13 April 2021

Investment Report First Quarter 2021

;)

The first quarter of 2021 was generally positive for equities with the American market rising +7.3% and the UK market gaining +4.5%. The global index rose +3.8% with returns held back by a significant strengthening of sterling following our Brexit Deal with the EU.

Markets are buoyed by the roll-out of vaccine programmes worldwide (albeit some are quicker than others) and a very positive economic outlook everywhere.

Lower-risk investments (gilts and bonds) that populate most portfolios performed well during the spring and summer of 2020. However, these gains are being given back now, as the markets are fretting about a resurgence in inflation which could follow the money printing by governments everywhere to support Covid-hit economies.

The UK commercial property market has enjoyed modest steady gains since investment funds reopened for trading last quarter.

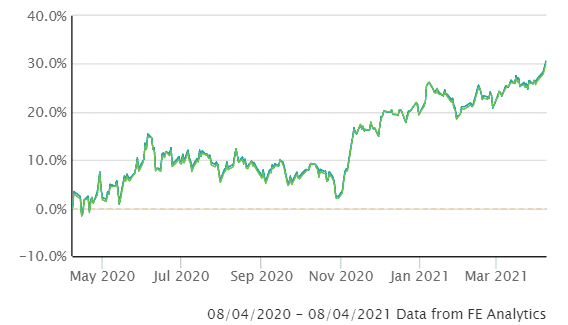

Here is a chart of the FTSE All-Share Index for the previous 12 months:

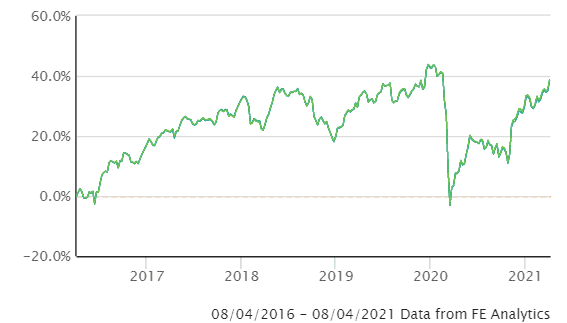

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to 31 March 2021.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 31 March 2021 |

One year Performance to the 31 March 2021 |

|---|---|---|

| Cautious Portfolio | +0.3% | +14.8% |

| Average Mixed Investment fund (20-60% shares) | +0.8% | +19.8% |

| Balanced Portfolio | +2.0% | +27.2% |

| Average Mixed Investment fund (40-85% shares) | +1.5% | +26.4% |

| Adventurous Portfolio | +2.0% | +34.0% |

| Average Flexible Investment Fund | +2.2% | +29.1% |

| FTSE all share index | +5.1% | +26.7% |

| FTSE world index ex UK (£) | +4.0% | +40.8% |

| IBOX Gilt Index | -7.4% | -5.5% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 31 March 2021 |

Ten year Performance to the 31 March 2021 |

|---|---|---|

| Cautious Portfolio | +30.2% | +78.4% |

| Average Mixed Investment fund (20-60% shares) | +30.2% | +60.0% |

| Balanced Portfolio | +50.1% | +106.3% |

| Average Mixed Investment fund (40-85% shares) | +44.2% | +84.5% |

| Adventurous Portfolio | +64.9% | +126.0% |

| Average Flexible Investment Fund | +49.3% | +83.4% |

| FTSE all share index | +35.6% | +78.9% |

| FTSE world index ex UK (£) | +103.9% | +212.1% |

| IBOX Gilt Index | +15.3% | +59.2% |

PORTFOLIO REVIEW

All Portfolios

All portfolios made steady gains during the first quarter of 2021, although the growth in the Cautious Portfolio was very modest.

Markets continued to make progress as vaccine programs were rolled out around the world.

Fixed interest securities were very weak over the quarter due to concerns that inflation may reappear after a decade of absence.

Cautious Portfolio

The Cautious Portfolio gained +0.3% over the quarter underperforming its benchmark – the average mixed investment (20-60% shares) fund – which gained +0.8%. The cautious portfolio’s relative underweight to the UK market was a negative factor.

During the month, our UK investments performed well but our international and fixed-income investments less so. It was nice to see UK commercial property make a positive contribution of 3.0% over the quarter.

Over the quarter we reduced our allocation to cash so as to fully participate in the unfolding economic recovery and started a new position in the Fidelity Emerging Markets fund.

Balanced Portfolio

The Balanced Portfolio gained +2.0% over the quarter, just outperforming its benchmark – the average mixed investment (40-80% shares) fund – which gained +1.5%. The Balanced Portfolio’s relative overweight to the UK market was a boost to performance.

During the quarter we trimmed exposure to the UK market adding to emerging markets to fully participate in the unfolding economic recovery and started a new position in the Fidelity Emerging Markets fund.

Adventurous Portfolio

The Adventurous Portfolio gained +2.9% over the quarter, just out-performing its benchmark (the average Flexible fund) which gained +2.2%.

Our UK investments led the charge with strong gains but our exposure to European property was a detractor.

During the quarter we reduced our small allocation to fixed interest securities adding to sustainable investments (Liontrust Sustainable Future) and Asian and emerging markets with Fidelity, to fully participate in the unfolding global economic recovery.

OUTLOOK

Looking forward there are concerns about the valuation of stocks in the US market, where there is a debt-fuelled bubble forming in the technology sector and other investments, such as Bitcoin. A period of consolidation would be welcome, so that company earnings could catch up with lofty share price valuations.

There are also still Covid-19-related risks; the main concerns being new Covid-19 variants and poor take-up of the vaccine due to “anti-vaxxers”.

There are some worries about the future of global trade flows as many nations denounce Chinese actions regarding the Uighur Muslims and many countries are becoming protectionist. The US falls into this category and seems to be defending its “tech giants” vigorously as a variety of nations propose a tax levy on internet and social media companies.

Finally, governments around the world have pumped huge sums into the markets. This could prove to be inflationary. Indeed, in the last week in February, the bond markets suffered a major tantrum due to concerns that higher inflation was on the way but was calmed when Central Bankers made soothing comments.

On a more positive note, the markets are looking through the current troubles to a world where businesses can operate normally in any sector (including hospitality, travel & tourism), which implies normal levels of profitability. The UK market may also revert to historic valuation levels now Brexit uncertainty is past us and we have become world leaders in the production and distribution of vaccines.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner

Category: Investment Report, News