1 June 2020

Investment Update – 01 June 2020

;)

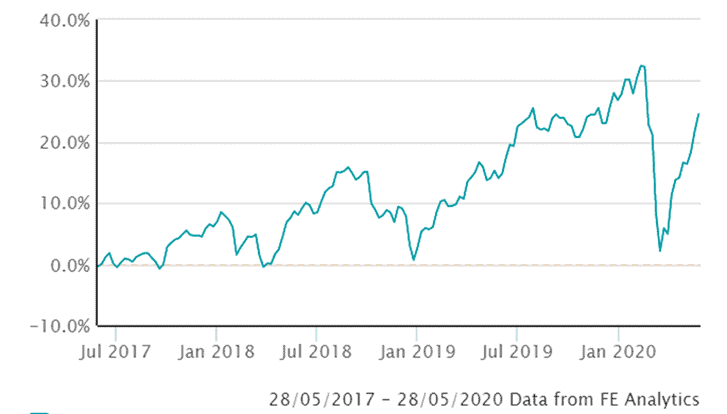

Markets continued the recovery that started in April with further good progress in May.

The prospect of economic revival has driven share prices up. Whether the trend is sustainable is very much a topic of debate.

Share prices have been boosted by the massive monetary stimulus enacted by governments globally, especially is the US. The US government is actively buying securities in the bond market, including corporate bonds, which supports the value of all financial assets.

Markets face a number of significant risks;

- A second wave of Covid-19

- A wave of bankruptcies and business closures

- An escalation in the dispute between the US and China

- Global unemployment continuing to rise with consumers refusing to spend and incomes being depressed

So, plenty to worry about, yet the markets continue to march higher. There’s an old motto in the world of investment; “Don’t fight the Fed”. In other words, when the US government makes money more plentiful or cheaper it generally results in higher stock prices. Professional investment managers are buying equities now and some think share prices are cheap, which is a good sign.

Here’s a chart of Global Markets (The FT Developed World ex UK Index) over the previous three years highlighting the recovery;

Category: Investment Report, Investments, News