2022 was a poor year for investors. Some green shoots are emerging as we move into 2023, but the global economy still faces numerous headwinds.

The battle to control inflation is still ongoing with interest rates steadily rising in all western economies. There is a consensus as to how high peak rates will be and many commentators think that inflation levels have topped out and will fall from here. However, there is still work to do and to squeeze inflation out central banks must create a recession (or at least an economic slowdown).

Over 2022 the US market fell by -18.0%. European markets have fallen -9.8% and the Chinese market has returned a fall of -12.0%.

The UK market has held up much better than everywhere else. The UK Index fell -2.3% in 2022. We had the benefit of a weak currency and defensive oil, gas, and mining sectors which were the winners from the Ukraine War.

The main damage to portfolios has been our allocations to bonds (including gilts). At one point the UK Gilt Index was down -28.0%. The annual return was a fall of -23.8%. These fixed-interest securities are used to reduce risks in portfolios but have detracted from performance significantly. We held few gilts last year but do have allocations to other sectors of the bond markets, which although not affected so badly, still delivered significant losses.

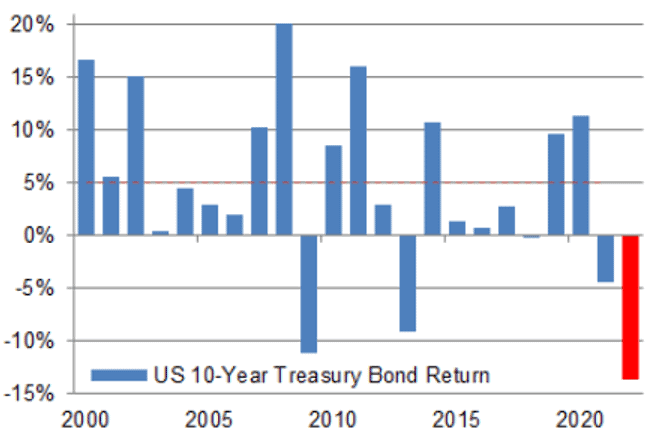

The US has the largest bond market and 2022 was the worst year in over a century. Here’s the relative performance of the 10-year Treasury bill over the previous 20 years:

Weak bond and equity markets meant that there was nowhere to hide in 2022. At least for a UK investor, the weakness in sterling has helped support investment values on international investments, softening the impact of weak markets considerably.

UK commercial property also had a roller coaster year with values falling heavily when the UK gilt market got into trouble in the autumn.

L&G Property Fund

Finally, here’s our own UK index, which held up well as a great proportion of the earnings from our biggest companies is earned in US dollars and euros.

FTSE All-Share Index over one year (source Google Finance)

FTSE All-Share Index over five years (source Google Finance)

Outlook

I shall produce my outlook for the year soon and will publish this as a separate document.

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various periods to the end of December 2022.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 31 December | One year Performance to the 31 December |

|---|---|---|

| Risk Grade 4 (old Cautious Portfolio) | +2.7% | -11.0% |

| Average Mixed Investment fund (20-60% shares) | +3.0% | -9.4% |

| Risk Grade 6 (old Balanced Portfolio) | +3.2% | -11.7% |

| Average Mixed Investment fund (40-85% shares) | +2.8% | -10.0% |

| Risk Grade 8 (old Adventurous Portfolio) | +4.4% | -11.8% |

| Average Flexible Investment Fund | +2.4% | -8.9% |

| FTSE All-Share Index | +8.9% | +0.3% |

| FTSE World Index ex UK (£) | +2.0% | -7.6% |

| FTSE UK Gilts Index | +1.6% | -23.8% |

Long term performance

| Parmenion Portfolio/Index | Five year Performance to the 31 December | Ten year Performance to the 31 December |

|---|---|---|

| Risk Grade 4 (old Cautious Portfolio | +8.4% | +57.3% |

| Average Mixed Investment fund (20-60% shares) | +6.6% | +45.6% |

| Risk grade 6 (old Balanced Portfolio) | +19.3% | +90.6% |

| Average Mixed Investment fund (40-85% shares) | +14.2% | +74.8% |

| Risk grade 8 (old Adventurous Portfolio) | +23.2% | +119.1% |

| Average Flexible Investment Fund | +16.6% | +80.8% |

| FTSE All-Share Index | +15.5% | +88.2% |

| FTSE World Index ex UK (£) | +54.3% | +229.5% |

| FTSE UK Gilts Index | -15.9% | +3.6% |

PORTFOLIO REVIEW

All Portfolios

All portfolios recovered some of the year’s losses in the final quarter of 2022. Both bond and equity markets improved, but international investors gave up some value as sterling appreciated from a very weak position.

Risk Grade 4 Portfolio

The Risk Grade 4 Portfolio gained +2.7% over the quarter, underperforming its benchmark – the average mixed investment (20-60% shares) fund – which gained +3.0%.

Our UK and international investments put in strong gains with JO Hambro UK Equity Income fund increasing by +14.2% and Fidelity Europe rising by +11.5%. To offset this our holding in L&G Property fell by -13.8%. Fixed-interest Securities posted strong gains with, for example, Royal London Corporate Bond rising by + 6.0%.

In November we sold Jupiter Strategic Bond Fund after a period of poor performance and also disagreeing with the manager’s investment strategy. We switched to a low-cost passive solution, the Vanguard Global Bond Index in lieu.

Risk Grade 6 Portfolio

The Risk Grade 6 Portfolio gained +3.2% over the quarter, outperforming its benchmark – the average mixed investment (60-80% shares) fund – which gained +2.8%.

Our UK and international investments put in strong gains with JO Hambro UK Equity Income fund increasing by +14.2% and Fidelity Europe rising by +11.5%. To offset this our holding in L&G Property fell by -13.8%. Fixed-interest securities posted strong gains with, for example, Royal London Corporate Bond rising by + 6.0%.

In November we sold Jupiter Strategic Bond Fund after a period of poor performance and also disagreeing with the manager’s investment strategy. We switched to a low-cost passive solution, the Vanguard Global Bond Index in lieu.

Risk Grade 8 Portfolio

The Risk Grade 8 Portfolio gained +4.4% over the quarter, outperforming its benchmark – the average Flexible fund – which gained +2.4%.

Our UK and international investments put in strong gains with JO Hambro UK Equity Income fund increasing by +14.2%, Liontrust Special Situations increasing by +8.9% and Fidelity Europe rising by +11.5%. Only one fund fell in value in this portfolio, and this was the Fidelity American Special Situations Fund, which had enjoyed strong gains so far this year. This fell by -0.3% over the quarter.

In November we sold our smallholding in Jupiter Strategic Bond Fund after a period of poor performance and also disagreeing with the manager’s investment strategy. We switched to a low-cost passive solution, the Vanguard Global Bond Index in lieu.

STRATEGY

Further comments will follow regarding strategy in a separate item later this month.

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner