The Global Markets Index grew +6.1% over the previous quarter and has handsomely improved over the year, with a +17.6% gain. The improvement disguises considerable volatility brought about by a combination of much-reported political events around the world and constantly changing expectations for inflation and interest rates in various key countries.

I’m sure you could list the political events as well as I can, but they include:

- War in the Middle East

- A US election which hangs on a knife edge

- A shift to right-wing “populist” political parties around the world.

All these events are “ongoing” with uncertain outcomes that can have, in some cases, a major impact on market values as they affect, for example, the price of oil or the level of taxation.

Going around the countries which make up the global index we have:

United States

The S&P 500 grew by +4.3% over the quarter, topping off a super 12-month period with a gain of +15.1%. There has been considerable volatility in the large US tech stocks that have performed so well in recent years. Valuations became stretched after all the excitement over AI. Over the summer, several factors have impacted various companies’ potential future earnings, such as Chinese electric car imports damaging Tesla’s global car sales and anti-trust action affecting Google. There are lots more examples I could name.

There is also constant debate regarding the outlook for US interest rates with changes in sentiment almost daily as financial and economic data are released. These snippets of information affect the US bond markets which price off interest rate expectations (linked to the rate of inflation) which in turn impact share prices. It’s a merry-go-round. However, the overall direction of travel is up, as inflation and interest rates come down.

Europe

The European Index flatlined over the quarter as economic news for the region was poor. Over the year the index is up +18.3%, reflecting an easing of concerns over the supply of gas despite the continuing war in Ukraine and lower interest rates, but the general economic outlook is difficult. This is due to weak demand from China (more below) affecting all sorts of European manufacturing companies and weak consumer demand which affects everything. This includes, perhaps surprisingly, the demand for luxury goods, the producers of which are significant businesses in the region.

UK

The FTSE All-Share Index grew by +1.4% over the quarter after gaining a relatively decent +10.6% over the year. Positives include a significant fall in inflation (now down to 1.7% in the 12 months to September) and the start of reductions in the rate of interest with more to come. The economy is also showing signs of modest growth and house prices have started to rise.

Although the UK now benefits from much-lauded “economic stability” there are tax increases in the offing and our domestic market is always heavily influenced by the global economic scene, which faces increased uncertainty.

Asia

The Asian markets are now driven by what’s going on in China, which has meant that a spate of very poor economic data from China has had a negative influence on all markets in the region. Nonetheless, the index was up +3.1% over the quarter and up +10.8% over the year. China is still grappling with a real estate crash. Geopolitical tensions with the US and Taiwan don’t help things either.

Other asset classes

Fixed interest securities (our clients generally hold global bonds) performed well over the quarter, gaining +2.2% with an annual return of +9.0%. This reflects the rollover of inflation that has occurred over the previous year and a reduction in interest rates which commenced this summer. Bond values are very sensitive to inflation and interest rates and increase in value as inflation and interest rates fall.

A few clients have exposure to the UK commercial property market, and this is now showing signs of life as interest rates start to fall. This reduces the cost of borrowing (many property businesses are geared). The UK index put on +3.3% over the quarter after a very dull year which generated a modest +3.5% return.

Here is a chart of global markets over one year (in US$):

(Source: Google Finance)

One-year gain: +17.7%.

…And over 5 years (in US$):

Source: Google Finance

Five-year gain: +22.9%.

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of the main indices over various periods to the end of September. The performance of your portfolio will reflect your risk grade and portfolio style.

Short-term performance

| Index | Three-month Performance to 30 September 2024 | One-year Performance to 30 September 2024 |

|---|---|---|

| Average Mixed Investment Fund (20-60% shares)/Cautious | +2.2% | +12.0% |

| Average Mixed Investment Fund (40-85% shares)/Balanced | +1.6% | +13.8% |

| Average Flexible Investment Fund/Adventurous | +1.0% | +13.0% |

| FTSE All-Share Index | +2.2% | +13.4% |

| FTSE World Index ex UK (£) | +0.1% | +20.8% |

| FTSE UK Gilts Index | +2.3% | +7.8% |

Long-term performance

| Index | Five-year performance to 30 September 2024 | Ten-year performance to 30 September 2024 |

|---|---|---|

| Average mixed investment fund (20-60% shares) / Cautious | +15.7% | +47.4% |

| Average mixed investment fund (40-85% shares) / Balanced | +25.1% | +73.9% |

| Average Flexible Investment Fund/Adventurous | +27.7% | +77.6% |

| FTSE All-Share Index | +32.2% | +83.6% |

| FTSE World Index ex UK (£) | +73.1% | +233.2% |

| FTSE UK Gilts Index | -22.4% | +4.2% |

OUTLOOK

The markets have moved on from waiting for interest rate cuts to wondering how far they will go and how fast they will arrive. These expectations change frequently, and the changes drive a lot of the market volatility we have seen.

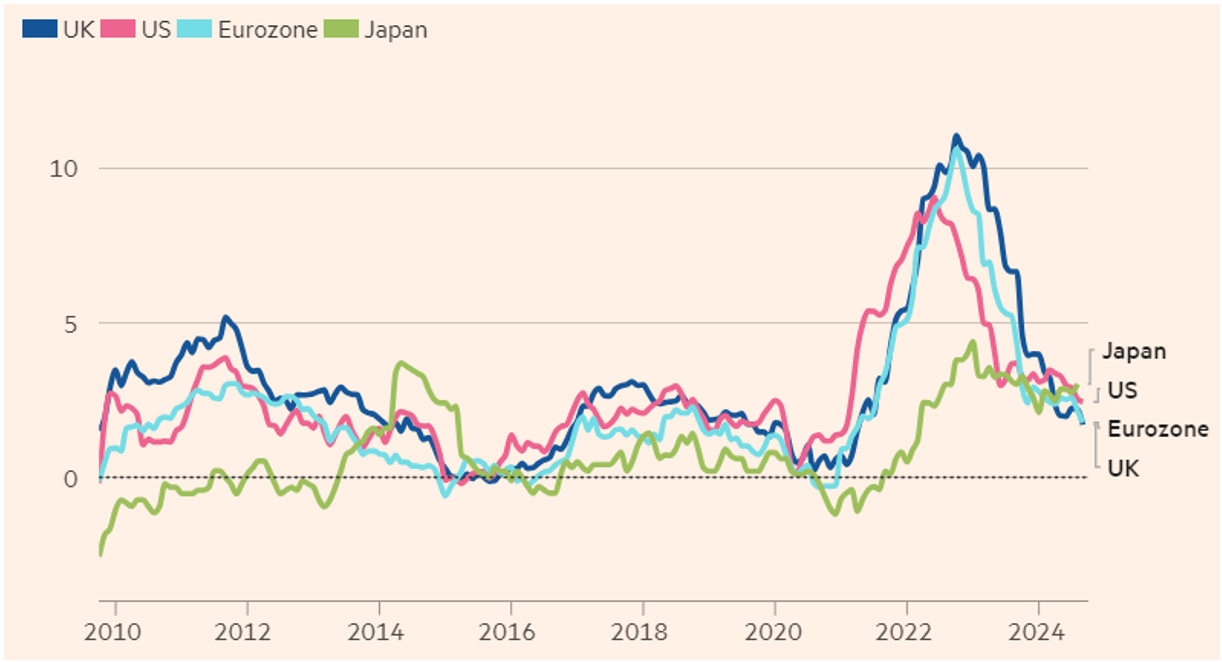

Here’s a chart comparing global rates of inflation:

Source: FT

As you can see, in major economies inflation is converging on the generally accepted target of 2.0% to 2.5%. Interest rates have started to fall in all regions and are likely to settle at around the 3.0% to 3.5% mark. This is a positive backdrop for the markets and should presage an increase in economic activity, which is good for business, industry, and the markets generally.

Historically, the first cut in interest rates heralds strong equity market rallies. However, nowadays, markets seem to be more forward-looking, and I think this rally started once central banks announced that interest rates were likely to fall, an event that occurred last November. We now live in a world where the fundamental economic backdrop is improving and the price of all types of long-term investments will be well supported by lower rates of interest and borrowing costs.

Wars aside, the one big issue looming is the US election. The markets would probably prefer Trump for president, despite the chaos he would likely bring. He has pledged to roll over the expansive tax breaks he introduced in his previous term in office. Harris on the other hand would end them. Tax breaks have to be paid for, however, and one does wonder what the long-term impact on the US economy would be of even more borrowing on top of the existing debt mountain of $35 trillion.

Best wishes,

Jim

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner