Markets rebounded strongly in April after suffering a mournful first quarter. All the concerns that were causing angst have been forgotten and stock market growth has resumed.

Here in the UK the FTSE 100 index surged by over +6.0% as Sterling weakened considerably on the foreign exchanges. As Sterling falls the value of overseas earnings increases and this feeds through into higher share prices. Ironically, all this occurred due to worries about the Brexit negotiations. Due to currency moves, currently, Worse Brexit = Higher Stock Market.

All the troubles surrounding the FAANGS in America (see last month’s report) have melted away with the US market climbing +2.8%. A more positive mood has ensued after a surge in US company profits due to Trump’s Corporation Tax reduction.

UK Commercial property had a steady month in spite of bad news relating to some high-profile retail failures. Luckily the investment managers we use have limited exposure to the Nation’s High Streets where the outlook for retail properties is poor.

Globally, thoughts that US interest rates might remain lower for longer meant that Asia, European and Emerging markets all made strong gains in April and now stand at all-time highs.

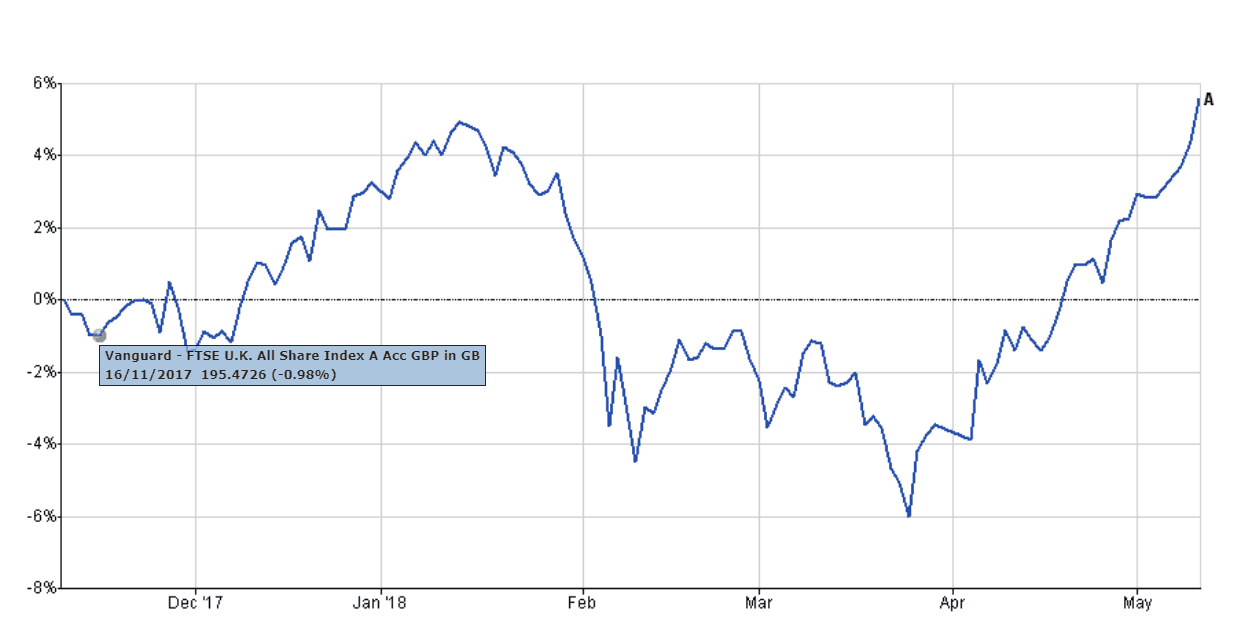

Here is a chart of the FTSE all-share Index for the last six months:

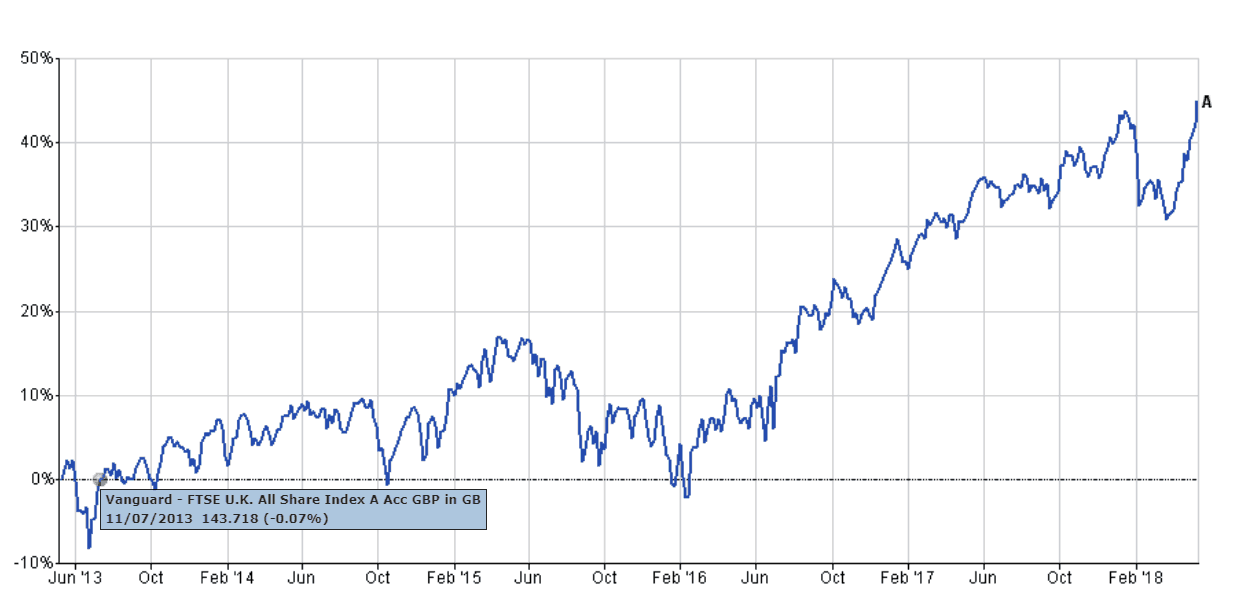

…and the last five years, which puts this into perspective:

Portfolio Performance

I enclose tables showing the performance of all portfolios over various time periods to the 30 April 2018.

Short-term performance

| Parmenion Portfolio/Index | One month Performance to 30 April 2018 |

One year Performance to 30 April 2018 |

|---|---|---|

| Cautious Portfolio | +1.7% | +4.0% |

| Average Mixed Investment fund (20-60% shares) | +2.2% | +2.9% |

| Balanced Portfolio | +3.0% | +7.4% |

| Average Mixed Investment fund (40-85% shares) | +3.1% | +4.8% |

| Adventurous Portfolio | +3.0% | +7.9% |

| Average Flexible Investment Fund | +2.9% | +5.6% |

| FTSE all share index | +6.4% | +8.1% |

| FTSE world index exUK (£) | +2.6% | +7.4% |

| IBOX Gilt Index | -1.0% | -0.7% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 30 April 2018 |

Five year Performance to 30 April 2018 |

|---|---|---|

| Cautious Portfolio | +14.4% | +33.6% |

| Average Mixed Investment fund (20-60% shares) | +13.3% | +26.7% |

| Balanced Portfolio | +24.0% | +45.8% |

| Average Mixed Investment fund (40-85% shares) | +18.9% | +26.7% |

| Adventurous Portfolio | +33.4% | +63.4% |

| Average Flexible Investment Fund | +19.7% | +40.0% |

| FTSE all share index | +22.5% | +45.5% |

| FTSE world index exUK (£) | +43.1% | +81.7% |

| IBOX Gilt Index | +12.2% | +21.1% |

Portfolio Review

All portfolios surged in value in April as markets recovered from a series of bad pieces of news which arose over the first quarter. The UK market was particularly strong as the GB Pound was weak on the foreign exchanges.

Cautious Portfolio

The Cautious Portfolio gained +1.7% in April, under-performing the its benchmark (the average mixed investment (20-60% shares) fund) which gained +2.2%. Our UK investments performed very well with help from a strong performance from Europe. UK commercial property added modestly to returns.

No changes were made to the portfolio this month.

Balanced Portfolio

The Balanced Portfolio gained +3.0% in April, just under-performing the its benchmark (the average mixed investment (40-80% shares) fund) which gained +3.1%. Our UK investments performed very well with help from a strong performance from Europe. Our Emerging Market investments detracted from returns.

No changes were made to the portfolio this month.

Adventurous Portfolio

The Adventurous Portfolio gained +3.0% in April, just out-performing its benchmark (the average Flexible fund) which gained +2.9%. Our UK investments performed very well with help from a strong performance from Europe. Our Emerging Market investments detracted from returns.

No changes were made to the portfolio this month.

Outlook

The US economy is currently driving market expectations globally, with two issues being stand-out;

Firstly, there is an ongoing debate about the outlook for inflation and interest rates. Here is a comment from Jay Powell, the new FED Chair is of interest,

“As we focus on the long-run fiscal situation, our goal should be to put the debt on a declining path as a share of the economy. That will require running smaller deficits in strong economic periods — such as the present — to offset the larger deficits that are needed in recessions to restore demand and avoid deeper crises. Last year’s Tax Cuts and Jobs Act turned that economic logic on its head. The economy was already at or close to full employment and did not need a boost. This year’s bipartisan spending agreement contributed further to the ill-timed stimulus. The Federal Reserve will have to act to make sure the economy does not overheat.”

Mr Powell makes the point that Trump’s corporate tax cuts are ill-timed and make it more likely that interest rates will have to increase. Stock markets can take modest rises in interest rates in their stride, but more severe moves will be damaging to asset prices.

The second issue is the performance of US corporate profits growth. Over the previous year profits have increased by an average of 25%. This is an outstanding result. Ironically, share prices actually fell during this quarter’s reporting season as these increases were all “in the price”. The equanimity of the market also points to investor caution as valuations are high.

To sum up, metaphorically, all in the garden is rosy, autumn is upon us, but what of winter? Concerns about the UK economy and Brexit are a sideshow at present, to the main drivers of global markets.