The fourth quarter of 2019 resulted in a strong performance from global equity markets and included, for once, the UK market.

Over the quarter the FTSE World Index gained +1.1%. This return disguises a much higher return from global markets which was ameliorated by a significant strengthening in the value of Sterling. So, for example, the S&P500 index gained +8.5% over the quarter, but a UK investor only enjoyed a gain of +1.7%

Global markets were strong as the US Fed continued its policy of cutting interest rates and Trump announced an initial trade deal with the Chinese (due to be signed soon) which should engender a global economic recovery.

Here in the UK a strengthened GB£ also held back growth in our domestic market. Nonetheless, the FT All share index climbed by +4.2%. The UK market was buoyed by Boris Johnson achieving an initial trade (or exit) deal with the EU and then winning the general election with a sizeable majority. This will hopefully allow the nation to move ahead after years of Brexit malaise. This good news also explains the rebound in the value of Sterling mentioned above.

Fixed interest securities gave up some of the gains enjoyed earlier in the year as expectations for growth and inflation rose.

UK commercial property has suffered its worst year for a long time with values gently falling. The woes on the Nation’s High Street are well documented, but a wider Brexit-related loss of confidence has taken its toll with one well know property fund having to “gate” withdrawals.

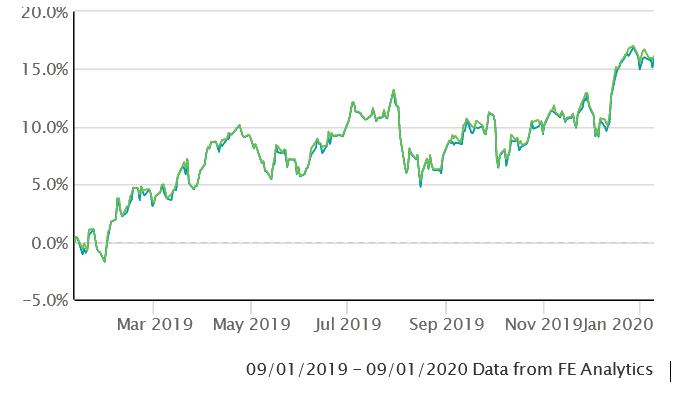

Here is a chart of the FTSE All-share Index for the previous 12 months:

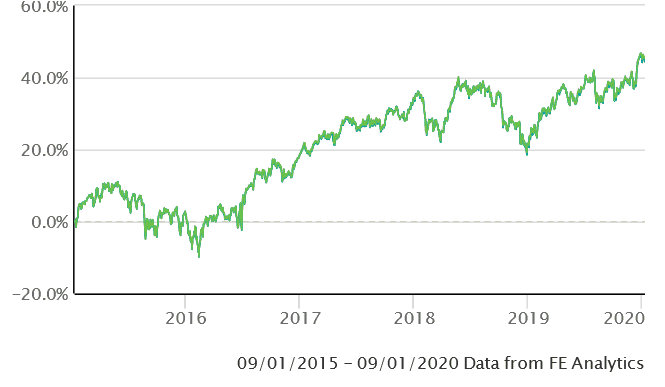

…and the previous 5 years:

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 31 December 2019.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 31 December 2019 |

One year Performance to 31 December 2019 |

|---|---|---|

| Cautious Portfolio | +1.1% | +12.1% |

| Average Mixed Investment fund (20-60% shares) | +1.7% | +11.8% |

| Balanced Portfolio | +3.7% | +18.0% |

| Average Mixed Investment fund (40-85% shares) | +2.3% | +15.7% |

| Adventurous Portfolio | +4.4% | +20.2% |

| Average Flexible Investment Fund | +2.7% | +15.6% |

| FTSE all share index | +4.1% | +19.1% |

| FTSE world index exUK (£) | +1.2% | +23.1% |

| IBOX Gilt Index | -4.2% | +7.1% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to 31 December 2019 |

Ten year Performance to 31 December 2019 |

|---|---|---|

| Cautious Portfolio | +28.7% | +93.3% |

| Average Mixed Investment fund (20-60% shares) | +27.0% | +67.2% |

| Balanced Portfolio | +46.8% | +116.7% |

| Average Mixed Investment fund (40-85% shares) | +38.5% | +94.0% |

| Adventurous Portfolio | +60.6% | +136.7% |

| Average Flexible Investment Fund | +39.2% | +87.3% |

| FTSE all share index | +43.8% | +118.2% |

| FTSE world index exUK (£) | +85.7% | +213.6% |

| IBOX Gilt Index | +21.9% | +73.1% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +1.1% over the fourth quarter under-performing its benchmark (the average mixed investment (20-60% shares) fund) which gained +1.7%.

Markets were strong over the quarter with funds focused on UK mid and smaller sized companies performing well (eg Miton UK Multicap Income up +7.1%). Our fixed-income investments were a drag on performance.

During the quarter we sold Jupiter European and bought Fidelity European as the manager at Jupiter left to set up his own fund management business. This was a shame as the Jupiter fund had been a superb investment. We also reinvested most of the cash held in the portfolio in Gilts which provide a counter balance for the equity component.

Balanced Portfolio

The Balanced Portfolio gained +3.7% over the final quarter, outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +2.3%.

Markets were strong over the quarter with funds focused on UK mid and smaller sized companies performing well (eg Marlborough Special Situations up +10.5%). Our exposure to European property shares on a currency-hedged basis was a significant boost.

During the quarter we sold Jupiter European and bought Fidelity European as the manager at Jupiter left to set up his own fund management business. This was a shame as the Jupiter fund had been a superb investment. We also reinvested the cash held in the portfolio in Gilts which provides a counterbalance for the equity component.

Adventurous Portfolio

The Adventurous Portfolio gained +4.4% over the fourth quarter, outperforming its benchmark (the average Flexible fund) which gained +2.7%.

Markets were strong over the quarter with funds focused on UK mid and smaller sized companies performing well (eg Marlborough Special Situations up +10.5%). The absence of traditional UK commercial property exposure aided performance and our exposure to European property shares on a currency-hedged basis was a significant boost.

During the quarter we sold Jupiter European and bought Fidelity European as the manager at Jupiter left to set up his own fund management business. This was a shame as the Jupiter fund had been a superb investment. We also reinvested the small cash holding in the portfolio in Gilts, which provides a counterbalance for the equity component.

OUTLOOK for 2020

We go into 2020 with global markets, excluding the UK, looking rather expensive. A lot of good news is priced into equity valuations with events, such as the US/China trade deal, being widely anticipated with lofty expectations about the future growth of corporate profits.

Whilst I don’t think that markets are buoyed by feelings of exuberance, valuations are generous and for this reason, I anticipate a slow first half to 2020 whilst we wait for the real world to catch up to where markets think we are.

There is also a growing debt bubble in the US with companies being “over-leveraged” and the markets lending to such businesses on too generous terms. In other words, investors are not being amply rewarded for the risks that they are taking. We avoid such risky investments.

Here in the UK, I do perceive a new-found optimism since the Nation appears to be governable again, with the Tory party securing a large majority in Parliament. Whilst our future trading relationship with the EU has yet to be negotiated, a deal is in everyone’s interests and Boris has already proved that he is a man who can cut a deal. Getting this agreement in place may prove to be a challenge, but one that can be overcome. The negotiations may result in periods of market weakness.

International Investors have shunned the UK. I expect that investor’s money will come back into the domestic market which will support UK equities and progressively narrow the gap between the valuation of the UK and other Western markets.

Overall, I’m most positive about the UK market thinking that globally, we may see a period of consolidation.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner