12 December 2022

Gifting this Christmas: An Inheritance Tax guide

;)

Rising energy bills and soaring inflation mean that money is tight for many UK households this Christmas. The challenging economic climate might even call for a different approach to your present buying.

You might consider gifting cash or investments. They could prove to be the gift that keeps on giving while being tax-efficient for you too.

Keep reading for your guide to HMRC’s gifting rules and how tax-efficient gifting could lower the value of your estate, and even lower the rate of Inheritance Tax (IHT) payable.

Thresholds are currently frozen but you could have a £1 million estate without IHT to pay

You become liable for IHT at 40% of the value of your estate that exceeds a certain HMRC threshold. This is known as the nil-rate band, which currently stands at £325,000. The chancellor, Jeremy Hunt, used his autumn statement to freeze this threshold until at least 2028.

You can also make use of the residence nil-rate band. This applies up to the value of £175,000 when you pass on a residence to certain loved ones, including a child, grandchild, or foster child.

Both of these amounts, if unused, can be passed onto a surviving spouse or civil partner, raising their IHT threshold to £1 million.

While this might seem like a large sum, the value of your investments and property will probably rise over the next five years, during which time these thresholds will remain frozen.

If you think your estate might exceed these thresholds, you might opt to lower the value of your estate while you are still alive. This is where gifting comes in.

The IHT “seven-year” rule and the benefits of giving while living

You can make as many gifts as you like during your lifetime. These gifts are known as “potentially exempt transfers (PETs)” because they become liable to IHT at 40%, but only if you survive for less than seven years after making the gift. This is the seven-year rule.

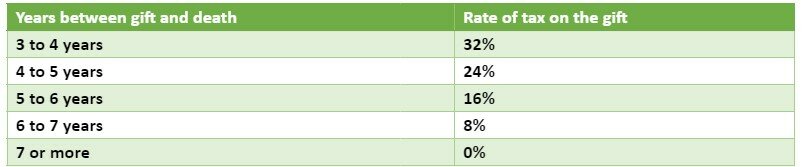

If you survive longer than three years, but less than seven, tax is also payable on a sliding scale as taper relief.

Source: HMRC

While it has been traditional to leave an inheritance on death, usually via a will, “giving while living” has been increasing in popularity over the last few years.

You will still be around to see the difference your money makes. Plus, the earlier you make the gift, the more likely you are to survive for a further seven years, rendering the gift tax-free.

HMRC’s regular gifts from income exemption is a great way to help a loved one gain financial security

Investments like a Junior ISA or a pension can be a great way to provide the gift of future financial stability in the present. What’s more, you can do so tax-efficiently.

HMRC’s regular gifts from income exemption allow you to make regular payments to an individual, perfect for making contributions to a pension or investment. You’ll need to be able to prove that the gift is made from your regular income and doesn’t detrimentally affect your standard of living.

Paying into an investment for a child or grandchild this Christmas is a great way to begin establishing their future financial security. It also gives many years of potential investment returns and compound growth.

Gifting into an investment using HMRC’s regular gifts from income exemption can be tax-efficient for you while helping to secure a loved one’s future financial stability.

Other HMRC gifting exemptions might be great this Christmas too, including:

- Small gifts worth less than £250 are not subject to IHT (as long as they are not made to a person who has already received your whole annual exemption, see below).

- Gifts that fall within your annual exemption of £3,000 a year. This exemption applies to an individual and can be carried forward for up to a year.

- You can make wedding gifts of up to £5,000 depending on what relation the couple are to you. For example, you can gift £5,000 or less to a child and up to £2,500 to a grandchild.

Charitable giving could lower the rate of IHT you pay

Christmas is a great time to give a gift to a cause you care about. Gifts to charities are tax-efficient for you too.

Not only are charitable gifts tax-free, helping to lower the value of your estate, but they can also lower the rate at which any IHT is paid. You’ll need to donate 10% of the net value of your estate to charity. If you do so, the IHT rate for any liability you have will drop from 40% to just 36%.

You can give to charity while you are alive or use your will to leave a charitable legacy. If this is something you think you would like to do please get in touch and we can help.

Get in touch

Frozen allowances are set to raise millions for the treasury over the next few years, affecting your retirement, investments, and your estate planning.

If you have any concerns about the effect of the chancellor’s autumn statement or your finances, or you’d just like help to gift to a loved one tax-efficiently this Christmas, get in touch.

Contact us now to find out how our Chartered financial planners could help you.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Category: News, Taxation