculiar as strong global markets failed to translate into investment gains for UK-based investors. Here at home, the UK market was weak as investors grappled with the extent to which interest rates will have to rise, and remain elevated, to tame inflation. For most of 2022, investors held the view that inflationary pressures were transitory and that interest rates would not have to increase much from previous levels to restore normality.

This benign view is now being tested as UK inflation is proving to be far more “sticky” than previously anticipated, exacerbated by a shortage of key workers in many industries.

In the US, which generally leads market sentiment, the inflation numbers are actually looking quite good, with the US CPI falling to 4% in June. Here in the UK, inflation is more than double that, at 8.7% –although this was May’s figure. You would have thought that a headline number of 4% would be good news and this is reflected in positive market performance from the US. However, economists are concerned about the strength of the US economy and labour markets, where there is no unemployment. The concern arises from conventional economic theory that states inflation can only be reduced by lower levels of economic activity, which increases the unemployment rate.

This economic backdrop has played out in markets where the UK All-Share Index fell by -4.8% last quarter and is down -3.4% for the year to date. The UK’s heavy exposure to oil and financial stocks (especially banks) has been the main driver of market weakness, as well as our general economic malaise.

Global markets are up +4.6% over the quarter, led by America which is up +7.2% year to date – a far more optimistic picture. The US market also presents some peculiarities; most stocks in the S&P 500 Index actually fell over the quarter. The index appreciated overall due to the influence of the seven largest US companies, which are all benefiting from a surge of investor optimism regarding the future of Artificial Intelligence (AI). One basically had to be invested in the index to benefit.

In China, the government is struggling with economic problems relating to the property collapse that occurred last year and a patchy recovery from the Covid lockdowns. The main Chinese market was down -2.3% over the quarter and up +2.5% year to date. China isn’t a large component of client portfolios but the economy and its market are significant.

The issue that has afflicted most client portfolios has been the bond markets. Bonds form the bedrock of most investment portfolios and generally produce a reliable income stream. They have the benefit of acting as “shock absorbers”, so in difficult market conditions bonds often appreciate in value when share values are dropping. They are also interest-rate sensitive, and values fall as interest rates increase.

There was a general view that inflation would be a temporary phenomenon and interest rates would peak at lower levels than we are currently experiencing – especially in the UK. This has resulted in weak bond markets which have disproportionately afflicted lower-risk portfolios.

The UK commercial property market is in the doldrums due to weakness in the office market, where most businesses are downsizing. Fortunately, our choice in this sector has little exposure to the office market and invests heavily in industrial, out-of-town retail and more latterly, residential properties. Over the quarter, values improved by 1.4% recovering from the sell-off witnessed last year.

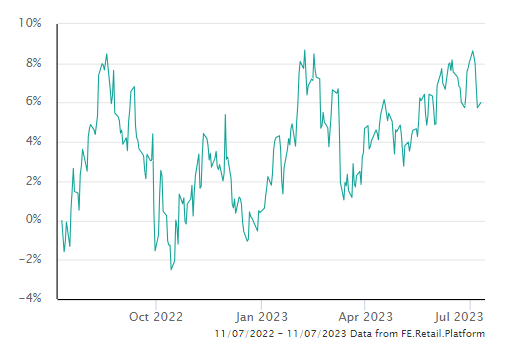

Here is a chart of global markets over one year:

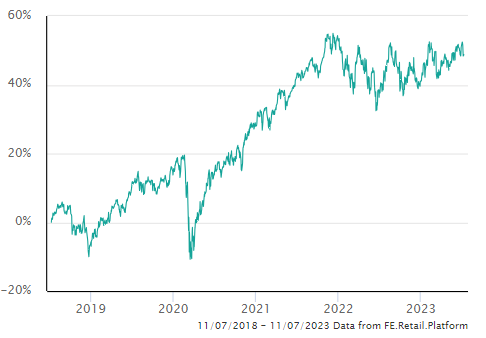

…and over 5 years:

Outlook

Despite the gloom that seems to have engulfed the world and the UK especially, I am optimistic. Why? Because interest rates are nearing their peak. Soon, markets will start to look forward to the point where interest rates start to fall and any economic slowdown is reversed. However, improvement may well not be evident until 2024.

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various periods to the end of June 2023:

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 30 June | One year Performance to the 30 June |

|---|---|---|

| Risk Grade 4 (old Cautious Portfolio) | -0.7% | -1.5% |

| Average Mixed Investment fund (20-60% shares) | -0.4% | +1.1% |

| Risk Grade 6 (old Balanced Portfolio) | 0.0% | +1.1% |

| Average Mixed Investment fund (40-85% shares) | +0.1% | +3.2% |

| Risk Grade 8 (old Adventurous Portfolio) | +0.3% | +3.2% |

| Average Flexible Investment Fund | +0.1% | +3.2% |

| FTSE All-Share Index | -0.4% | +7.8% |

| FTSE World Index ex UK (£) | +3.8% | +13.6% |

| FTSE UK Gilts Index | -5.4% | -14.4% |

Long term performance

| Parmenion Portfolio/Index | Five year Performance to the 30 June | Ten year Performance to the 30 June |

|---|---|---|

| Risk Grade 4 (old Cautious Portfolio | +8.1% | +49.0% |

| Average Mixed Investment fund (20-60% shares) | +8.3% | +41.8% |

| Risk grade 6 (old Balanced Portfolio) | +18.5% | +81.0% |

| Average Mixed Investment fund (40-85% shares) | +16.3% | +66.8% |

| Risk grade 8 (old Adventurous Portfolio) | +24.1% | +107.8% |

| Average Flexible Investment Fund | +18.4% | +71.3% |

| FTSE All-Share Index | +16.5% | +78.0% |

| FTSE World Index ex UK (£) | +64.3% | +211.3% |

| FTSE UK Gilts Index | -19.1% | +3.2% |

PORTFOLIO REVIEW

All Portfolios

Risk Grade 4 Portfolio

The Risk Grade 4 Portfolio lost -0.7% over the quarter, underperforming its benchmark – the average mixed investment (20%-60% shares) fund – which lost -0.4%.

The quarter was punctuated by a significant fall in the value of UK gilts with the UK Gilt Index dropping -5.4% over the quarter as the markets absorbed the news that inflation in the UK was likely to be higher for longer. Luckily, we are light on gilts, preferring global bond exposure, but this fall had some impact.

While global markets appreciated, most gains were wiped out by an improvement in the value of sterling, which has steadily risen this year.

No changes were made to the portfolio over the quarter.

Risk Grade 6 Portfolio

The Risk Grade 6 Portfolio was unchanged in value over the quarter, underperforming its benchmark –the average mixed investment (60-80% shares) fund – which gained +0.1%.

The quarter’s highlight was the strength in the US markets, which was led higher by the large US tech companies. However, for a UK investor, these gains were mitigated by the strength of sterling, which has steadily appreciated in the foreign exchange markets this year.

No changes were made to the portfolio this quarter.

Risk Grade 8 Portfolio

The Risk Grade 8 Portfolio gained +0.3% over the quarter, outperforming its benchmark – the average Flexible fund – which gained +0.1%.

The quarter’s highlight was the strength in the US markets which was led higher by the large US tech companies. However, for a UK investor, these gains were mitigated by the strength of sterling, which has steadily appreciated in the foreign exchange markets this year.

No changes were made to the portfolio this quarter.

Going forward

As you will know, the HA&W models are closing next quarter and so my focus is on ensuring a smooth transition to Parmenion’s portfolio solutions.

I would like to thank all the customers who have invested in this solution which has run for over 13 years now, and I fully expect Parmenion’s very competent investment managers to provide the very best risk-adjusted returns going forward.

Best wishes,

Jim

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner