Investment Review

The UK market ended the year in style with bumper gains being enjoyed during December. Our local market was playing “catch-up” after a very flat Autumn, as other global indices had made decent gains during this period. The FT 100 share index gained +4.7% over the month.

Elsewhere markets were firm, with the US market pushing ahead as Trump’s reform of Corporation tax pushed US stocks ahead. Thus, the S&P500 index ended up +2.4%. In Europe markets fell a little declining by -0.4% over the month due to political concerns about the Catalonia crisis.

Asian stocks made modest gains, pushing ahead +1.5%, although shares in China and Hong Kong were very strong due to good economic numbers.

Emerging Markets zoomed ahead gaining +2.7%. The Indian market was boosted by a win by Prime Minister Modi in a regional election that he was widely forecast to lose. This enhances the prospects for the reformist and pro-business Modi to win the next Indian general election. Meanwhile, the South African market enjoyed a boost, as the allegedly corrupt Zuma family lost control of the ANC to the reformist Cyril Ramaphosa, who it is hoped will engender political reform.

Fixed interest securities held firm and UK commercial property continued to make steady progress as investors remained attracted by the high rental yields on offer and shrugged off Brexit concerns.

Overall, a great end to the year.

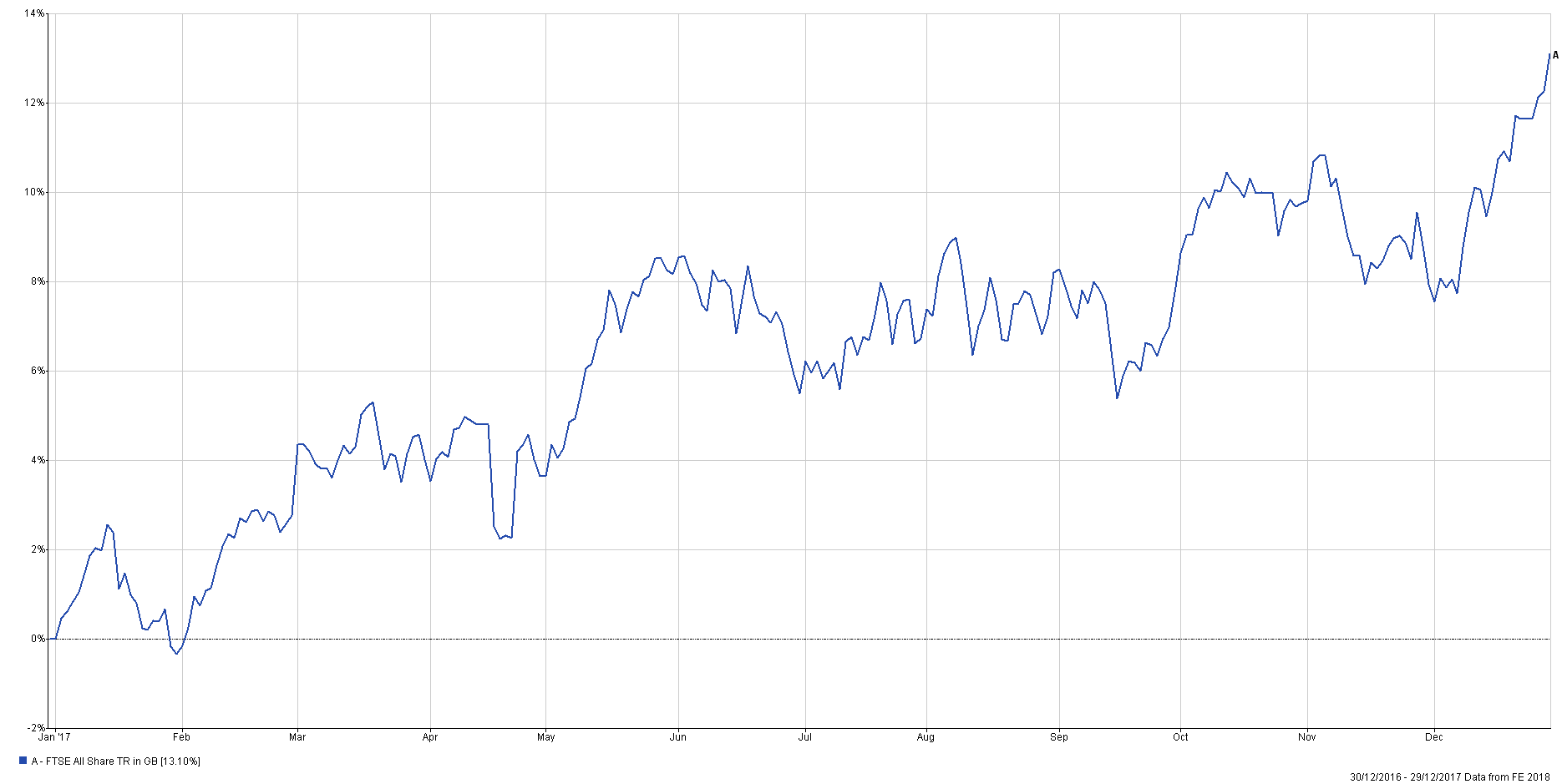

Here is the chart of the FTSE All share index for the last six months:

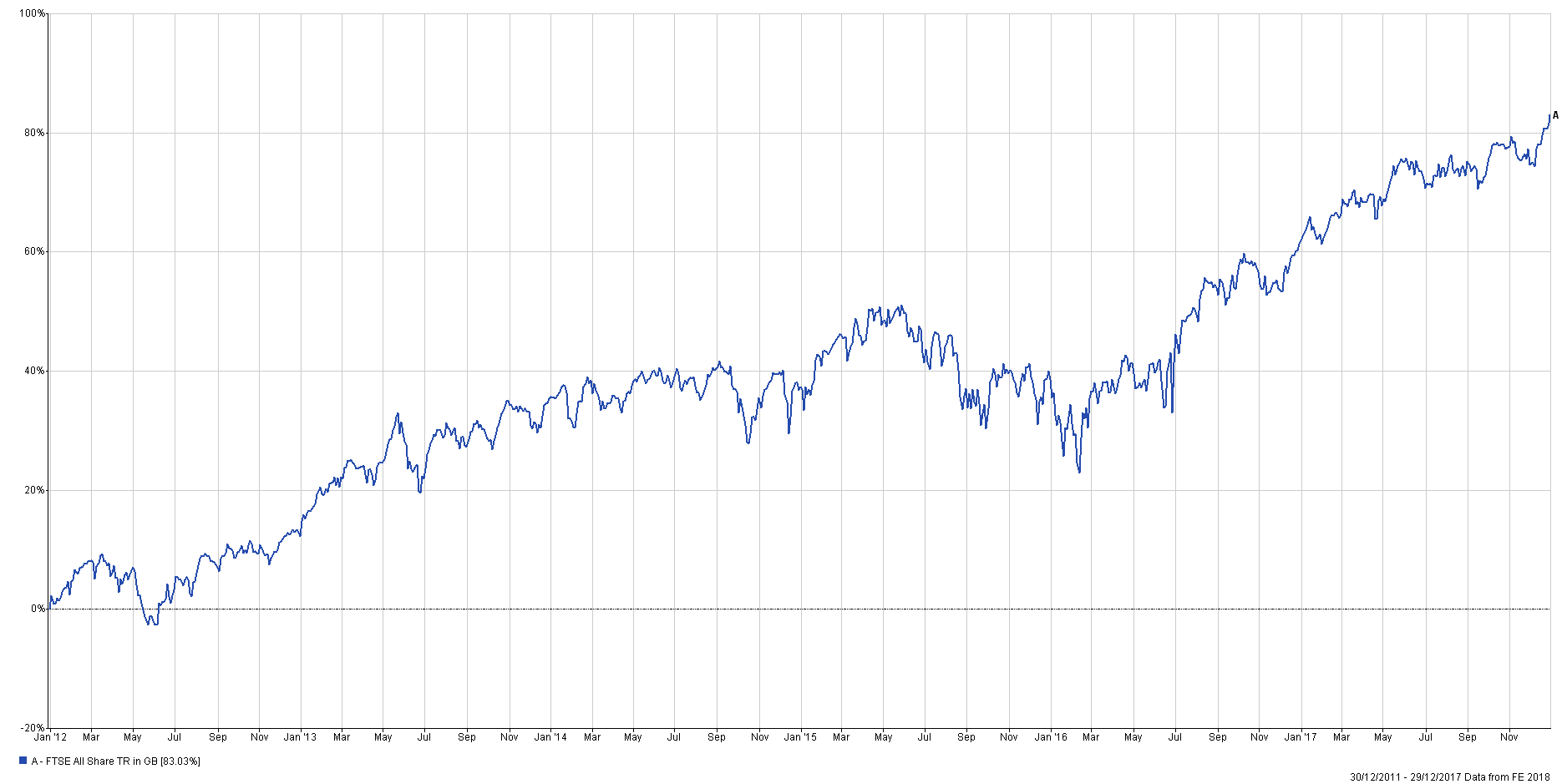

…and the last five years, which puts this into perspective:

Portfolio performances

I enclose tables showing the performance of the portfolios over various time periods to the end of December 2017:

Short-term performance

| Parmenion Portfolio/Index | One month performance to 31 December 2017 |

One year performance to to 31 December 2017 |

|---|---|---|

| Cautious Portfolio | +1.1% | +8.0% |

| Average Mixed Investment fund (20-60% shares) | +1.0% | +7.1% |

| Balanced Portfolio | +1.9% | +13.1% |

| Average Mixed Investment fund (40-85% shares) | +1.3% | +9.9% |

| Adventurous Portfolio | +2.3% | +16.1% |

| Average Flexible Investment Fund | +1.1% | +11.2% |

| FTSE all share index | +4.7% | +13.1% |

| FTSE world index exUK (£) | +1.4% | +13.4% |

| IBOX Gilt Index | +1.4% | +1.9% |

Long-term performance

| Parmenion Portfolio/Index | Three year performance to 31 December 2017 |

Five year performance to to 31 December 2017 |

|---|---|---|

| Cautious Portfolio | +19.3% | +45.0% |

| Average Mixed Investment fund (20-60% shares) | +19.6% | +36.5% |

| Balanced Portfolio | +30.9% | +59.0% |

| Average Mixed Investment fund (40-85% shares) | +27.4% | +52.9% |

| Adventurous Portfolio | +44.0% | +80.5% |

| Average Flexible Investment Fund | +29.0% | +55.0% |

| FTSE all share index | +33.3% | +62.9% |

| FTSE world index exUK (£) | +55.0% | +113.5% |

| IBOX Gilt Index | +13.1% | +24.3% |

(Source; Parmenion Capital Partners LLP)

Portfolio review

All portfolios produced super returns during December as both the UK and world markets made strong gains.

Cautious Portfolio

The Cautious Portfolio gained +1.1% in December in-line with its benchmark (the average mixed investment (20-60% shares) fund) which gained +1.0%.

For the first time in a long while our investment in UK equities lead the charge, with our UK tracker fund gaining +4.6%. Global equity funds made progress and our UK property funds also put in a strong performance, gaining around 1.0% on average.

During the month we disposed of our remaining holding in Woodford Equity Income*, switching into an All-share tracker fund.

Balanced Portfolio

The Balanced Portfolio gained +1.9% in December ahead of its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.3%.

For the first time in a long while our investment in UK equities lead the charge with our UK tracker fund gaining +4.6%. Global equity funds made progress, with our Emerging Market fund being the stand-out performer.

During the month we disposed of our remaining holding in Woodford Equity Income*, switching into a Global equity tracker fund.

Adventurous Portfolio

The Adventurous Portfolio gained +2.3% in December out-performing its benchmark (the average Flexible fund) which gained +1.1%.

For the first time in a long while our investment in UK equities lead the charge with our UK tracker fund gaining +4.6%. Global equity funds made progress, with our Emerging Market funds and Asian funds making solid gains.

During the month we disposed of our remaining holding in Woodford Equity Income, switching into an Emerging Market Fund.

Outlook for 2018

Globally, economic growth is in an upswing and corporate profitability is improving. It’s a favourable back-drop to the markets. This move has been led by Europe for a change, where the political and economic outlook (UK excepted) has significantly improved.

Here in the UK the market is driven almost entirely by exchange rate factors as opposed to the strength of our domestic economy. Bizarrely, a “good Brexit”, which would boost the pound, could hold the stock market back. A “bad Brexit” on the other hand, might boost the value of our overseas earnings and might be good for the UK market, as Sterling would take a hit.

Further afield global equity markets trade on high valuations and we have taken a cautious stance. Markets will have to be weaned off a glut of monetary stimulus that has kept interest rates low and asset prices high. Interest rates have already risen in the US and on a more modest basis, here in the UK, and against this back drop, I would expect share price appreciation to be pedestrian.

After flagging this note of caution, it is a fact that investors and business leaders in both the US and Europe are very optimistic. Company profits are likely to please, which could sustain the bull market in equities for a while yet.

My concern is that this optimism is over-done, which is always the case in late bull markets. There is evidence of speculative bubbles emerging with the popularity of Bitcoin and other cryptocurrencies. Any company that announces that it is going to use Blockchain technology sees an immediate pronounced rise in its share price.

A number of technical factors relating to the bond markets indicate that investors think that there will be an increase in inflation globally. This is almost certain to result in an application of the monetary brakes, which will impact on investment markets. It is for this reason that I am cautious and maintain my conservative stance in the management of client portfolios.

PS Don’t forget the usual risk warning for all long-term investments: “The value of units can fall as well as rise, and past performance is no guarantee of future performance. The value of income payments from investment funds is not guaranteed and can fall as well as rise”.