As tax year end approaches, you’ll want to maximise your ISA contributions if you can afford to. It’s also important to start the new year in good shape to make the most of your investment’s tax efficiencies in 2023/24.

The type of ISAs you hold, which you pay into, and when, can all influence the returns you can expect.

To get the most from your investment, you’ll want to avoid these three common ISA mistakes this year.

1. Not using up your full ISA subscription

ISAs are incredibly tax-efficient. For this reason, the government caps the amount you can save into them during a single tax year. This is known as the “ISA Allowance” and it currently stands at £20,000 for both 2022/23 and 2023/24.

There are two main ISA types – a Cash ISA and a Stocks and Shares ISA – and the allowance is spread over all ISAs you hold. You’ll need to decide how to use your allowance in a given year.

With a Cash ISA, you don’t pay tax on the interest you earn. Any UK resident over the age of 16 can open one, and the money held in it is protected under the Financial Services Compensation Scheme (FSCS).

Gains you make in a Stocks and Shares ISA, meanwhile, are free of Income Tax and Capital Gains Tax (CGT). Your money is invested in the stock market so can rise as well as fall. You must be over 18 to open one.

If you can afford to use your full ISA Allowance, do so. It is the best way to make full use of the tax efficiencies your ISA offers.

2. Not making payments early in the new tax year

You’ll also want to think about when you contribute. You’ll find that the start of the tax year is a great time to pay into your ISA if you can afford to, as it gives you a whole tax year of growth and returns.

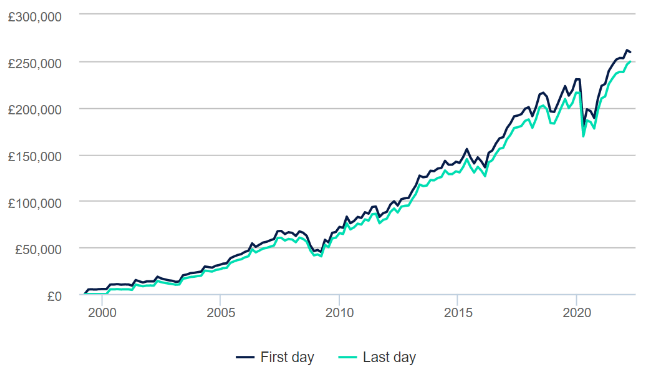

Hargreaves Lansdown recently looked at the difference between investing on the first day of the new tax year, compared to the last day of the old one.

The report tracked £5,000 invested in a Stocks and Shares ISA each year from 1999 (the year the product launched). For one, the £5,000 was invested on the first working day of the tax year, the other on the last, meaning a total of £115,000 was invested for both.

Source: Hargreaves Lansdown (Source: Lipper IM, 06/04/99 to 28/03/22. Includes 2021/22 tax year subscriptions for both.)

The investment period covered the start of the Iraq War, the 2008 global financial crisis, and the coronavirus pandemic, and yet both performed well.

Investing at the start of the tax year, though, would have seen you £10,000 better off.

While this suggests that saving early is the best course of action, it’s also important to remember that investments can rise and fall, and past performance is no guarantee of future success.

That said, invest at the start of 2023/24 and your fund will benefit from an extra 12 months of investment returns and compound growth, which could make a big difference over the longer term.

3. Mismanaging risk by taking too much or too little

Choosing between a Cash and a Stocks and Shares ISA isn’t easy.

With a Cash ISA, your money is protected under the Financial Services Compensation Scheme (FSCS), but with savings rates currently low and inflation high, you might find other products with more competitive rates. It’s also possible that your money could lose value in real terms, compared to the rising cost of living.

You might find that the biggest risk to your savings is not taking enough risk, and this remains true even as inflation begins to fall.

Last summer you might have read our blog ‘3 important reasons why now is a good time to consider a Stocks and Shares ISA’ in which we looked at the pros and cons of each.

We found that 1.6 million savers ditched their Cash ISA in 2020/21. During the same period, Stocks and Shares ISA subscriptions increased by 860,000.

Stocks and Shares ISAs are invested in the stock market. This means they carry additional risk, but with the potential for increased returns.

Think about the level of risk you are willing to take and speak to us if you need help deciding how best to manage your ISA allowance.

Get in touch

At HA&W we can help you to make the most of the ISAs you hold. Contact us now to find out how our Chartered financial planners could help you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.