8 March 2024

Why the 4% withdrawal rule no longer applies to your pension

;)

The so-called “4% rule” for pension withdrawals was the brainchild of American financial planner William Bengen, back in 1994.

He suggested that 4% withdrawals would provide a comfortable retirement while still allowing for growth.

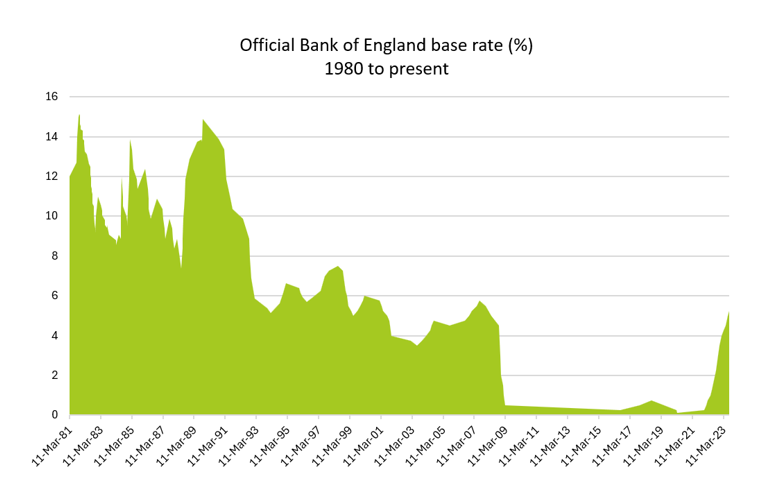

But the economic climate was very different 30 years ago. For one, interest rates were a lot higher:

Source: Bank of England (BoE)

The average base rate during the 1990s was 7.61% but the decade began with interest rates at 13.88%.

More recently, Bengen 4% rule has been debunked. Some studies even suggest that using this rule could mean you’re three times more likely to run out of money in retirement.

Keep reading to find out why the 4% rule is unlikely to work for you, and, more importantly, what you should do instead.

4 reasons why the 4% rule won’t be right for you

1. You could have non-pension retirement income

It’s important to remember that your dream retirement is individual to you. So is your long-term financial plan. This means that even if the 4% withdrawal rule works for one retiree, there’s no guarantee your pension could support it.

One reason for this potential discrepancy is that the rule doesn’t consider an individual’s non-pension retirement income.

If you have dividends, ISA investments, or income from buy-to-let properties, these could all help to support the pension payments you receive. Equally, if you don’t have other forms of income, your pension will need to go that little bit further.

The best way to manage your retirement will always be by sticking to a bespoke financial plan, designed around your needs and circumstances.

2. Your retirement expenditure won’t be regular

Withdrawing the same amount of income each month, throughout a retirement that could last three or four decades, has one clear limitation.

It suggests that your retirement expenditure will be static throughout that time. But this is unlikely to be the case.

You might have big plans for the early, active years of your retirement. These might include house renovations or world travel, which are likely to be expensive.

One-off expenditures like these might decrease as you settle into retirement. Later in life, health factors might mean you to pay for care, for example, and your expenditure will rise again.

A robust long-term financial plan can consider these changes in outgoings, ensuring you have enough for the whole of your retirement. Those means you won’t run out of money when you need it most. Your plan can also include a constituency for what happens to the money put aside for care if care isn’t needed.

Back in January, we asked, ‘Are you ready for your second 50?’ and explained how rising life expectancies could impact your retirement plans.

3. Short-term market dips could see your fund fall faster than expected

Your irregular expenditure in retirement means that drawing down the same amount of income each time could become unsustainable. As well as your outgoings, you’ll also need to factor in the wider economy.

When markets fall, for example, you’ll need to sell more units to raise the same amount of income. When inflation is high, the spending power of your pension payments will be reduced.

This is why budgeting is key to managing your flexible retirement, and why seeking financial advice is key. Read more about managing pension decumulation with these three lessons mountaineering can teach you about your retirement income and get in touch if you need help or have any questions.

4. Withdrawing more than you need could see your money lose real-terms value

As we have seen, at the start of your retirement, you might find that you aren’t drawing enough to cover your active lifestyle. But you could also face problems if you withdraw too much.

As we have seen over the last two years or so, high inflation can erode the buying power of your money. If you withdraw more pension income than you need, you’ll likely keep the excess in an easy access cash account.

While bank interests are high and inflation low, this doesn’t pose a problem. But if inflation rises above bank rates, your money will be effectively losing value in real terms.

It’s another reason why taking the wider economy into account is so important and why the hard work doesn’t stop when you retire.

Get in touch

Contact us now to find out how our Chartered financial planners could help you manage your pension decumulation.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Category: News