Global markets have been flat over the previous quarter but are up at the half-year stage after a positive start to the year, early in the first quarter.

There’s certainly been a “treading water” feel to the markets, which have had to come to terms with the fact that much-promised interest rate cuts haven’t yet occurred (except in Europe where the European Central Bank cut rates by 0.25% last month). Europe likely boasts the weakest economic profile out of the G7 nations so it’s not surprising that they have cut rates first.

The Global Equity Index fell by -0.8% over the quarter after increasing by +10.3% over the previous 12 months. Here in the UK, the FTSE All-Share Index increased by +4% over the quarter, having grown by a respectable +16.9% over the year. It’s worth mentioning here that the UK market didn’t flinch a bit after the announcement of the General Election results.

The US market added +4.4% over the quarter, after growing by a strong +26.7% over the year, buoyed by hype over AI. European markets have been weak and volatile in recent weeks, due to the recent election called in France which has resulted in considerable uncertainty. The result was a quarter loss of -2.2% and an annual return of +16.1%.

Asian markets collectively were relatively flat with a gain of +1.3% over the quarter and +10.5% over the year. These numbers disguise considerable volatility. The Chinese market wobbled as the region fought a property slump and the Indian market had unexpected election results to cope with.

Here is a chart of global markets over one year (in US$):

One-year gain: +10.3%. Source: Google Finance

…And global markets over five years (in US$):

Five-year gain: +20%. Source: Google Finance

Market performance

I enclose tables showing the performance of the main indices over various periods to the end of the year. The performance of your portfolio will reflect your risk grade and portfolio style.

Short-term performance

| Index | Three-month performance to 30 June 2024 | One-year performance to 30 June 2024 |

|---|---|---|

| Average Mixed Investment Fund (20-60% shares)/Cautious | +1.1% | +9.3% |

| Average Mixed Investment Fund (40-85% shares)/Balanced | +1.6% | +11.8% |

| Average Flexible Investment Fund/Adventurous | +1.7% | +11.7% |

| FTSE All-Share Index | +3.7% | +12.9% |

| FTSE World Index ex UK (£) | +2.6% | +21.4% |

| FTSE UK Gilts Index | -0.8% | +4.7% |

Long term performance

| Index | Five-year performance to 30 June 2024 | Ten-year performance to 30 June 2024 |

|---|---|---|

| Average mixed investment fund (20-60% shares) / Cautious | +15.2% | +44.8% |

| Average mixed investment fund (40-85% shares) / Balanced | +25.5% | +72.4% |

| Average Flexible Investment Fund/Adventurous | +28.5% | +77.5% |

| FTSE All-Share Index | +30.9% | +77.8% |

| FTSE World Index ex UK (£) | +79.7% | +244.2% |

| FTSE UK Gilts Index | -19.2% | +5.7% |

Outlook

The markets are still awaiting interest rate cuts, despite UK inflation hitting the official target of 2%. In the US, which is the one that really counts, inflation is stuck at 3%.

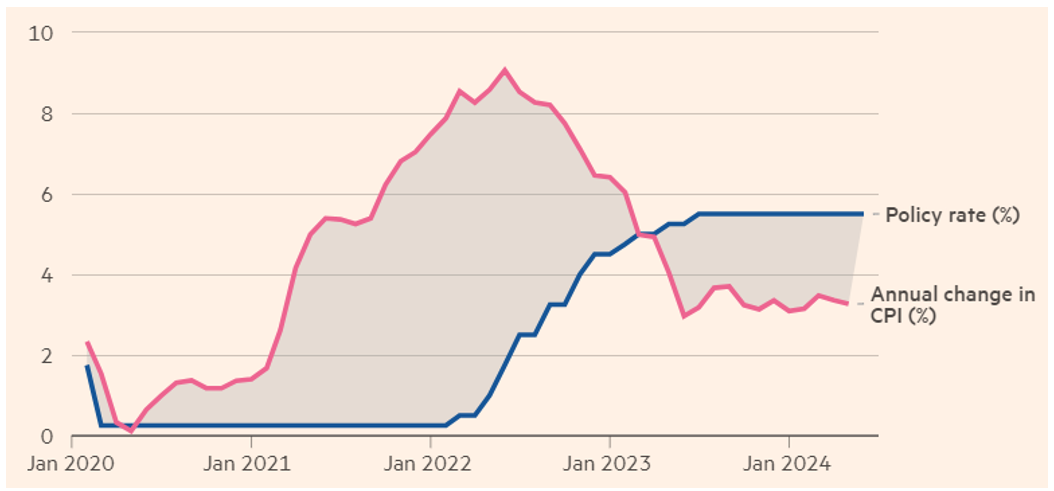

Here’s a chart comparing the US Federal Bank rate with US inflation numbers:

Source: Financial Times

The Fed in America is really struggling to dispose of the final 1%. The issue is that falling energy prices resulted in a big dent in the headline rate but that underlying inflation – service industry costs and salaries – is increasing at 4.5%. This is still too high, so interest rate cuts have been deferred.

I therefore hold my view that markets will tread water until interest rates start to fall. I am still confident going into 2025. This is a positive stage in the economic cycle with the trend for inflation and interest rates in a downward direction and a likely improvement in economic growth.

I must mention our own, unloved, UK market. I have a lot of optimism about the prospects for the FTSE over the next year or so. Why? Stability. We have a new government, which everyone hopes will put an end to non-stop political infighting and other shenanigans and improve on what has been our pariah status as an investment destination since Brexit in 2016. This, combined with a cheap market and a modicum of economic growth, could produce double-digit returns over the next 12 months.

The note of caution I must add is that this year sees numerous elections and now includes a surprise snap election in France (which left the nation with no ruling government). We have sailed through the UK election with the markets liking the outcome. The next test may be another four years of Donald Trump.

Best wishes,

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner