PARMENION ASSET ALLOCATION (STRATEGIC SOLUTIONS)

Before I get into my review of the fourth quarter (and 2020 generally) I have important news about the following Parmenion investment solutions. These solutions are used extensively by us at HA&W and so the changes being made affect a lot of customers.

What I’m about to say applies to;

- PIM Strategic Multi Option (active & passive)

- PIM Strategic Passive

- PIM Strategic Conviction

- PIM Tactical Active

- PIM Tactical Passive

These changes DO NOT APPLY to the HA&W portfolios.

Significant changes don’t occur very often, so when they do it’s worth flagging up.

At the start of December strategic changes were made which;

- Reduced the amount of cash held in portfolios (if any)

- Reduced exposure to the UK markets in every portfolio

This reflected thinking by the Investment Committee at PIM who felt that the long-term prospects for the UK market were not especially good, but that the prospects for equity investment globally were. Negative views on the UK included; the impact of Brexit; the fact that we have no large ‘tech businesses in the UK and demographic factors, such as an ageing population, which tends to depress economic growth.

The change has the effect of reducing UK exposure in the equity asset class (which excluded bonds and property) from 61.5% to 41.6% in a “typical” risk grade 6 portfolio.

The cash component drops in a typical risk grade 4 portfolio from 15.0% to 10.0% (risk grade 6 having no cash anyway). The cash is being allocated to bonds and equities.

These changes were made after the UK enjoyed one of its strongest rises ever, which occurred in November and pushed the FT 100 share index up by over 14.0%.

Sadly, the change reflects the view that there are better places to invest your money than in the UK, although it’s worth emphasising that there are plenty of opportunities here and that our home market will always play a significant part in Parmenion portfolios. Indeed, it often surprises customers to learn exactly how much business many of our leading companies do overseas. Investing in the UK market can give an investor significant exposure to international business opportunities.

FOURTH QUARTER 2020

The fourth quarter of 2020 served up the largest gains for the UK market that have been seen for decades, with the FT100 share index rising by over 14.0%. The trigger was, of course, the news in early November that Pfizer BioNTech had created a successful vaccine. All markets globally participated in a “relief rally”, but the UK market enjoyed the largest gains as we have more businesses that are sensitive to COVID-related shutdowns; retail, travel & leisure, the oil industry and aerospace.

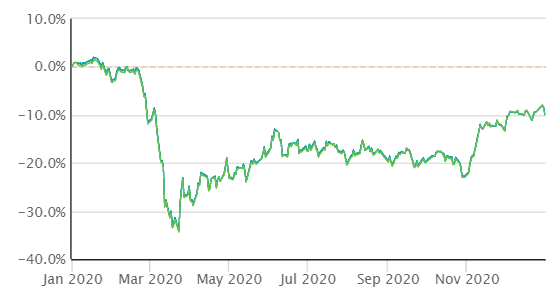

Here is a chart of the FTSE All-share Index for the previous 12 months:

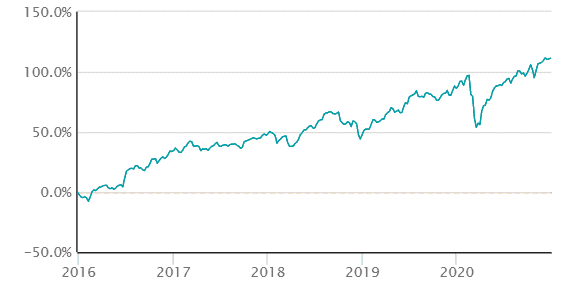

…and the previous 5 years:

Over the previous twelve months its not such a cheery picture with the FT100 share Index suffering its worst year since the 2008 financial crisis, falling by 14.3%. This is the poorest performance among the largest international stock indices and its biggest decline since 2008. The FTSE 100 has suffered from a total lack of technology stocks. They surged during 2020 as the pandemic forced “working from home”, creating a boom in video-conferencing and online shopping. It is for this reason that we and Parmenion (as mentioned above) are rethinking our allocation to the UK market.

While the FTSE 100 struggled, the US stock market is riding at an all-time high (see enclosed chart). The S&P 500 closed 16.2% up for the year at a new peak, with the technology-focused Nasdaq surging by 43.0%.

Here’s a chart of the S&P500 Index (the US market) over the previous 5 years

Germany’s DAX index ended the year up 3.6% and France’s CAC fell by around 7.0%. Japan’s index gained 16.0%, while China’s CSI 300 surged 27.0% during 2020. The strong rise in China’s index is noteworthy. This reflects the fact that Asian countries dealt with the pandemic better than us in the west and that China is rapidly becoming a desirable investment location as opposed to an “emerging market”. Chinese ‘tech stocks, in particular, are good value compared with their US equivalents. We have exposure to China in our higher-risk portfolios.

A significant part of our UK exposure is in smaller and medium-sized companies. These faired better than larger companies and The FTSE 250 index of medium-sized companies, more focused on the UK economy, fell by 6.4% during 2020 and hit a 10-month high earlier this week.

Our more cautious investment portfolios are populated by a mixture of Sovereign and Corporate Bonds. Sovereign bonds include things like Gilts and US Treasuries. Corporate Bonds are long-term loans issued by business and industry. All of these investments made handsome gains over the UK due to a number of reasons;

- When the pandemic struck there was a flight to safety, which benefited Sovereign Bonds in particular.

- Action by central banks included buying all types of bonds. This pushed up their price.

These two factors meant that cautious portfolios held assets that went up in value whilst the markets were falling and helped give investors a smooth ride. This does mean, however, that the yield on bonds is now very low.

The central bank action also propped up the markets and initially led to the recovery in share prices that occurred in April and May.

Commercial property has been in the doldrums all year with most property funds being suspended from trading. The property managers need a steady flow of transactions to put an accurate valuation on the properties they own and until the fourth quarter, there were no transactions occurring. The funds are now open for trading and the fund we use primarily (L&G) is now gently appreciating in value.

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 31 December 2020;

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to the 31 December 2020 |

One year Performance to the 31 December 2020 |

|---|---|---|

| Cautious Portfolio | +5.4% | +4.4% |

| Average Mixed Investment fund (20-60% shares) | +6.5% | +3.5% |

| Balanced Portfolio | +8.4% | +6.6% |

| Average Mixed Investment fund (40-85% shares) | +8.0% | +5.3% |

| Adventurous Portfolio | +9.9% | +9.0% |

| Average Flexible Investment Fund | +8.7% | +6.7% |

| FTSE all share index | +12.6% | -9.8% |

| FTSE world index ex UK (£) | +8.5% | +14.1% |

| IBOX Gilt Index | +0.4% | +8.8% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to the 31 December 2020 |

Ten year Performance to the 31 December 2020 |

|---|---|---|

| Cautious Portfolio | +29.5% | +80.0% |

| Average Mixed Investment fund (20-60% shares) | +29.8% | +59.4% |

| Balanced Portfolio | +47.5% | +102.6% |

| Average Mixed Investment fund (40-85% shares) | +42.1% | +81.9% |

| Adventurous Portfolio | +62.4% | +115.6% |

| Average Flexible Investment Fund | +45.7% | +79.4% |

| FTSE all share index | +24.4% | +71.9% |

| FTSE world index ex UK (£) | +102.3% | +206.8% |

| IBOX Gilt Index | +32.2% | +75.0% |

PORTFOLIO REVIEW

All Portfolios

I’d like to draw everyone’s attention to a rather remarkable point for a moment; if you refer to the table above and look at the one-year data you can see that the UK market FELL by -9.8%, yet global markets INCREASED by +14.1%. This is an outstanding divergence and demonstrates the virtue of having a diversified portfolio of investments. Part of the difference is due to currency changes (Sterling weakness), but most of it reflects the unremitting unpopularity of our domestic market. There’s more about this issue below.

All portfolios enjoyed super returns in the final quarter of 2020 as news that the Pfizer BioNTech vaccine had aced trials in the US. This has been a game-changer for markets which roared up, led by the UK market which gained over 14.0% in November.

Commercial property funds reopened for trading towards the end of the year too, which meant investors who wished to sell their investment could do so.

Corporate debt (which features especially in lower-risk portfolios) made decent gains reflecting an improved outlook for business and industry.

Cautious Portfolio

The Cautious Portfolio gained +5.4% over the quarter underperforming its benchmark (the average mixed investment (20-60% shares) fund) which gained +6.5%. The cautious portfolio’s relative underweight allocation to the UK market was a negative factor. By way of demonstrating the strength of the UK market one holding, HSBC FTSE250 index, increased in value by 18.4% in three months! Even our beleaguered investment in the UK property market (via L&G Property) increased in value by 2.0%.

Towards the end of the year, we sold a long-term holding in Asia managed by Schroder’s after a period of under-performance, replacing it with a fund from Fidelity. We also added a new holding in the Fidelity Emerging Market Fund. This purchase was funded by reducing the cash in the portfolio. We think that these regions will perform well in 2021.

Balanced Portfolio

The Balanced Portfolio gained +8.4% over the quarter, just outperforming its benchmark (the average mixed investment (40-80% shares) fund) which gained +8.0%. By way of demonstrating the strength of the UK market, one holding, HSBC FTSE250 index, increased in value by 18.4% in three months! Even our beleaguered investment in the UK property market (via L&G Property) increased in value by 2.0%.

During the quarter we trimmed exposure to the UK market as part of a long-term aim of increasing the allocation to global equities. We increased our exposure to Emerging markets in anticipation of good performance in 2021.

Adventurous Portfolio

The Adventurous Portfolio gained +9.9% over the quarter, outperforming its benchmark (the average Flexible fund) which gained +8.7%. Our heavy exposure to the Chinese market boosted our relative performance. By way of demonstrating the strength of the UK market, one holding, HSBC FTSE250 index, increased in value by 18.4% in three months! Even our beleaguered investment in the European property market (via premier/Miton) increased in value by 10.3%.

At the end of the year, we cut exposure to Sovereign debt (gilts and the like) and bought more Asian and Emerging market equities with Fidelity in anticipation of good performance in 2021.

OUTLOOK

There are obvious concerns due to the COVID pandemic. We are really in for a tough time in the UK with hospitals now overflowing with very sick patients. However, markets look to the future and things have changed rapidly as we moved through the Autumn and into 2021;

- The US election; whilst the latest news from the US is horrible with the Senate being stormed by Trump’s thugs and death rates due to COVID escalating, the election result has turned out to be a big positive. This wasn’t due to what happened on election day – a Biden win is, unfortunately, a negative for the markets due to his “tax and spend” policy. However, now the Democrats have control of the Senate they can push their agenda through, which includes a larger COVID stimulus package and greater investment in infrastructure, which is expansive for the economy.

- In the UK market, we now have our BREXIT (Brexmass?) trade deal which looks OK and we have the vaccine. The upshot from this is that what has been the West’s pariah market is now attracting global investors, resulting in a period of out-performance, which I think will run into the Spring.

- Looking at a wide range of economic indicators it is clear that the global economy is in a recovery phase. This means that the outlook for equity investment is positive and we have therefore upped our allocation to shares, especially in Asia and Emerging Markets. The reason for this is that in a global recovery these areas should perform better than most markets.

There are, as ever, concerns;

- The valuation of most markets (UK excepted) is relatively high, although there’s some value in Europe and Asia. We have reasonable allocations to these areas.

- The value of some components in the US market is in bubble territory, specifically the technology sector. Every client has some exposure to this sector as one can’t (or doesn’t want to) avoid the US ‘tech companies as they have delivered such superb returns for many years. However, investments in the US needs to be considered carefully.

- The most obvious concern is that a new strain of the virus becomes resistant to a vaccine. I suspect that the vaccine will become an annual event like the flu jab and new formula will be produced each year to deal with this issue.

- Finally, all the funds pumped into markets could be inflationary, as its too easy and too cheap for anyone, or any business to borrow money. There is a wall of money people have saved whilst in lock-down. Once unleashed the price of many goods in the shops (holidays, eating out etc) could rise. Inflation leads to higher interest rates which tend to upset investment markets.

I do however feel optimistic about markets going into 2021. I’m also optimistic that we will all get through the pandemic and life will return to normal over time. By summer things will look far more positive.

I wish all investors and customers a happy, prosperous and above all, healthy New Year.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner