The third quarter of 2019 ushered in a volatile period in the markets driven primarily by the trading relationship, or disruption thereof, between the US and China. The rally in the value of fixed interest securities, especially Sovereign debt, such as Treasuries and Gilts continued.

Over the quarter, the FTSE World Index gained +3.9%, with the gain being largely currency related as Sterling weakened on the foreign exchanges. The FTSE 100 share index gained +1.2% over the same period. The UK market is pretty much back to where it was 12 months ago.

Other headlines of note were:

- A number of economies are now either flirting with, or are actually in recession, such as The UK and Germany

- The trade negotiations between China and the US rumble on with some apparent progress but nothing concrete to report yet.

- Here in the UK the markets have concluded that a “no-deal Brexit” is unlikely and that has allowed Sterling to strengthen in recent weeks. Some sectors of the UK market have started to enjoy decent gains, but others are falling away, with currency exposure being the driver of these moves.

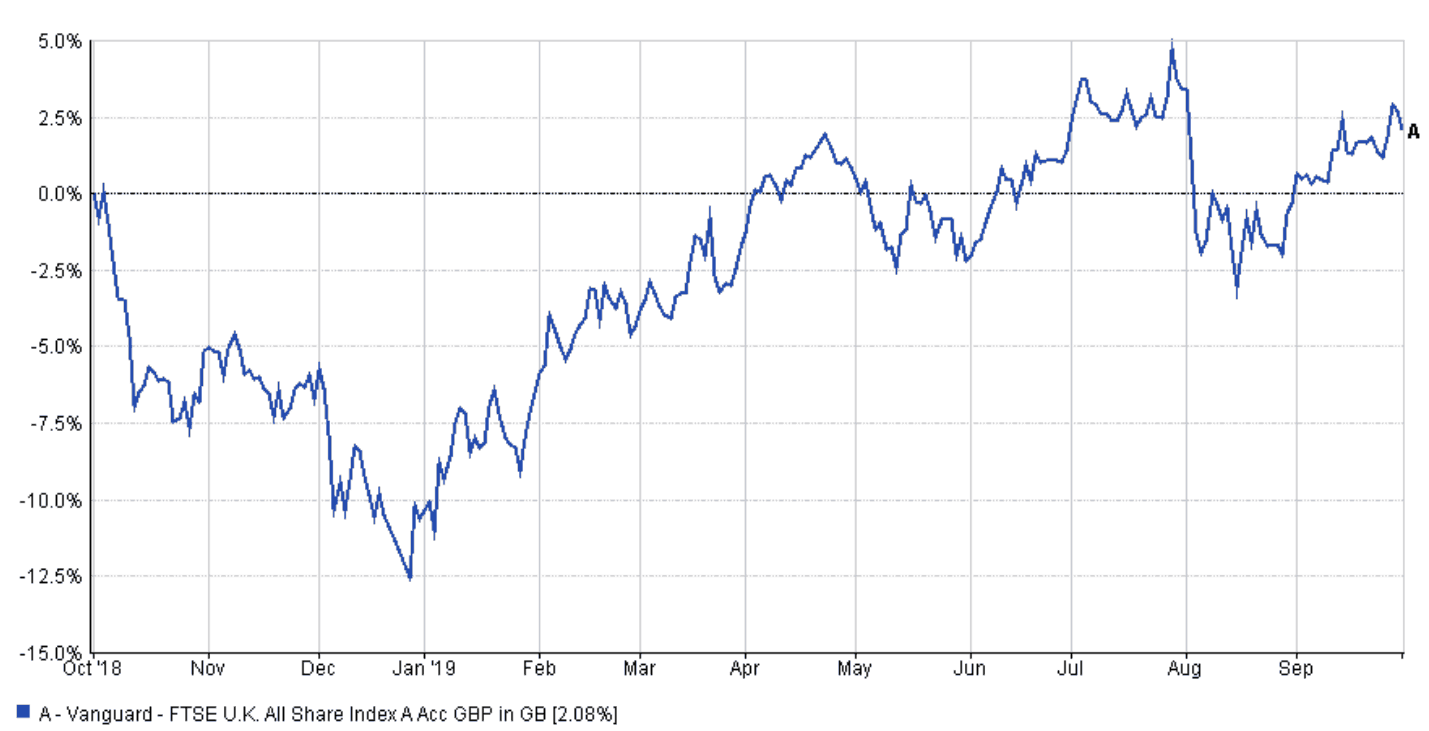

Here is a chart of the FTSE All-share Index for the previous 12 months:

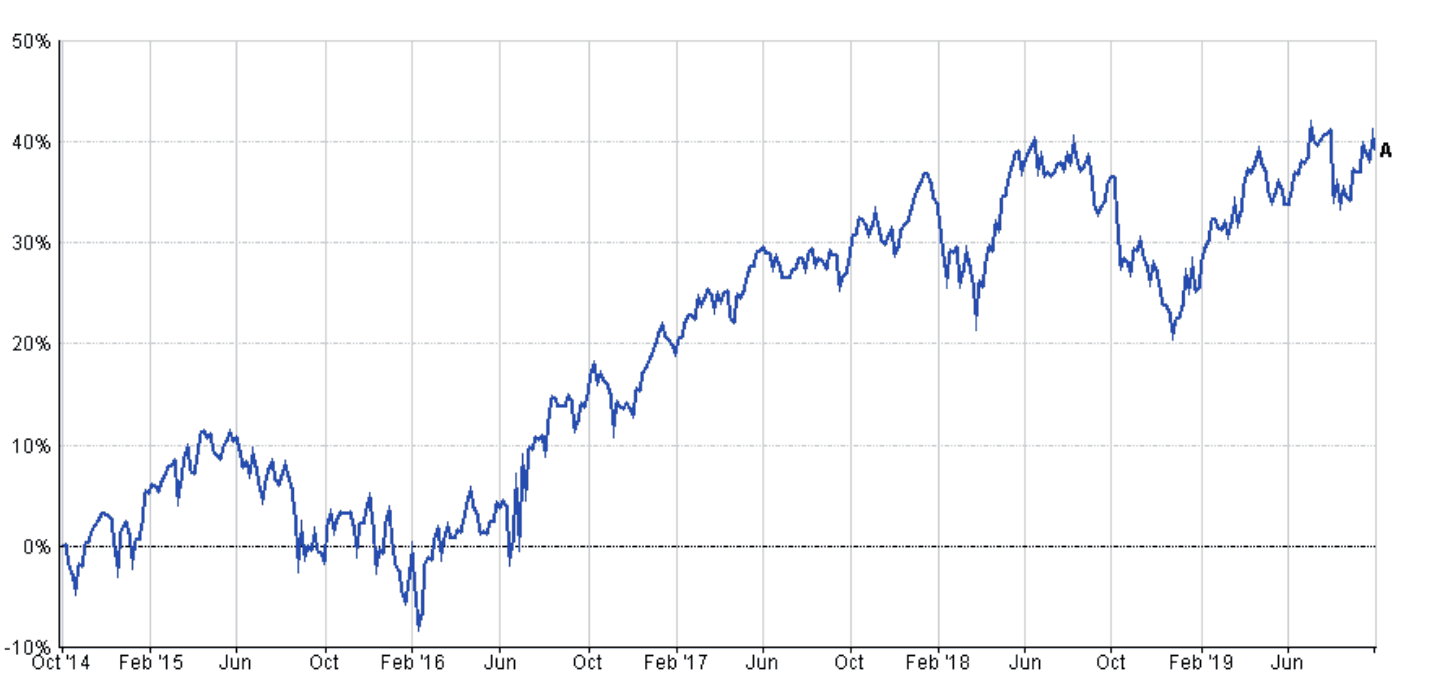

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 30 September 2019.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 30 September 2019 |

One year Performance to 30 September 2019 |

|---|---|---|

| Cautious Portfolio | +1.8% | +4.9% |

| Average Mixed Investment fund (20-60% shares) | +1.8% | +4.0% |

| Balanced Portfolio | +1.5% | +4.1% |

| Average Mixed Investment fund (40-85% shares) | +1.9% | +4.2% |

| Adventurous Portfolio | +1.2% | +4.6% |

| Average Flexible Investment Fund | +1.7% | +3.2% |

| FTSE all share index | +1.2% | +2.6% |

| FTSE world index exUK (£) | +3.9% | +8.2% |

| IBOX Gilt Index | +6.5% | +14.7% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to 30 September 2019 |

Ten year Performance to 30 September 2019 |

|---|---|---|

| Cautious Portfolio | +31.4% | +100.9% |

| Average Mixed Investment fund (20-60% shares) | +27.4% | +67.8% |

| Balanced Portfolio | +45.9% | +120.1% |

| Average Mixed Investment fund (40-85% shares) | +39.0% | +94.7% |

| Adventurous Portfolio | +58.9% | +139.0% |

| Average Flexible Investment Fund | +39.1% | +93.4% |

| FTSE all share index | +38.8% | +121.0% |

| FTSE world index exUK (£) | +92.4% | +219.6% |

| IBOX Gilt Index | +35.8% | +76.7% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +1.8% over the third quarter in-line with its benchmark (the average mixed investment (20-60% shares) fund) which also gained +1.8%. All asset classes enjoyed modest gains apart from UK Commercial property, which was flat. Fixed-interest securities made strong gains due to concerns that economic growth was stalling round the world.

Markets were volatile as the driver of sentiment was the trade negotiations between the US and China and the outlook for talks waxed and waned almost by the day.

During the quarter we increased our cash position in all portfolios and sold UK mid-sized companies preferring the strength of FTSE 100 share index companies.

We also introduced a modest element of “socially responsible” investing into the portfolio in an attempt to reduce the impact of global warming on investment values.

Balanced Portfolio

The Balanced Portfolio gained +1.5% over the third quarter, under-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.9%. All asset classes enjoyed modest gains apart from UK Commercial property, which was flat. Fixed-interest securities made strong gains due to concerns that economic growth was stalling round the world.

Markets were volatile as the driver of sentiment was the trade negotiations between the US and China and the outlook for talks waxed and waned almost by the day.

During the quarter we increased our cash position in all portfolios and sold UK mid-sized companies preferring the strength of FTSE 100 share index companies.

We also introduced a modest element of “socially responsible” investing into the portfolio in an attempt to reduce the impact of global warming on investment values.

Adventurous Portfolio

The Adventurous Portfolio gained +1.2% over the third quarter, under-performing its benchmark (the average Flexible fund) which gained +1.7%. All asset classes enjoyed modest gains apart from UK Commercial property, which was flat. Fixed-interest securities made strong gains due to concerns that economic growth was stalling round the world.

Markets were volatile as the driver of sentiment was the trade negotiations between the US and China and the outlook for talks waxed and waned almost by the day.

During the quarter we increased our cash position in all portfolios and sold UK mid-sized companies preferring the strength of FTSE 100 share index companies.

We also introduced a modest element of “socially responsible” investing into the portfolio in an attempt to reduce the impact of global warming on investment values.

OUTLOOK

The major rally in bond markets has now halted and in a way, this is perceived as good news as it implies that economic growth may pick up. Investors are starting to look through the current dull patch to when things pick up again. Should “green shoots” emerge markets could move ahead nicely.

The Sterling exchange rate is pointing to a Brexit deal, which would be welcomed by the market here in the UK. However, as international investors much of the returns we enjoy here are driven by exchange rates, and a strong Sterling involves the currency moving in the wrong direction. This could impact on returns over the short term.