Third Quarter – 2022

2022 has been a tough year for investors. After a solid 2021, 2022 has been grim.

Governments around the world are now fighting inflation, the main weapon of attack being higher interest rates. Supply shortages and sky-high energy prices have contributed to the inflationary spike. Higher interest rates control prices by slowing the economy and reducing demand – in effect creating a recession. That’s not a good backdrop for equity investment.

The US market has fallen -23.0% year to date. European markets have fallen -19.4% year to date and the Chinese market has returned -16.4% year to date.

The UK market has held up much better than everywhere else. The UK Index has fallen -11.7% so far this year.

All economies are heading for recession. The US is slowing down as the Fed raises interest rates. Europe is facing a gas crunch but has lower interest rates. China has Covid lockdowns underway and is suffering a construction meltdown following the collapse of Evergrande, its largest property developer.

In the UK, things are slowing. Sadly, our own government has contributed to the malaise by wreaking havoc in the bond markets by announcing uncosted and unfunded tax cuts. Interest rates are therefore higher than they might have been. Recent political upheavals have restored financial stability, but it seems we face yet further austerity measures to “balance the books”.

The real damage to investment portfolios has been allocations of bonds (including gilts). At one point the UK gilt index was down -28.0%. These fixed-interest securities are used to reduce risk in portfolios but have detracted from performance significantly.

Here in the UK, the weakness in sterling has helped support investment values on our international investments, softening the impact of weak markets considerably.

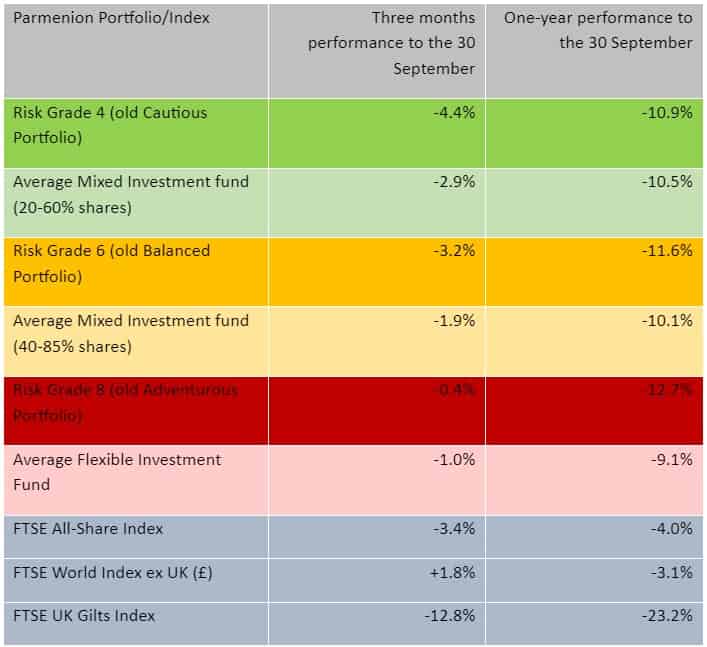

FTSE All-Share Index over one year (source Google Finance)

FTSE All-Share Index over five fears (source Google Finance)

Outlook

The global outlook is poor. The West has its troubles brought about by the war in Ukraine, soaring energy bills, and inflation. Everyone (China excepted) is raising interest rates to cool their economies and reduce economic activity. This is a poor backdrop for the markets as recessions damage corporate profitability.

It might be that once nations are in recession the markets start to move ahead. Always forward-looking, markets anticipate what is to come. In my experience, recessions are brief and a recovery quickly follows, although I’m less confident about the UK in this regard.

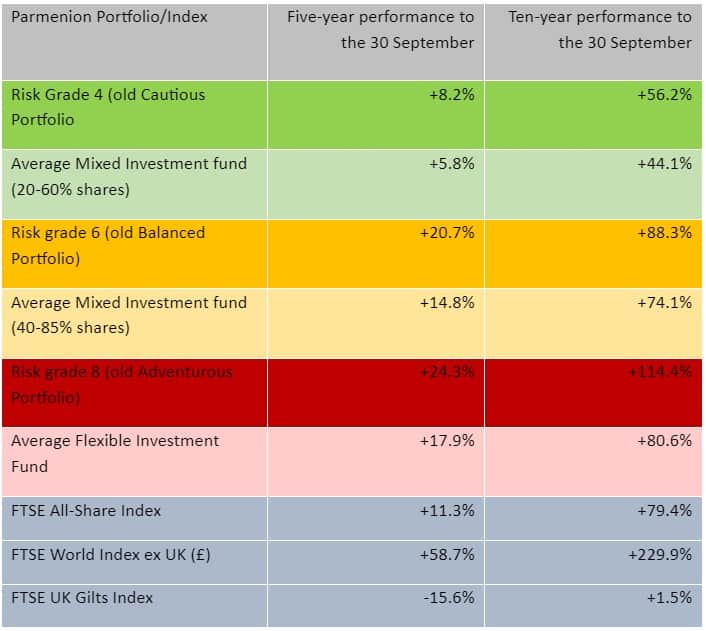

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various periods to the end of September 2022.

Short-term performance

Long term performance

PORTFOLIO REVIEW

All Portfolios

All portfolios suffered losses over the third quarter of 2022. Bond markets collapsed and equity markets were weak. However, international investors were cushioned by sterling’s weakness which mitigated market losses. The UK gilt market suffered well-documented catastrophic losses due to well-publicised failures at the very top of the British government.

Cautious Portfolio

The Cautious Portfolio lost -4.4% over the quarter, underperforming its benchmark – the average mixed investment (20-60% shares) fund – which lost -2.9%.

Significant detractors from returns this month were UK fixed-interest securities. Although we only hold 6.5% of this portfolio in gilts, contagion affected every corner of the UK’s fixed-income markets, so our gilt fund lost -11.5% and our corporate bond fund lost -9.5%.

Our exposure to the UK market generated losses with the All-Share Index dropping -3.4%.

Overseas investments helped ameliorate losses with our US and European funds returning +3.7% and -0.6% respectively, with currency gains helping support valuations.

The portfolio holds 9.0% in short-dated cash instruments as a defensive measure, and these investments helped performance significantly.

No changes were made to the portfolio over the quarter.

Balanced Portfolio

The Balanced Portfolio lost -3.2% over the quarter, underperforming its benchmark – the average mixed investment (40-80% shares) fund – which lost -1.9%.

Significant detractors from returns this month were UK fixed-interest securities. Although have almost no exposure to UK gilts contagion affected every corner of the UK’s fixed-income markets, our UK Corporate Bond Fund lost -9.5%. This represents 5.5% of the portfolio.

Our exposure to the UK market generated losses with some funds dropping over -10.0%. The All-Share Index dropped -3.4%.

Overseas investments helped ameliorate losses with our US and European funds returning +3.7% and -0.6% respectively, with currency gains helping support valuations. Exposure to the US market represents our largest holding at 13.6%.

We also hold a small position in European Real Estate Equities (at 3.8%) which lost an awful -17.8%, which was very disappointing.

No changes to the portfolio were made this month.

Adventurous Portfolio

The Adventurous Portfolio lost -0.4% over the quarter, outperforming its benchmark – the average Flexible fund – which lost -1.0%.

Our largest holding is a US equity tracker (at 18.5% of the portfolio) which gained +3.7%, with currency gains helping support valuations. Other funds with a US bias also turned in positive numbers with Fidelity American Special Situations growing by +4.0% and Liontrust SF Global Growth growing by +3.6%.

Our commitment to UK equities put a dampener on things though, with Slater Growth dropping -11.0% and Premier Miton UK MultiCap Income dropping -10.9%.

It is an odd situation when a higher-risk portfolio falls less than our lower-risk portfolios, but this reflects weakness in the fixed-income markets. They are bad here in the UK, but it is also a global phenomenon.

No changes to the portfolio were made this month.

STRATEGY

We are still debating increasing our allocation to US Treasury stocks but now include UK gilts, as valuations of both, in our opinion, are starting to discount the likely increase in interest rates globally. We were glad to be largely out of the gilt market this quarter.

The investing universe of bonds (fixed-income securities) has been exceedingly difficult to manage. I suspect the investment managers we use would agree with this statement too. We are currently searching for a replacement for a very long-term holding in the Jupiter Strategic Bond Fund. This manager can buy any type of bond anywhere in the world and historically the company had a good reputation. Over the last year, however, they really seem to have lost their way, and this was during a period when one really needed expertise. By the next quarter, we will have selected a replacement.

Many commentators notice how cheap the UK market is. One equity fund we hold yields over 5.0%. In my whole investing career, the UK market has always been cheap and I see little reason for the gap in valuation between the UK and other western markets to narrow.

The UK economy really is in a mess. We plan to further reduce exposure bit by bit over the coming years. After saying this, there are always interesting companies to invest in further down the scale. The UK has some great small and medium-sized businesses with excellent growth prospects. If you are a higher-risk investor you will have more exposure to this type of business in your UK allocation.

I also like the appeal of the European markets. They are very cheap and have scope for significant recovery once the price of gas retreats to something normal (although I appreciate this may take years). Europe may be a home for some of our UK equity holdings as we slowly reduce these.

Asia has become problematic. The issue is the Chinese government, which is becoming increasingly authoritarian. We have small exposure to China now and I wonder if at some point the nation will become uninvestable, in the same way that Russia has.

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner