26 March 2020

Why is the coronavirus impacting investment markets?

;)

Over the last couple of weeks, you’ve likely experienced investment volatility due to the coronavirus pandemic. No one wants to see their investment values fall, but for most people sticking to their financial plan is the best course of action.

How has Covid-19 had an impact?

The virus, which originated in Wuhan, China, was identified at the beginning of the year. It took several weeks for other countries to confirm cases but over the last few months, it’s spread around the globe and was declared a pandemic by the World Health Organisation.

As of 25th March, there have been more than 330,000 confirmed cases of Covid-19 and over 14,500 deaths. This has led to governments around the world taking draconian steps in an effort to stem the spread of the virus. In the UK, this has included ordering pubs and non-essential shops to shut, closing schools and imposing restrictions on when individuals can leave home, with fines should they be broken.

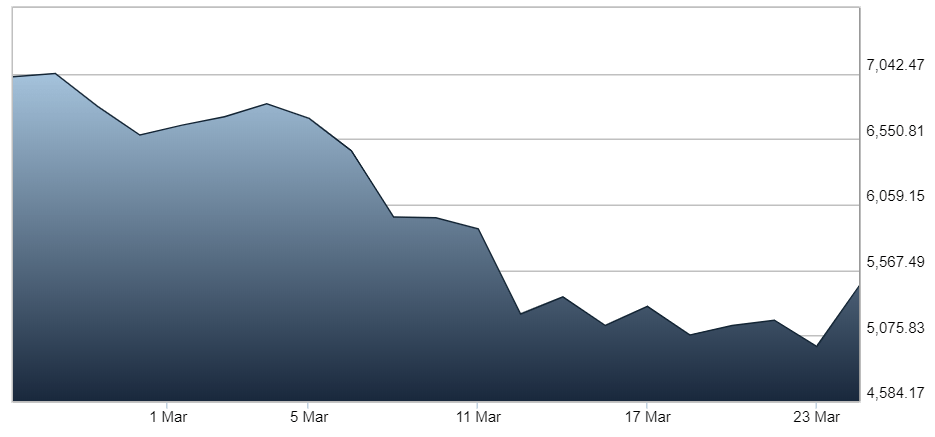

One of the most immediate consequences of the coronavirus outbreak has been the impact on the global stock markets. Between 25th February and 24th March, the value of the FTSE 100 has fallen by around 22%, despite the government announcing a raft of measures designed to support the economy, businesses and individuals.

Other markets around the world have also seen similar falls. So, why is the coronavirus having this impact?

First, numerous businesses have been affected by the pandemic. From travel companies suspending flights and seeing substantial drops in bookings to restaurants being forced to shut, the virus has had a far-reaching impact on the economy. Many well-known businesses have issued profit warnings, and some have already stated they’ll need assistance if they’re to continue operating. Unsurprisingly, this has affected stock markets.

Second, stock markets don’t like uncertainty. Whilst efforts are being made to contain the spread of coronavirus, we can’t be sure how long it will last for or how many people will be infected. As a result, stock market volatility will likely continue for some time until more is understood about the situation.

What do other pandemics show?

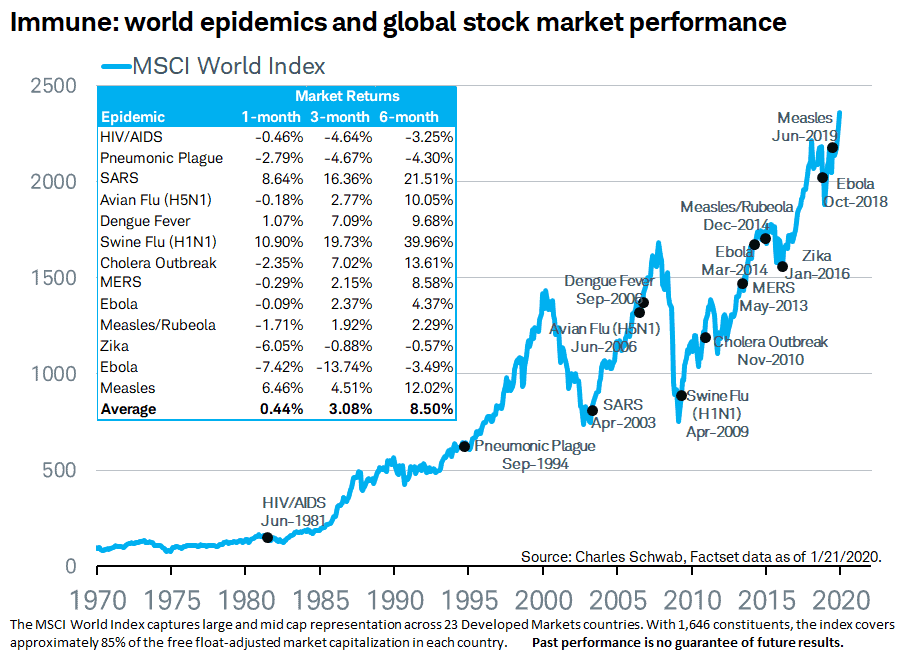

Earlier this year, Charles Schwab published research that looked at how global stock markets reacted to other pandemics.

The conclusion was: “Whilst there is always the chance that the next outbreak could have greater consequences, the global economy and markets have been relatively immune to the effects of past viral epidemics – even when the global economy was especially vulnerable to a shock. A short-term dip in stocks tended to be followed by the continuation of the upward trend.”

The graph below highlights how markets have changed with a long-term view.

Your investments and coronavirus

It’s natural to feel worried or anxious about your financial plans if investment values have fallen. However, it’s important not to let emotions lead you to make decisions that may not be right for you.

Short-term volatility in the stock markets is normal. This is why you should only invest with a long-term goal in mind, a minimum of five years. This gives your portfolio an opportunity to smooth out the peaks and troughs. If the current stock market activity is worrying you, there are some things to keep in mind:

- If your long-term plans haven’t changed, your existing financial plan is likely still appropriate. When you set out your financial plans, periods of volatility and downturn should be considered. Unless your personal aspirations and goals have changed over the last couple of months, sticking to what’s been set out is typically the best course of action.

- A well-diversified portfolio will include other asset classes, not just stocks and shares. As a result, whilst headlines of the ‘stock market plummeting’ can be alarming, this isn’t typically the same as the fall in value you’ll see when you assess your portfolio. Diversification is used for this reason, to provide some relief should one asset class suffer from a fall.

- Selling now will realise your losses. Investment values rise and fall each day but until they’re sold, these are just ‘paper’ losses and gains. A knee-jerk reaction of withdrawing your money now denies you the opportunity to benefit from long-term rises. Reacting emotionally to falls can be a mistake and affect your financial plans over the years to come.

Of course, past performance isn’t a reliable indicator of future performance and we can’t guarantee when or how markets will change in the future. But, for most investors, it’s important to have faith in your financial plan. If you’re worried about the impact of market volatility on your finances and goals, please get in touch. We want you to have complete confidence in your financial future, including during periods of downturn.

Please note: The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Category: Investments, News