Individual Savings Accounts (ISAs) were introduced by chancellor Gordon Brown back in 1999, making them 25 years old this year.

While they were initially branded a “colossal failure” by at least one Labour MP, their popularity among UK savers and investors has always been clear.

As of the 2021/22 tax year, more than 22 million Brits held an ISA, amounting to around 42% of UK adults. Take-up increased after the introduction of the Lifetime ISA in 2017, and the newly announced UK ISA is set to give consumers even more ways to save and invest tax-efficiently.

Keep reading for your look at the ISA options available, the pros and cons of each, and what we know so far about the UK ISA.

Cash ISAs remain the most popular but Stocks and Shares ISAs could see higher returns

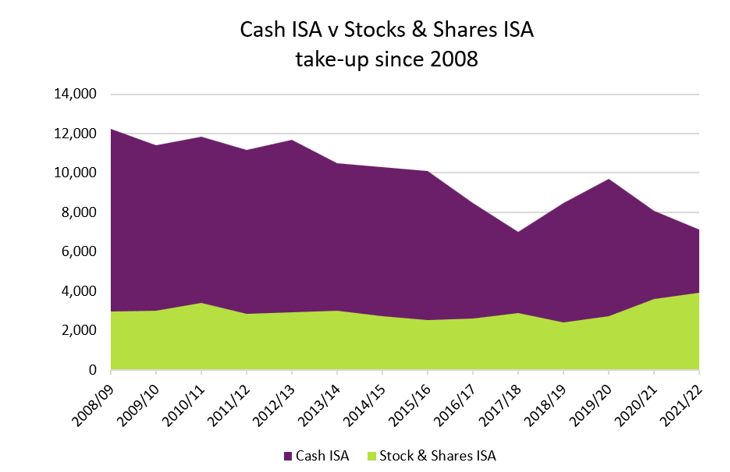

Morningstar recently looked at ISA take-up between 2008 and 2022.

Source: Morningstar (HM Treasury, March 2024)

Note: Figures for 2021/22 are provisional

Cash ISAs are clearly the most popular, with almost twice as many subscriptions as Stocks and Shares ISAs but there are pros and cons to each.

Cash ISA

Cash ISAs are similar to regular savings accounts but with added tax-advantages.

You don’t pay tax on the interest you earn in a Cash ISA and your money is protected under the Financial Services Compensation Scheme.

Because your cash is usually easily accessible, a Cash ISA can be a good choice for your emergency fund. That said, you might find more competitive rates by opting for a regular saver or a fixed-term option, which could tie your money up.

Stocks and Shares ISA

Unlike Cash ISAs, Stocks and Shares ISAs are invested in the stock market. Investing comes with added risks and your fund value will fluctuate daily with market movements, but over the long term, you could see higher returns.

You’ll need to have a long-term investment goal in mind – ideally one that is 5 to 10 years away – and focus on that, even when markets dip.

Stocks and Shares ISAs are also tax-efficient. Any investment gains you make are free of Income Tax and Capital Gains Tax.

Which one should you choose?

There’s no right answer to the Cash v Stocks and Shares ISA debate. The best choice for you will depend on your circumstances and your reasons for opening an ISA.

Both are tax-efficient, and the best way to make the most of these tax efficiencies is to max out your ISA Allowance each year. For 2024/25, this stands at £20,000.

You might opt to help your child onto the property ladder using a Lifetime ISA

If you’re looking to help your child onto the property ladder, the Lifetime ISA (LISA) might be a good choice.

The LISA was introduced in 2017 and is available to those aged between 18 and 39. The annual LISA subscription limit is £4,000 but contributions benefit from a 25% top-up from the government.

The downside is that the money must be used toward the purchase of a first home or remain tied up until your child reaches age 60.

Early withdrawals, or withdrawals not used toward a first home, are subject to a 25% charge.

Some recent ISA rule changes have altered the landscape

The chancellor used his Autumn Statement and Spring Budget to introduce several ISA changes. Here are three of the main points to consider.

1. You can now pay into multiple ISAs of the same type in the same tax year

Previously, it was only possible to pay into one type of ISA each year. This meant you had to choose between topping up your Cash or Stocks and Shares ISA at the start of the tax year.

This rule has now been abolished. From April 2024, you can pay into both types of ISA throughout the year, massively increasing your flexibility.

2. The minimum age for an adult Cash ISA is raised from 16 to 18

New rules have increased the minimum age for opening an adult Cash ISA from 16 to 18, in line with other adult ISA products.

If your 16-year-old child wants to open a Cash ISA they will need to opt for a JISA and be subject to the lower JISA allowance.

At 18, their ISA will convert to an adult product with a higher subscription limit.

3. Partial transfers are now permitted

Under pre-April 2024 rules, if you wanted to transfer an ISA of one type, you had to transfer the whole account.

For 2024/25, you can opt for a partial transfer, effectively spreading your funds over different accounts and have multiple ISAs of the same type open at once. Again, this provides greater flexibility.

The chancellor used his Spring Budget to announce a new UK ISA

In March 2024, Jeremy Hunt unveiled his Spring Budget and announced details of a new UK ISA, designed to encourage investment in UK companies.

The UK ISA will have its own allowance of £5,000, applied on top of your £20,000 ISA Allowance. This provides you with the chance to increase your tax-efficient investment. You will, though, need to consider the diversification within your portfolio.

Usually, an investment diversifies across asset classes, sectors, and geographic regions. Opening a UK ISA could be seen as limiting this diversification, putting too much onus on home stock. Further details will follow, so watch this space.

Get in touch

If you would like to discuss your current ISAs or opening a new ISA product, contact us now to find out how our Chartered financial planners could help you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.