23 October 2018

Investment Report Third Quarter 2018

;)

The third quarter of 2018 has been characterised by increasing political uncertainty which has resulted in global markets stalling, except for the US market which continued to make progress until we moved into the fourth quarter.

The main headlines to note are:

- An easing in global growth, except for the US economy, which has been very strong.

- A modest tightening in global monetary conditions led by another increase in the “fed funds rate” of ¼%.

- A ramping up of the Trump inspired global trade war with a focus on China.

- Political tensions in Italy, where a populist Government is evolving economic policies that are unpalatable for investors.

- At home there are ongoing political tensions and increased uncertainty about Brexit, combined with a weakening economy.

Over the quarter markets have fallen a little, except for the US market, which has pushed ahead. So, the UK 100 share index was down -1.5%, The European indices are up +0.5% and the US index is up +7.0%.

Elsewhere the Chinese stock market has been hit particularly hard with the main Shanghai Composite Index falling -11.6% over the quarter. Indeed, all the Asian and Emerging markets have fallen hard, due to the combined impact of trade sanctions and the strength of the US$.

Stop Press

At the start of the fourth quarter markets round the globe fell heavily due to increasing concerns about the rate of inflation and the consequences this will have for US interest rates. At the time of writing (Tuesday 23 October) the FT100 share index had fallen -6.6% and the S&P500 index -5.8%.

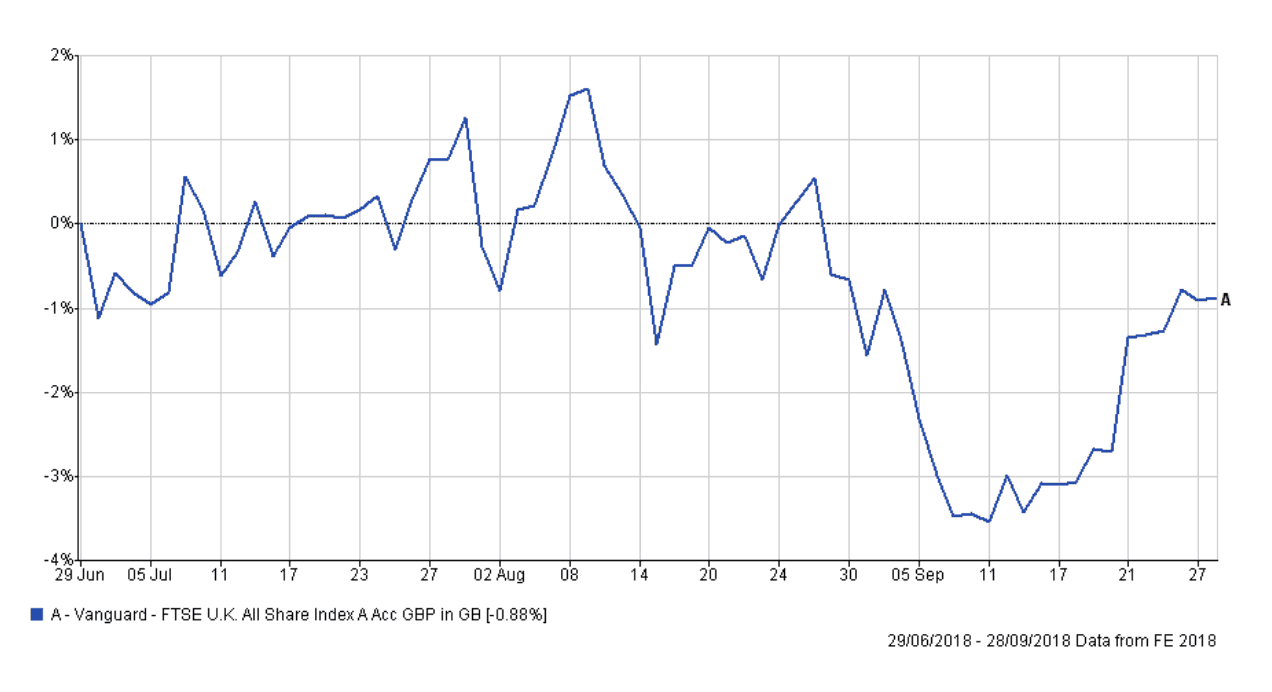

Here is a chart of the FTSE all-share Index for the Third Quarter:

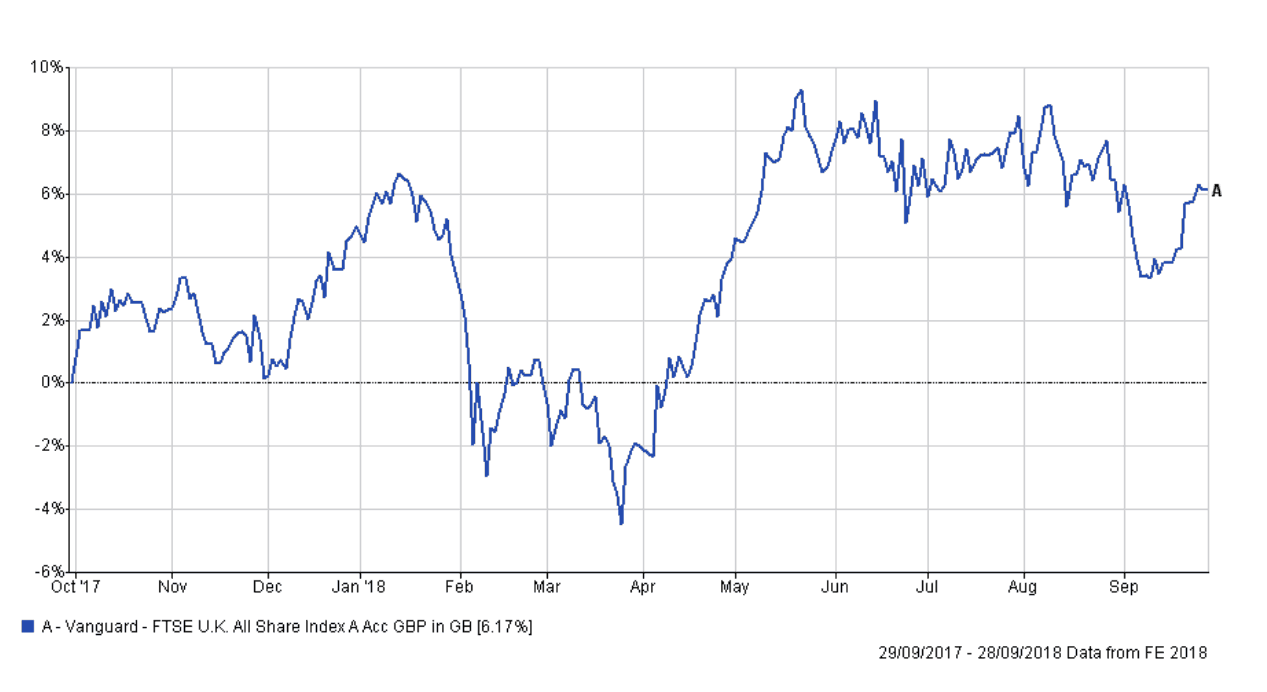

…and the last 12 months:

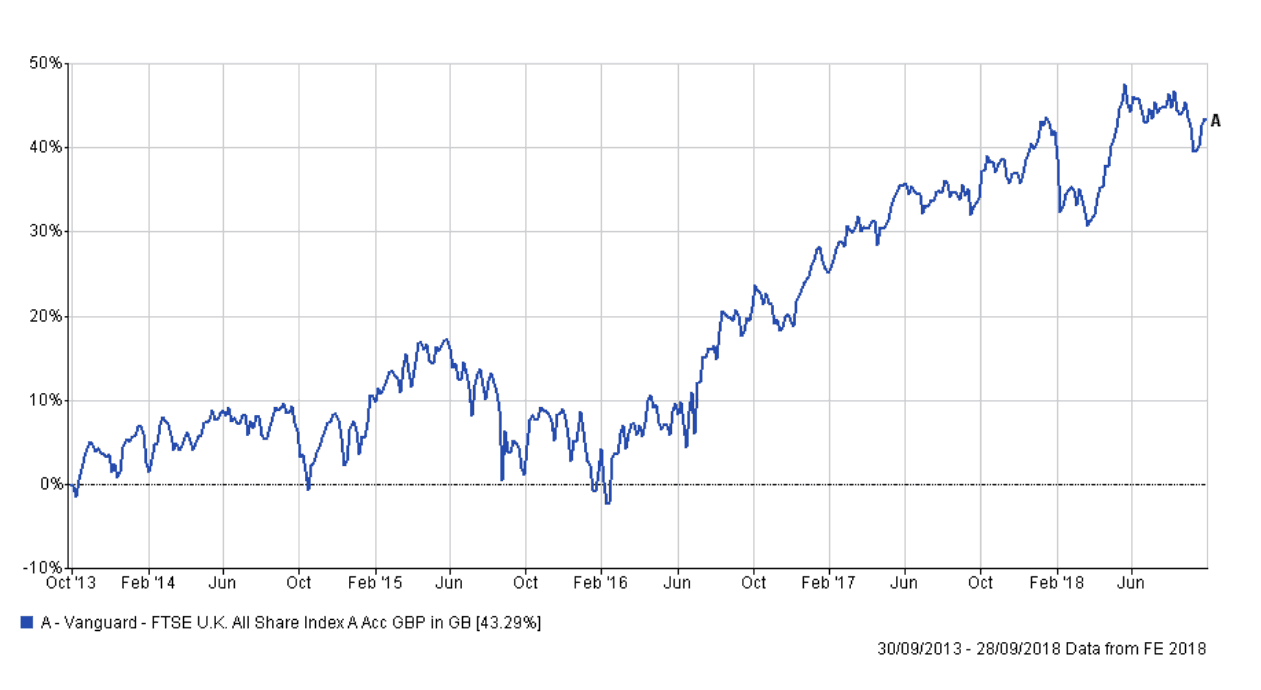

…and the previous 5 years:

Portfolio Performance

I enclose tables showing the performance of all portfolios over various time periods to the 30 September 2018.

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 30th September 2018 |

One year Performance to 30th September 2018 |

|---|---|---|

| Cautious Portfolio | +0.8% | +4.1% |

| Average Mixed Investment fund (20-60% shares) | +0.7% | +2.6% |

| Balanced Portfolio | +1.6% | +8.2% |

| Average Mixed Investment fund (40-85% shares) | +1.4% | +5.3% |

| Adventurous Portfolio | +1.0% | +7.4% |

| Average Flexible Investment Fund | +1.4% | +5.3% |

| FTSE all share index | -0.8% | +5.8% |

| FTSE world index exUK (£) | +6.6% | +14.7% |

| IBOX Gilt Index | -1.8% | +0.5% |

Long-term performance

| Parmenion Portfolio/Index | Three year Performance to 30th September 2018 |

Five year Performance to 30th September 2018 |

|---|---|---|

| Cautious Portfolio | +19.7% | +36.2% |

| Average Mixed Investment fund (20-60% shares) | +22.1% | +28.7% |

| Balanced Portfolio | +33.2% | +67.2% |

| Average Mixed Investment fund (40-85% shares) | +32.6% | +40.9% |

| Adventurous Portfolio | +44.0% | +67.2% |

| Average Flexible Investment Fund | +35.6% | +42.3% |

| FTSE all share index | +38.4% | +43.5% |

| FTSE world index exUK (£) | +75.5% | +100.0% |

| IBOX Gilt Index | +9.5% | +26.0% |

Cautious Portfolio

The Cautious Portfolio gained +0.8% over the third quarter just out-performing the its benchmark (the average mixed investment (20-60% shares) fund) which gained +0.7%. All our international equity investments made reasonable gains with some funds that have US exposure adding over 5.0%. Our allocation to UK equities either flat-lined or made modest losses. This portfolio has significant exposure to lower risk fixed-income securities and against the backdrop of increasing interest rates in the US these lost a little value.

Over the previous quarter we changed how we invest cash and switched from a conventional bank account into funds that invest in short-term money market instruments, to try to improve returns on this money.

Balanced Portfolio

The Balanced Portfolio gained +1.6% over the third quarter, just out-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +1.4%. All our international equity investments made reasonable gains with some funds that have US exposure adding over 5.0%. Our allocation to UK equities produced mixed returns with some funds posting modest gains and others modest losses. This portfolio has some exposure to lower risk fixed-income securities and against the backdrop of increasing interest rates in the US these lost a little value.

Over the previous quarter we changed how we invest cash and switched from a bank account into funds that invest in short-term money market instruments, in an attempt to improve returns on this money.

Adventurous Portfolio

The Adventurous Portfolio gained +1.0% over the third quarter, under-performing its benchmark (the average Flexible fund) which gained +1.4%. International equity funds focused on Western markets made reasonable gains with some funds adding over 5.0%. However, funds with an Asian or Emerging market focus lost money, due to the strength of the US$, and were down one or two percent. Our modest holdings in fixed interest securities also lost a little value due to interest rates creeping up in the US.

Over the previous quarter we changed how we invest cash and switched from a bank account into funds that invest in short-term money market instruments, in an attempt improve returns on this money.

Outlook

Markets face a combination of gently slowing growth, modest but progressive increases in rates of interest, increasing inflation and trade tensions. All these issues emanate from the US, where the Trump inspired cuts in Corporation tax threaten to blow the lid off the an already booming economy. Short-term this is positive, but markets focus on the medium to long-term and the medium-term outlook is not so positive.

I’m surprised that markets have proved to be resilient in the face of these concerns, probably supported by strong corporate profits and dividend growth achieved before American interest rates started to rise.

We maintain our cautious stance.

Category: Investment Report, News