Environmental issues have rarely been out of the news in recent years. From the campaigning of high-profile figures, such as Sir David Attenborough and Greta Thunberg, to the protests of Extinction Rebellion, and the Paris Agreement, environmental issues have dominated headlines.

Customers will know that Jim has been promoting ESG (Environmental, Social & Governance) investment over the previous year and you may be curious to know how these investments have fared during the COVID-19 pandemic.

Increased awareness of global warming, plastic pollution, and issues around sustainability, has meant that ESG investing has come to the fore.

The number of investors looking to match their investments to their values has risen, and if investing ethically once meant foregoing good returns, this is no longer the case. Recently, as the coronavirus pandemic hit global markets, sustainable funds largely outperformed their traditional counterparts.

If you’re thinking of aligning your investments with your values, speak to us.

In the meantime, here’s everything you need to know about the rise of sustainable investment, starting with a fundamental question.

What is ESG investing?

ESG investing considers environmental, social, and governance factors, as well as traditional financial ones.

- Environmental factors

Global warming and climate change are dominating headlines worldwide, increasing awareness and engagement with environmental issues.

Consumers and investors are keener than ever to know that production methods are ethical and sustainable. A company with good ESG credentials will also understand – and be actively looking to lower – its carbon footprint.

- Social

Social factors deal with how a community views a company, and how that company treats those within its community. Fair and equal wages, safe working conditions, and a good record in employee relations would all be strong evidence of social awareness.

A recent example of investor reaction to a company’s poor record on social issues would be the Boohoo wages scandal, which saw its value drop by more than £1 billion.

- Governance

This looks at factors such as the democratic election of Board members, the size of executive pay-packets, and wider issues like bribery and corruption.

Strong leadership and control of issues of governance would increase the likelihood of investment from those keen to support ESG.

How does ESG investing work?

There are many different strategies a fund manager might use to ensure a potential investment meets your ESG requirements. These include strategies such as:

- Positive screening

Singling out a company based on its strong ESG credentials. For example, those having a positive impact on their local community, or who are actively engaged in lowering their carbon footprint.

- Negative screening

Effectively the opposite of positive screening, this means actively avoiding companies known to have poor attitudes or track records on ESG issues

- ‘Best in class’

Choosing to invest in a given sector and then selecting the company with the best ESG record in that sector

- Thematic investing

Investing in companies that will benefit from specific themes related to ESG factors. It’s possible that the company’s ESG credentials in one area might be poor, but their long-term work in another area aligns with an investor’s desired theme.

- Faith-based investing

This would mean avoiding companies whose business activities do not align with the teachings of a certain faith

The rise of ESG

American finance company MSCI suggest that socially responsible investing ‘began in the 1960s, with investors excluding stocks based on business activities such as tobacco production or involvement in the South African apartheid regime.’

Forbes state that the term ESG was first coined in 2005.

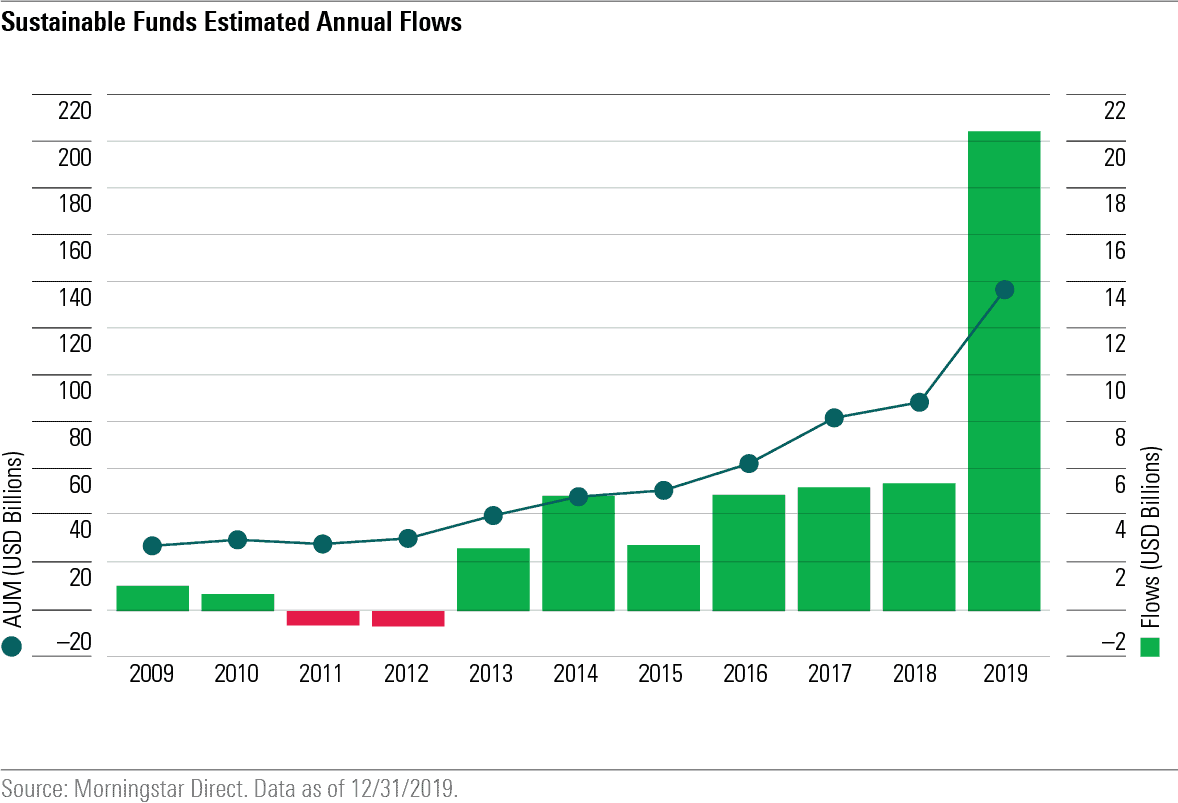

This graph from Morningstar highlights the rise in inflows into US sustainable funds. A sharp increase in 2013 and 2014 marked the release of studies showing that good sustainability performance was associated with favourable financial results.

Source: Morningstar

Over the next few years inflows remained relatively steady until 2019 when they quadrupled.

FTAdviser reports that inputs into ESG products increased by nearly 2500% between 2014 and the end of October 2019. By this point, £124 million a week was being placed into UK ESG funds, a total of £4.4 billion.

ESG and the coronavirus pandemic

The effect of Covid-19 on stock markets has been well-documented.

The BBC confirmed in March that the FTSE 100, the Dow Jones and the S&P 500 had all suffered their largest single-day losses since 1987. But how have ESG funds fared during the pandemic?

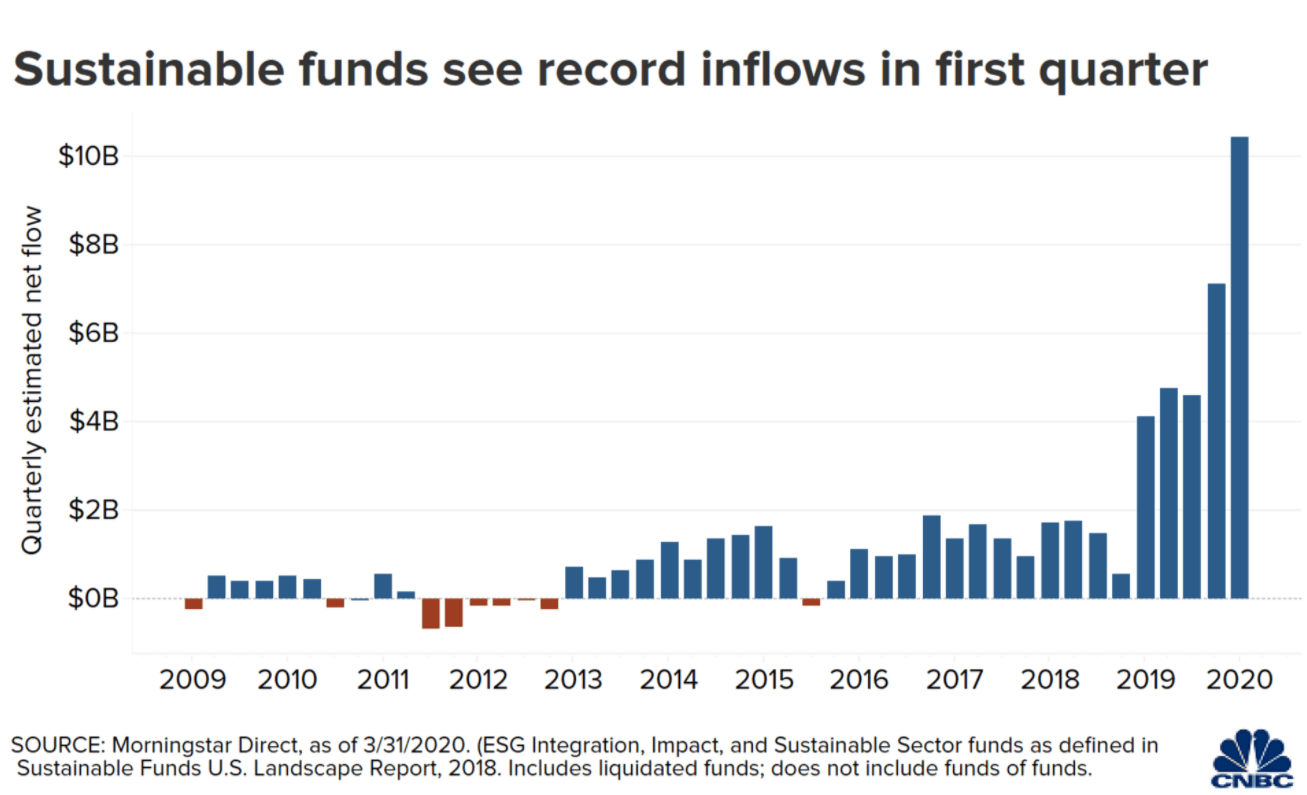

The earlier graph shows a steep rise in US inputs for 2019, but the rise for the first quarter of 2020 is even more pronounced.

Source: CNBC

It’s a similar story in the UK and Europe.

London-based Citywire reports that global ESG funds recorded inflows of £37 billion for the first quarter of 2020. Of that amount, 72.5% was into European funds. 2020 has been a record year for ESG funds so far.

CNBC recently linked this sharp rise to the coronavirus pandemic, suggesting ‘the outbreak of Covid-19 could prove to be a major turning point for ESG investing.’

As global lockdowns grounded planes, restricted the number of cars on the road, and halted non-essential heavy industry, sustainability became headline news. The effect on air pollution and wildlife numbers focused attention on environmental issues and might partly account for ESG’s relative success.

However, the main driver of growth has been that ESG funds invest heavily in the technology and pharmaceutical industries – both areas of investment that have prospered during lockdown.

Not only have ESG funds enjoyed strong inflows but the performance has been superb. Investing with a conscience has its rewards!

If you’d like to discuss making changes to your investments, get in touch.

We can help you match your investments to your values, maintaining a diversified portfolio that matches your risk profile and aligns with your long-term goals.

Get in touch

Please contact us if you’d like to discuss investment based on environmental, social, or governance issues.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.