Recent market movements have been positive with the second quarter ushering in a strong recovery in investment values. In the US the market is almost at its previous all-time high. In the UK we are some 18% lower than the previous peak, due to currency issues and the fact that the UK has few (if any) large technology firms. In the US these companies (like Microsoft and Amazon) have gone from strength to strength.

Further cheer has greeted the progressive ease in lock-down regulations round the world and a slow resumption of economic activity.

In the UK commercial property funds remain suspended as there are no transactions with which to determine property valuations.

Fixed interest securities have made strong gains as the governments round the world recommenced bond-buying programs that were a feature of the credit crunch a decade ago. This has caused all types of bond, including corporate bonds, to improve in value significantly.

The swift recovery in markets has puzzled many investors as it seems too much too soon. One could understand a quick bounce in the markets if economic activity followed a V shape – a sharp drop followed by a quick recovery, but many think we are in for a U-shaped recovery – a long slow restoration of business activity. Valuations have rebounded mostly due to the monetary stimulus injected into financial markets by almost all governments round the globe. However, whilst many obvious sectors of the economy (such as travel, tourism and hospitality) clearly have massive issues, many companies (such as on-line retailing, cardless transactions or computer gaming) have received a massive boost. Its not all doom and gloom out there!

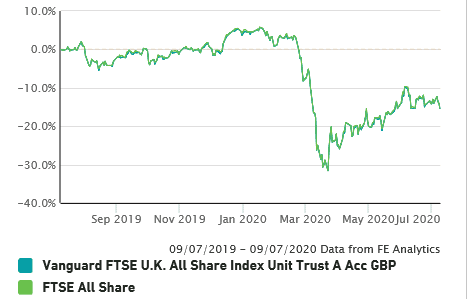

Here is a chart of the FTSE All-share Index for the previous 12 months:

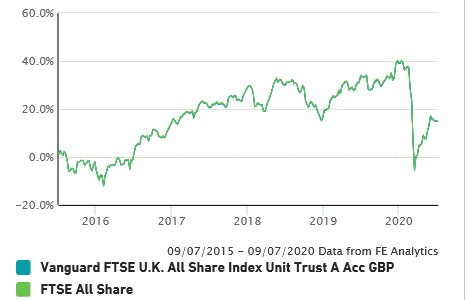

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 30 June 2020;

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 30 June 2020 |

One year Performance to 30 June 2020 |

|---|---|---|

| Cautious Portfolio | +7.7% | +1.4% |

| Average Mixed Investment fund (20-60% shares) | +10.3% | -0.6% |

| Balanced Portfolio | +12.8% | +1.6% |

| Average Mixed Investment fund (40-85% shares) | +13.1% | -0.1% |

| Adventurous Portfolio | +15.2% | +1.9% |

| Average Flexible Investment Fund | +13.5% | +0.3% |

| FTSE all share index | +10.1% | -12.9% |

| FTSE world index ex UK (£) | +20.4% | +6.9% |

| IBOX Gilt Index | +2.5% | +11.9% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to 30 June 2020 |

Ten year Performance to 30 June 2020 |

|---|---|---|

| Cautious Portfolio | +23.9% | +87.9% |

| Average Mixed Investment fund (20-60% shares) | +19.3% | +60.4% |

| Balanced Portfolio | +36.6% | +107.8% |

| Average Mixed Investment fund (40-85% shares) | +28.4% | +88.6% |

| Adventurous Portfolio | +47.2% | +129.5% |

| Average Flexible Investment Fund | +43.1% | +88.7% |

| FTSE all share index | +15.1% | +91.8% |

| FTSE world index ex UK (£) | +85.1% | +225.1% |

| IBOX Gilt Index | +35.8% | +79.1% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio gained +7.7% over the quarter under-performing its benchmark (the average mixed investment (20-60% shares) fund) which gained +10.1%. The cautious portfolio lost significantly less than the benchmark when markets crashed, and thus gave investors a much smoother ride.

No changes were made to the portfolio this quarter although it was rebalanced in March. This meant we would have sold some of the bonds that had risen in value, buying cheap shares.

Balanced Portfolio

The Balanced Portfolio gained +12.8% over the quarter, under-performing its benchmark (the average mixed investment (40-80% shares) fund) which gained +13.1%.

During the quarter we sold an investment manager I had supported for over 20 years; Marlborough Special Situations, run by an industry veteran called Giles Hargreaves. This has produced spectacular returns for customers over a long period of time, but has now simply grown too large and the manager is retiring. We replaced it with an FTSE All share index tracker which looked to be good value at the time.

Adventurous Portfolio

The Adventurous Portfolio gained +15.2% over the quarter, out-performing its benchmark (the average Flexible fund) which gained + 13.3%.

During the quarter we sold an investment manager I had supported for over 20 years; Marlborough Special Situations, run by an industry veteran called Giles Hargreaves. This has produced spectacular returns for customers over a long period of time but has now simply grown too large and the manager is retiring. We replaced it with a FTSE All share index tracker which looked to be good value at the time.

OUTLOOK

Markets have bounced back very quickly. The more international exposure your portfolio includes the better; not only have all international markets outperformed the UK, but there were currency gains to boot. I think this is a trend that will continue and we are therefore slowly increasing our exposure to global markets at the expense of the UK.

Where we go from here depends on the success in finding a vaccine for COVID 19 and whether local outbreaks can be contained. There is also the change in consumer behaviour to consider. If the virus is beaten but the public no longer wishes to visit their local pub or high street, we might be in for a long slow recovery rather than a sharp bounce back.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner