15 January 2021

3 lessons mountaineering can teach you about your retirement income

;)

An expedition set off last month aiming to be the first to conquer K2, the ‘Savage Mountain,’ in winter.

It’s a daunting challenge. National Geographic reports that over 9,000 climbers have successfully reached the summit of Everest, while the figure for K2 is just 367 – and all of those in summer. Even if the team reaches the summit, the hard work isn’t over.

The climb is incredibly challenging, but the descent can be even more dangerous. The same is true for your pension.

Reaching your retirement summit doesn’t mean the hard work is over

Reaching retirement can seem like an uphill battle. You’ll have planned your route, taken the necessary steps and precautions, and been in training – contributing to a pension – for decades.

You’ll have an idea of the type of retirement you want and know what you’ll do when you get there. But reaching the summit isn’t the end of the journey.

Pension Freedoms mean you’ll have some important choices to make about how you’ll use your hard-earned pot.

You’ll need to think about budgeting, the tax implications of certain options, and be sure you’ll have enough to maintain your desired lifestyle for the rest of your life. You might also hope to leave some money behind for loved ones.

Reaching your retirement summit doesn’t mean the culmination of your financial planning, but we at HA&W are here to help.

3 tips to help you manage your income in retirement

1. Understand the impact of market volatility

Climbing K2 in winter means contending with sub-zero winds, rock-falls, and potential avalanches. You might encounter challenging conditions in your retirement too, in the form of market volatility.

The coronavirus pandemic caused huge short-term volatility in March 2020. The FTSE 100, the Dow Jones, and the S&P 500 all suffered their worst days since 1987, and 2020 as a whole was tough. The BBC reports that the FTSE recorded its worst year since the global financial crisis.

But what does this mean for your retirement?

When you withdraw income from your pension you are selling invested units. When prices are low, as they were in March, you need to sell more units to achieve the same amount of income. This can see your pot diminish faster than expected.

Taking a smaller income when markets are low is the best way to combat this if you can afford to.

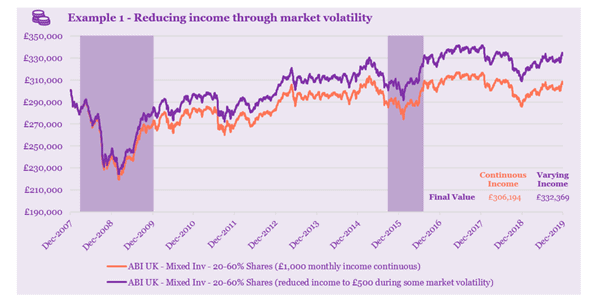

You can see the difference a varied income can make in this example. It imagines a £300,000 investment made in December 2007.

The orange line shows the impact on a pension fund of taking a steady income of £1,000 a month. The purple line highlights the positive impact of reducing withdrawals to £500 during periods of market loss (the shaded areas).

Source: Royal London

The difference in the final value of the investment by December 2019 is more than £26,000.

2. Consider how long your retirement income might need to last

While the State Pension age is currently 66, the earliest you can access your pension is aged 55 (rising to aged 57 in 2028). Life expectancy in the UK, according to the Office for National Statistics, is 79 years for males and nearly 83 years for females.

Depending on when you take your pension, your pot may need to last another 30 years or more. Careful budgeting will be needed to ensure you can live the lifestyle you want while remaining financially secure and able to leave your intended legacy.

You’ll also need to remember that your spending in retirement won’t be uniform. The earlier years will likely be more active and that could make them more expensive.

You might find the extra income of a phased retirement offsets your increased expenditure. You might also need to factor in later life costs, such as care, and think about what you will do with that extra money if you don’t need it.

We can be your Sherpa guides, helping you find a path to sustainable retirement income, whatever the future holds.

3. Factor inflation into your calculations

During a thirty-year retirement, you’ll want to consider the impact of inflation.

In terms of purchasing power, £100 in 2020 will be equivalent to about £240 by 2050. You might have an annuity that rises annually to combat inflation, but be wary if you are taking withdrawals via Flexi-Access Drawdown.

Withdrawing only what you need will allow you to keep the largest possible amount invested. If you take more than you need, it is likely the excess will be held in cash. The impact of inflation could see that cash amount lose value in real terms over time.

We can help you manage your retirement income so get in touch.

Get in touch

Here at HA&W, we understand the relief of reaching your pension summit and the perils of complacency during the decumulation stage of your retirement.

Please contact us if you’d like to discuss any aspect of your finances or to find out how why we can put a long-term retirement plan in place for you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Category: News, Pensions, Personal finance, Planning, Retirement