13 October 2020

Investment Report Third Quarter 2020

;)

The third quarter was generally positive for markets with momentum continuing, but at a much slower pace than during Q2. As ever, events in the US set the tone for global markets and the US Presidential election is imminent. Trump is easily the market’s favourite as a Biden victory would usher in higher taxes for business.

The US market is holding all-time highs, but Europe and the UK are still some 20% lower than the previous peak. The UK market has lagged, perhaps due to the ongoing Brexit negotiations. Asian markets are firmer, especially the Chinese market where economic growth is all but restored to pre-COVID levels.

The cheer that greeted the easing of lockdowns around the world has been replaced with caution that these may be reinstated.

In the UK, commercial property funds which were suspended, are about to reopen. We are reviewing the market now, to determine whether we will advise customers to remain invested.

All nations are grappling with the tension that exists between the need to keep economies moving and the need to keep populations safe and healthy and going forward, I suspect that this tension will also be played out in the markets.

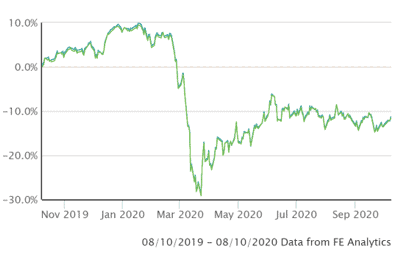

Here is a chart of the FTSE All-share Index for the previous 12 months:

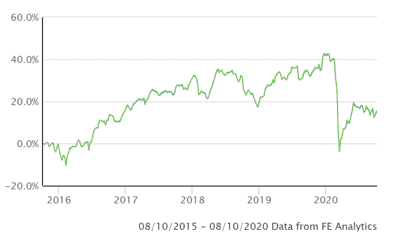

…and the previous 5 years:

PORTFOLIO PERFORMANCE

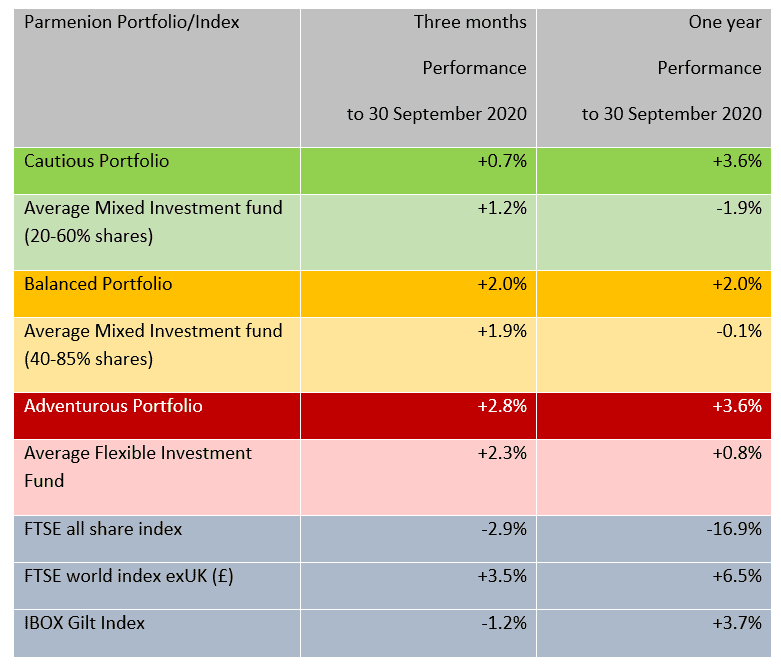

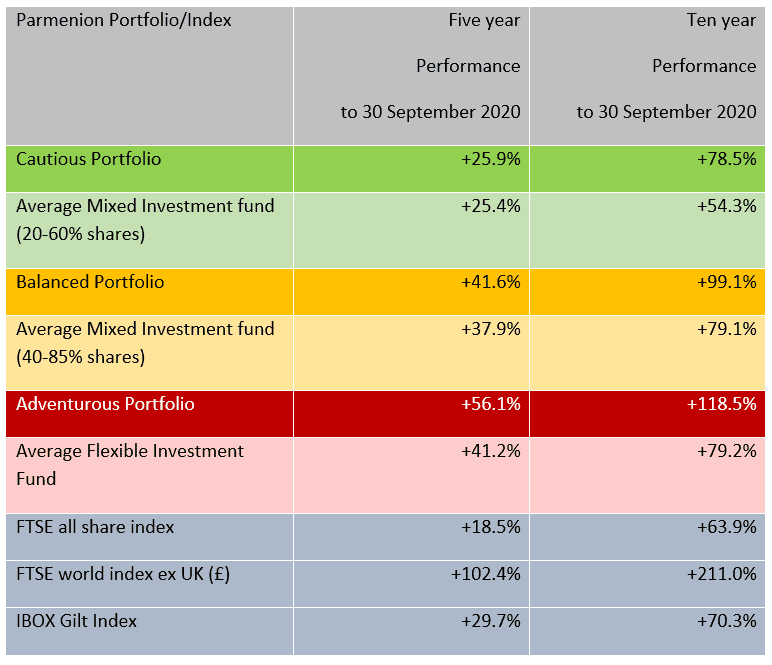

I enclose tables showing the performance of all portfolios over various time periods to 30 September 2020:

Short-term performance

Long term performance

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +0.7% over the quarter, underperforming its benchmark (the average mixed investment (20-60% shares) fund) which gained +1.2%. The cautious portfolio’s relative underweight allocation to the UK market was a positive factor, but one of our international funds produced poor returns and is now under review.

No changes were made to the portfolio this quarter.

Balanced Portfolio

The Balanced Portfolio gained +2.0% over the quarter, just outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.9%.

Our in-line allocation to UK equities didn’t help performance, but Asian-focused funds we use from Fidelity (including an emerging market fund) really flew, benefiting from a recovery in the Chinese market.

No changes were made to the portfolio this quarter.

Adventurous Portfolio

The Adventurous Portfolio gained +2.8% over the quarter, outperforming its benchmark (the average Flexible fund) which gained +2.3%.

Fund selection in the international and Asian markets boosted returns as Liontrust and Fidelity produced strong gains in these areas.

No changes were made to the portfolio this quarter.

OUTLOOK

I mentioned the US election – I’d guess what could be much worse than a Biden victory (from a market point of view) is Trump refusing to leave the White House. Time will tell on that issue.

The US markets have also been waiting for a large stimulus package that is under negotiation, but Trump has blocked this and that has been a negative.

There are still plenty of COVID concerns; trying to keep the economy open whilst also keeping citizens safe is a very difficult balancing act for any government. Fortunately, the effects are felt by certain sectors (such as tourism and hospitality) whereas for much of the economy its business as usual.

The valuation of markets (UK excepted) is relatively high, although there’s some value in Europe and Asia. We have reasonable allocations to these areas.

THE BENEFIT OF DIVERSIFICATION

One figure caught my eye when penning this report; Our Cautious Portfolio has posted a one-year gain of +3.6%. This compares with a one-year loss on the FT All-share Index of -16.9%. The two aren’t strictly comparable, but an investment solution that consisted solely of UK assets would look poor indeed – even if it included a lot of low-risk components.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner

Category: Investment Report, News