Back in October, the Queen respectfully declined an “Oldie of the Year” award at the age of 95, stating that “you are only as old as you feel”. It’s a sentiment worth bearing in mind when planning your retirement.

An individual retiring at the current minimum retirement age of 55, who lived to be the age the Queen is now, would this year be entering their fourth decade of retirement.

A lot can change in 40 years, from your priorities and goals, to how able you are to achieve them. This is why expenditure throughout retirement isn’t static and why life expectancy is such an important part of retirement planning.

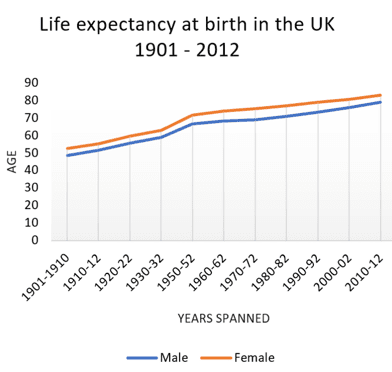

UK life expectancy has been steadily rising

Life expectancy has been rising steadily in the UK. In the early 1900s, this was largely due to improvements in child health through immunisation programmes. In the second half of the 20th century, the rise was more likely due to improvements in the health of the older population, including advancements in the treatment of heart disease, for example.

Source: Office for National Statistics (ONS)

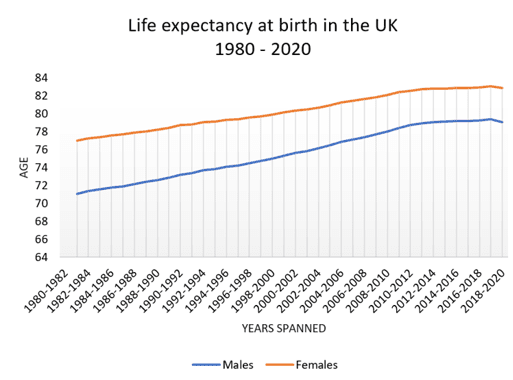

More recently, improvements in life expectancy have slowed and for the period 2018 to 2020, life expectancy saw the first drop in over 30 years.

The ONS is quick to point out that this most recent set of figures is the first to include the higher mortality rate seen as a result of the coronavirus pandemic.

Source: ONS

The current life expectancy at birth for men is just over 79 years, while for women it is nearly 83.

Back in July, we looked at the things to consider when planning for a 100-year life and found that a woman aged 50 today has a 1 in 10 chance of reaching age 99, and a 7% chance of making it to 100. The chances of becoming a centenarian rise to 8.8% for a 40-year-old woman.

While increased expectancy – especially where those years are lived in good health – is great news, the type of retirement you want throughout these years might change. The unexpected can strike at any time, too, and this is one of the main reasons why budgeting for retirement is so difficult.

The role of life expectancy in your retirement plans

When you formulate your retirement plan, you’ll need to ask yourself some important questions.

1. When do I want to retire?

You’ll no doubt have an ideal retirement date in mind but it’s important to ensure that this is realistic.

By looking at your current pension provision, we can help you decide if you have a large enough fund to be financially stable for the rest of your life.

Beginning to plan for retirement – and starting to build a pension fund – as early as possible gives you more time to increase contributions, if necessary. It also increases your chances of retiring when you want to.

Remember though, that this date won’t be set in stone. Life events might alter your priorities, causing your retirement date to be brought forward, or put back.

2. What do I plan to do in retirement?

As part of the above calculation, we’ll also need to know what your plans are.

Extensive travel will likely be more costly than remaining in the UK and downsizing. It’s important to remember too that your spending won’t be regular.

You might find travel becomes too stressful and tiring later on in retirement, but, as the Queen was quick to point out, “You are only as old as you feel”, and everyone’s retirement will look different.

You’ll need to factor in the things you might not want to plan for too, such as the potential costs of later-life care.

As life expectancy has risen, “healthy” life expectancy – although also rising – has failed to keep up. This means an increased chance that we’ll all need some form of care as we get older.

3. How long will my money need to last?

The final factor to consider is how long your pension fund will need to last.

You’ll need a fund large enough to live your desired lifestyle throughout your retirement. But you’ll also need to think about providing any inheritance you plan to leave to the next generation and ensuring you can pay for care costs if needed.

Good estate planning will allow you to put contingencies in place so that you can access – or pass on – your money tax-efficiently, whatever the future brings.

Get in touch

Understanding what you plan to do in the active stage of your retirement, how much that will cost, and how much you will need to cover potential costs later in life is vital to the success of your retirement plan.

We can help, so contact us to find out how our Chartered financial planners can work with you to put a retirement plan in place that is aligned with your goals.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.