Important News

Today (6 January) marks the conversion of our three existing Cautious, Balanced and Adventurous portfolios to our new risk-graded solutions of 4, 6, and 8. Clients who had a blend of these portfolios will be placed in either the new risk-grade 5 or risk-grade 7 in most instances.

The new portfolios will initially look very similar to the old ones, but we plan to introduce a few subtle changes over the year to refine each solution and hopefully boost long-term returns.

Customers should have received a letter regarding the changes via our portal or in the post.

Fourth Quarter, 2021

The final quarter of 2021 was a very positive one for investors, with many markets hitting all-time highs. This was despite considerable volatility caused by the emergence of the Omicron Covid variant and ongoing concerns regarding the pace of monetary tightening in the US.

The global equity index grew by +6.9%. The American market surged by +10.6% and the UK market gained +4.2%. The Chinese market continued to struggle but managed to gain +2.0% as the nation came to terms with the impending bankruptcy of Evergrande, China’s largest property developer.

The UK commercial property market has really come to life as investors sought high yielding quality assets, driving up valuations. We support the L&G Property fund which has grown by an outstanding +7.0% over the quarter.

Fixed-interest securities gained a little over the month as expectations regarding the pace of interest rate increases, when they arrive, eased somewhat.

What the markets were sensing was that the Omicron variant will not result in mass lockdowns or huge numbers of additional deaths; the economic impact would be small. This positive and ongoing economic recovery resulted in continued investor optimism.

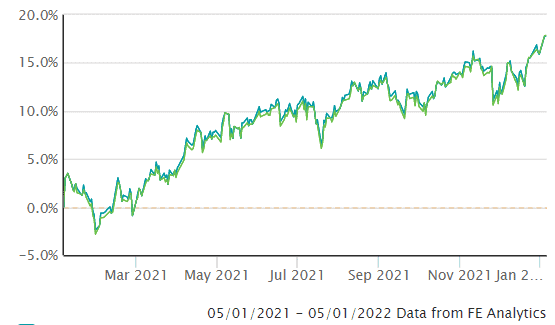

Here is a chart of the FTSE All-share Index for the previous 12 months:

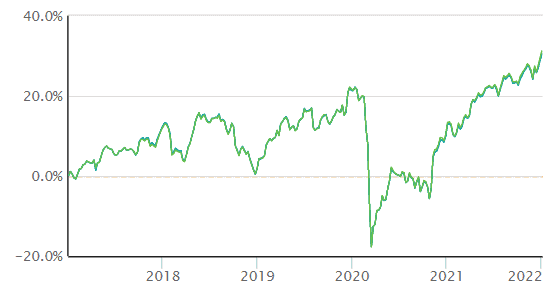

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the end of December 2021.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 31 December 2021 |

One year Performance to the 31 December 2021 |

|---|---|---|

| Cautious Portfolio | +2.7% | +8.1% |

| Average Mixed Investment fund (20-60% shares) | +1.8% | +7.2% |

| Balanced Portfolio | +3.3% | +13.1% |

| Average Mixed Investment fund (40-85% shares) | +2.7% | +10.4% |

| Adventurous Portfolio | +3.3% | +14.9% |

| Average Flexible Investment Fund | +2.2% | +11.3% |

| FTSE all share index | +4.2% | +18.3% |

| FTSE world index ex UK (£) | +6.9% | +22.2% |

| IBOX Gilt Index | +2.4% | -5.1% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 31 December 2021 |

Ten year Performance to the 31 December 2021 |

|---|---|---|

| Cautious Portfolio | +31.8% | +99.5% |

| Average Mixed Investment fund (20-60% shares) | +26.2% | +77.4% |

| Balanced Portfolio | +53.0% | +140.7% |

| Average Mixed Investment fund (40-85% shares) | +39.6% | +113.6% |

| Adventurous Portfolio | +62.4% | +179.1% |

| Average Flexible Investment Fund | +42.4% | +118.8% |

| FTSE all share index | +30.1% | +110.7% |

| FTSE world index ex UK (£) | +89.6% | +299.5% |

| IBOX Gilt Index | +12.4% | +39.8% |

PORTFOLIO REVIEW

All Portfolios

All portfolios made decent gains during the final quarter of 2021. Markets continued to make progress as economic growth recovered and concerns regarding the Omicron Covid variant waned.

Fixed-interest securities gained small sums as expectations regarding the pace of interest rate hikes (when they arrive) eased and commercial property valuations continued to move ahead as investors hunted for stable income streams.

Cautious Portfolio

The Cautious Portfolio gained +2.7% over the quarter, outperforming its benchmark (the average mixed investment (20-60% shares) fund) which gained +1.8%.

US and European shares enjoyed strong gains with our main global fund run by Vanguard climbing +7.0% over the quarter. UK commercial property surged as investors bid up the value of distribution units and it became apparent that owners of office properties could redevelop unwanted premises into flats. Asian markets were weak and markets here were flat overall.

Balanced Portfolio

The Balanced Portfolio gained +3.3% over the quarter, outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +2.7%.

US and European shares enjoyed strong gains with our main global fund run by Vanguard climbing +7.0% over the quarter. UK commercial property surged as investors bid up the value of distribution units and it became apparent that owners of office properties could redevelop unwanted premises into flats. Asian markets were weak and markets here were flat overall.

Adventurous Portfolio

The Adventurous Portfolio gained +3.3% over the quarter, outperforming its benchmark (the average Flexible fund) which gained +2.2%.

US and European shares enjoyed strong gains with our main global fund run by Vanguard climbing +7.0% over the quarter. Fidelity Europe delivered +7.5% and Premier Miton Pan Euro Property fund grew by +6.6%. Our allocation to Asia was a drag on performance with Fidelity Asia only growing by +0.2%.

2021 REVIEW & OUTLOOK

2021 was a great year for investors; all markets bar the Chinese Shanghai Index climbed by impressive amounts with the UK growing by +17.8% and the Global benchmark growing by +22.4%. Surprisingly, the UK commercial property market went into overdrive with the benchmark growing by an impressive +13.8%. These returns were all achieved as the world benefited from a successful vaccine rollout that was effective against Covid and continuing monetary and fiscal support from central banks.

As we move into 2022 investors are in good cheer. Unfortunately, there is a reasonable list of concerns that cloud the outlook:

- There are concerns about the valuation of stocks in the US market where the nation’s top 10 companies (Google, Microsoft, Apple, etc.) have led the US market much higher.

- There are also Covid-related risks; the main concerns being potential new variants and poor take-up of the vaccine in some countries due to “anti-vaxxers”. A combination of these two issues could result in more lockdowns.

- How big an issue will Omicron be? The markets are taking an optimistic view that while case numbers are up, they are mostly among the young. Vaccines protect the old and vulnerable and this is reflected in lower hospital admissions. Anti-viral treatments now exist too. The biggest economic impact could be the number of people self-isolating who are removed from the workforce.

- China also has its own economic problems; they have banned the import of coal from Australia due to a political spat and now are suffering power shortages. The nation’s largest property developer is in serious financial difficulties and is going to default on its debts and will have to be bailed out by the government. Property and real estate make up 1/3rd of the Chinese economy and this failure has the potential to cause a recession in the country.

- Governments around the world have pumped huge sums into the markets. This has been inflationary. The solution for higher inflation, which is increased interest rates, is bad for markets. Central bankers were claiming that we are going through a temporary inflationary spike, but the story is slowly changing to one where inflation could be more persistent. As things stand, interest rate increases are forecast to be modest and the inflation may prove to be transitory, so we may well dodge this bullet.

- There are also tax increases in the pipeline to help pay for all the support provided during lockdown. This could be a drag on economic growth.

Overall, this could well be a year of consolidation, as the markets cope with monetary tightening, but long-term investors know that the markets always have a habit of surprising – one way or another!

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner