16 July 2021

Investment Report Second Quarter 2021

;)

The second quarter of 2021 saw an acceleration of progress for all markets with the global index increasing by +7.2%. The American market increased by +9.1% and the UK market gained +5.6%.

Markets were focussed on the roll-out of vaccine programmes world-wide and a very positive economic outlook everywhere. Concerns about an increase in inflation abated as investors took the view that this was more likely to be a blip than a trend. Lower-risk fixed-income investments (gilts and bonds) gained modestly in value reflecting these views, as forecasts of a benign inflationary environment is generally good for these investments.

The UK commercial property market continued to make modest steady gains, recovering some of the lost ground that occurred when the COVID pandemic hit.

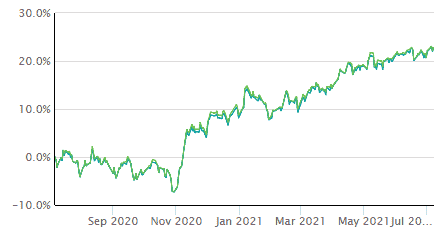

Here is a chart of the FTSE All-share Index for the previous 12 months:

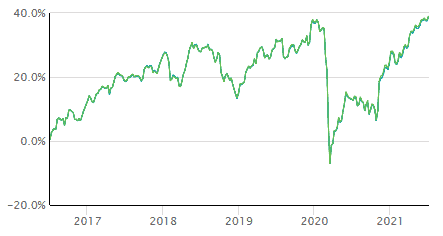

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 30 June 2021;

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 30 June 2021 |

One year Performance to the 30 June 2021 |

|---|---|---|

| Cautious Portfolio | +3.9% | +10.7% |

| Average Mixed Investment fund (20-60% shares) | +3.6% | +12.7% |

| Balanced Portfolio | +5.7% | +19.3% |

| Average Mixed Investment fund (40-85% shares) | +4.9% | +17.2% |

| Adventurous Portfolio | +6.6% | +24.0% |

| Average Flexible Investment Fund | +5.1% | +19.4% |

| FTSE all share index | +5.6% | +21.4% |

| FTSE world index ex UK (£) | +7.6% | +25.8% |

| IBOX Gilt Index | +1.7% | -6.2% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 30 June 2021 |

Ten year Performance to the 30 June 2021 |

|---|---|---|

| Cautious Portfolio | +35.7% | +82.9% |

| Average Mixed Investment fund (20-60% shares) | +32.0% | +64.8% |

| Balanced Portfolio | +57.8% | +115.2% |

| Average Mixed Investment fund (40-85% shares) | +47.8% | +93.1% |

| Adventurous Portfolio | +74.0% | +141.7% |

| Average Flexible Investment Fund | +52.0% | +92.9% |

| FTSE all share index | +36.8% | +85.4% |

| FTSE world index ex UK (£) | +101.5% | +234.9% |

| IBOX Gilt Index | +10.5% | +58.0% |

PORTFOLIO REVIEW

All Portfolios

All portfolios made strong gains during the second quarter of 2021. Markets continued to make good progress as vaccine programs were rolled out round the world and investors looked forward to a resumption of normal economic activity.

Fixed interest securities also posted modest gains along with commercial property.

Cautious Portfolio

The Cautious Portfolio gained +3.9% over the quarter out-performing its benchmark (the average mixed investment (20-60% shares) fund) which gained +3.6%.

Investments in Europe and the US enjoyed the strongest returns. Our small investment in European real estate also produced sparkling returns of +10.4%

Over the quarter we sold the BNY Global Income fund after 10 years of support, due to underperformance, and switched into the UK market where we think there is good recovery potential. We also sold a fixed-income fund from Artemis that we had also supported for a decade and bought a “Real return” fund from BNY Mellon. This fund provides exposure to a diversified range of investments such as commodities and infrastructure.

Balanced Portfolio

The Balanced Portfolio gained +5.7% over the quarter, outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +4.9%.

Investments in Europe and the US enjoyed the strongest returns. Our investment is European real estate also produced sparkling returns of +10.4%.

No changes were made to this portfolio over the quarter.

Adventurous Portfolio

The Adventurous Portfolio gained +6.6% over the quarter, outperforming its benchmark (the average Flexible fund) which gained +5.1%.

Two of the fund’s largest holdings put in sparkling returns with Liontrust Sustainable Future Global Growth gaining +10.4% and Premier Pan-European Property Share growing by +10.4% also.

No changes were made to this portfolio over the quarter.

OUTLOOK

There are still well-founded concerns about the valuation of stocks in the US market, where there is a debt-fuelled bubble in the technology sector. A period of consolidation would be welcome, so that company earnings could catch up with elevated share prices.

COVID-related risks rumble on, with concerns that the new “Delta” variant could prevent economies from fully reopening.

Concerns about inflation have eased, but consumers have yet to be hit with the full impact and historically, price rises have led to a spiral of rising wage claims. The jury is still out on this issue.

Jim Aitkenhead BA(Hons)Econ FCII APFS ASCI

Chartered Financial Planner

Category: Investment Report, Investments, News