The first half of 2022 has been challenging, to say the least. After a balmy 2021 things started badly and then got worse.

The world is now plagued with inflation levels approaching double digits and the war in Ukraine has forced the price of many commodities, especially oil and gas, through the roof. Although well-publicised supply chain issues are easing, these do continue and have now been complicated by Chinese Covid-related lockdowns.

Central banks, and especially the US FED, have now taken a firmly hawkish stance and intend to get tough on inflation. Increases in interest rates are underway which have the deliberate effect of slowing economic growth to squeeze inflation out of the system. This squeeze will also crimp the outlook for business and industry, with expectations of reduced corporate profits causing markets to fall.

Over the previous 12 months, we face a US market that has lost -11.9% but has fallen -20.2% year to date. European markets have fallen -15.5% over the previous 12 months and have fallen -20.3% year to date. And the Chinese market has returned -3.6% over the previous 12 months but fell only -6.2% year to date.

Unusually, the UK market has held up much better than everywhere else. The UK Index has increased by +1.0% over the previous 12 months and has only fallen -3.5% so far this year.

Focusing on the previous quarter, the UK All-Share Index fell -5.0%, the FT World Index -9.0%, the UK Gilts Index also fell -7.4% and surprisingly, the UK Inflation-Linked Securities Index also fell -18.2%.

The only positive number I can see on my screen is the UK Property Index which increased +1.2%. It’s most unusual for all asset classes to fall together and this has made the management of investments very challenging this year so far.

The Chinese market deserves a special mention. The collapse of the nation’s largest property developer caused the market to sag this spring. Evergrande is such a large business that the impact of this failure is severe. Other property developers are also in trouble. China has also suffered from a surge in Covid cases and widespread lockdowns. The Chinese market is now recovering as the government is providing monetary support for their economy, although the lockdowns continue.

It’s worth mentioning that the UK commercial property market has woken up and the main fund we support grew by an outstanding +20.0% over the previous 12 months. We’ve been buyers of this asset class over the year as surprisingly, there is a shortage of good quality commercial property, especially for distribution warehousing.

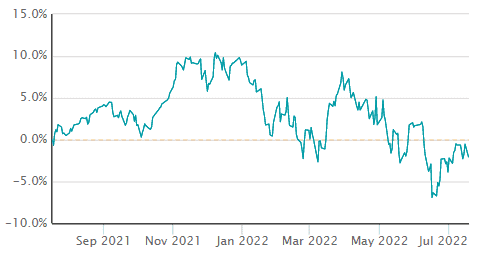

Here is a chart of the FTSE All-share Index for the previous 12 months:

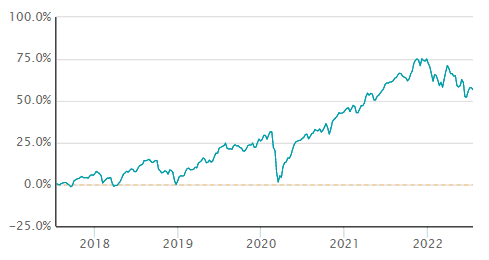

…and the previous five years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the end of June 2022.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 30 June 2022 |

One year Performance to the 30 June 2022 |

|---|---|---|

| Cautious Portfolio | -5.7% | -5.8% |

| Average Mixed Investment fund (20-60% shares) | -6.3% | -7.0% |

| Balanced Portfolio | -7.1% | -7.1% |

| Average Mixed Investment fund (40-85% shares) | -7.4% | -7.1% |

| Adventurous Portfolio | -8.3% | -9.2% |

| Average Flexible Investment Fund | -6.9% | -7.0% |

| FTSE all share index | -5.0% | +1.6% |

| FTSE world index ex UK (£) | -9.3% | -3.2% |

| IBOX Gilt Index | -7.4% | -13.6% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 30 June 2022 |

Ten year Performance to the 30 June 2022 |

|---|---|---|

| Cautious Portfolio | +14.3% | +71.5% |

| Average Mixed Investment fund (20-60% shares) | +9.7% | +54.2% |

| Balanced Portfolio | +26.9% | +104.5% |

| Average Mixed Investment fund (40-85% shares) | +18.1% | +85.8% |

| Adventurous Portfolio | +29.4% | +131.8% |

| Average Flexible Investment Fund | +20.4% | +91.7% |

| FTSE all share index | +17.7% | +94.6% |

| FTSE world index ex UK (£) | +58.2% | +223.8% |

| IBOX Gilt Index | -3.6% | +17.8% |

PORTFOLIO REVIEW

All Portfolios

All portfolios suffered losses over the second quarter of 2022. Equity and bond markets have been weak due to the inflationary impact of the war in Ukraine and the prospect of central bank action necessary to tame these inflationary pressures.

Cautious Portfolio

The Cautious Portfolio lost -5.7% over the quarter, outperforming its benchmark – the average mixed investment (20-60% shares) fund – which lost -6.3%.

Significant detractors from returns this month were UK shares of any type. Our exposure to “value” shares via the Fidelity European Fund, Schroder Global Sustainable Value, and Fidelity American Special Situations helped steady the ship.

In addition, our “Alternative Assets” fund from BNY Mellon was almost at par along with an unusual fund we’ve held for over a year now: the M&G UK Inflation-Linked Corporate Bond Fund, which has trounced almost every other bond fund (especially index-linked bonds) by holding its value. L&G Property, which we’ve held for over a decade, was the only bright spot, rising by +3.2% over the quarter.

In June we sold 25% of our holdings in a fund that tracks the UK All-Share Index. This reduced our exposure to the UK market by around 5.0% and is part of a longer-term strategy to allocate less to the UK market, where we think the long-term prospects are poor and the short-term benefits of war in Ukraine (due to high commodity exposure) are “in the price” and to increase allocations to global markets. In this case, we bought the US markets using a low-cost tracker which mirrors the S&P 500 Index.

Balanced Portfolio

The Balanced Portfolio lost -7.1% over the quarter, outperforming its benchmark – the average mixed investment (40-80% shares) fund – which lost -7.4%.

Significant detractors from returns this month were UK growth shares and our small exposure to European real estate, where the UK component was especially weak. Our exposure to “value” shares via the Fidelity European Fund, Schroder Global Sustainable Value and Fidelity American Special Situations helped steady the ship. In addition, our “Alternative Assets” fund from BNY Mellon was almost at par along with an unusual fund we’ve held for over a year now; the M&G UK Inflation-Linked Corporate Bond Fund, which has trounced almost every other bond fund (especially index-linked bonds) by holding its value.

In May we spilt our holding in Liontrust Special Situations (which has been our primary UK growth fund) with the Slater Growth Fund, which has been on our radar for years. Mark Slater has a good reputation for finding reasonably priced growth stocks and we felt that this might add some performance to our higher-risk grade models.

In June we sold 25% of our holding in a fund that tracks the UK all-share index. This reduced our exposure to the UK market by around 5.0% and is part of a longer-term strategy to allocate less to the UK market, where we think the long-term prospects are poor and the short-term benefits of war in Ukraine (due to high commodity exposure) are “in the price” and to increase allocations to global markets. In this case, we bought the US markets, using a low-cost tracker which mirrors the S&P 500 Index.

Adventurous Portfolio

The Adventurous Portfolio lost -8.3% over the quarter, underperforming its benchmark (the average Flexible fund) which lost -6.9%.

Significant detractors from returns this month were UK growth shares and our small exposure to European real estate, where the UK component was especially weak. Our exposure to “value” shares via the Fidelity European Fund, Schroder Global Sustainable Value and Fidelity American Special Situations helped steady the ship.

In May we spilt our holding in Liontrust Special Situations (which has been our primary UK growth fund) with the Slater Growth Fund, which has been on our radar for years. Mark Slater has a good reputation for finding reasonably priced growth stocks and we felt that this might add some performance to our higher-risk grade models.

In June we sold 25% of our holding in a fund that tracks the UK all-share index. This reduced our exposure to the UK market by around 5.0% and is part of a longer-term strategy to allocate less to the UK market, where we think the long-term prospects are poor and the short-term benefits of war in Ukraine (due to high commodity exposure) are “in the price” and to increase allocations to global markets. In this case, we bought the US markets, again using a low-cost tracker which mirrors the S&P 500 Index.

STRATEGY

Last month I espoused the phrase coined by Margaret Thatcher, “TINA”, or “There Is No Alternative”. In investment circles this phrase is often used to mean one has to buy shares – there’s nothing else that works, especially over the longer term.

We are coming round to the view that US Treasuries are starting to look like reasonable value now and will probably increase our weighting after discussion at our next quarterly investment committee meeting with Parmenion at the end of July.

We are becoming less optimistic about the UK commercial property market, which has enjoyed a strong run, yet valuations continue their march upwards. At the latest quarterly rebalance, this holding would have been trimmed and replaced with lower-priced equities and bonds.

We also took the view that the UK market was fully valued as commodity prices are rolling over due to the threat of global recession and started what is expected to be a long-term shift into global assets away from the UK. The UK market is stuffed full of oil, gas, and mining companies. In reality, unless one invests in small and mid-sized companies, the UK index has little to offer long term as we simply don’t have enough large growth stocks. There are more exciting opportunities elsewhere, especially in the US market.

Another structural aspect of stock market appreciation is demographic factors. Economies with ageing populations tend to struggle to generate economic growth. This is very evident here in the UK and can also be seen in Japan, which faces a similar issue. Even China, due to its (now reformed) one-child policy faces this issue. However, the economies of the American continent are still growing (sometimes due to immigration) and this population growth helps support higher rates of economic growth for investors.

We are warming to the attractions of the US market as a destination for investment. Valuations are less demanding, it’s well-insulated from the turmoil underway in Europe, and as I’ve discussed above, long-term drivers of growth are in place.

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner