2020 started well, but we’ve now been hit by the Coronavirus pandemic. This initially affected Asian markets when China went into “lock down”. The long-term impact for the world is uncertain. Short-term, economic activity in the West has all but ceased. Previously, viruses (Spanish flu excepted) caused deaths measured in thousands, not millions, but the complexity of the modern world with regards to business and trade is such that quarantine measures are very disruptive.

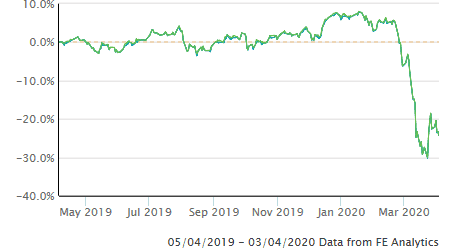

The markets finally woke up to the potential of this disruption when the virus spread to Italy over a month ago and global markets crashed, now falling around 30%. Northern Italy appears to have been especially vulnerable to the virus due to an aged population, an unusually large number of smokers and a patchy health care system.

A combination of population lockdown and an immediate loss of customers in some business sectors (eg travel and tourism) means that without Government support many businesses might not survive. This support appears to be forthcoming with Governments around the world offering a combination of financial packages for companies large and small, benefits for individual employees to keep them in funds and more general monetary stimulus measures. We may end up in a situation where there’s a drop of “helicopter money” which was tried recently by the Hong Kong government to try to get consumers spending in the shops again.

In my opinion, most reasonably sized businesses won’t go bust. Either companies have enough cash to ride out the storm (especially if 80% of their staff costs are covered) or governments will bail them out. This is OK for the long-term but in the short term, the tremendous uncertainty regarding prospects for almost every business means that they are impossible to value. Combine this with a “flight to safety” and you can see why markets have crashed.

In these circumstances, the lower-risk investments that populate most portfolios have performed well. Safe-haven investments, like government bonds, rise in value when equity markets suffer a large sell-off. This helps reduce the volatility of most portfolios. Other bonds which are loans to business and industry have fallen in value. These Corporate Bonds are valued on the ability of the borrower to repay and for many companies, this is a potential problem now.

The UK commercial property market is now in difficulty. Many tenants are unable to pay their rent, but landlords have no other prospective tenants at the moment. Valuers’ find it impossible to determine property values, so property funds have suspended trading, as to either buy or sell units in a property fund at present might disadvantage the buyer or the seller or both.

Generally, client’s exposure to the property sector is light.

Customers have three elements of protection;

1. Your asset allocation; most investors have a balanced portfolio with many components. The cautious elements have either risen in value or fallen a little, cushioning larger falls in the equity markets.

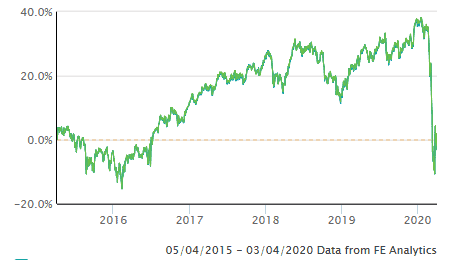

2. Time; all our clients invest for the long-term. Markets will recover (as will the underlying economies of the world) given time.

3. Scale; most portfolios invest in larger companies which are more resilient when there’s an economic downturn.

Here is a chart of the FTSE All-share Index for the previous 12 months:

…and the previous 5 years:

PORTFOLIO PERFORMANCE

I enclose tables showing the performance of all portfolios over various time periods to the 31 March 2020;

Short-term performance

| Parmenion Portfolio/Index | Three months Performance to 31 March 2020 |

One year Performance to 31 March 2020 |

|---|---|---|

| Cautious Portfolio | -8.6% | -2.8% |

| Average Mixed Investment fund (20-60% shares) | -12.8% | -7.1% |

| Balanced Portfolio | -14.5% | -5.6% |

| Average Mixed Investment fund (40-85% shares) | -15.4% | -7.9% |

| Adventurous Portfolio | -16.2% | -12.5% |

| Average Flexible Investment Fund | -15.5% | -13.1% |

| FTSE all share index | -25.1% | -18.4% |

| FTSE world index ex UK (£) | -15.6% | -5.2% |

| IBOX Gilt Index | +6.9% | +10.6% |

Long-term performance

| Parmenion Portfolio/Index | Five year Performance to 31 March 2020 |

Ten year Performance to 31 March 2020 |

|---|---|---|

| Cautious Portfolio | +13.2% | +67.8% |

| Average Mixed Investment fund (20-60% shares) | +6.0% | +39.9% |

| Balanced Portfolio | +19.0% | +74.9% |

| Average Mixed Investment fund (40-85% shares) | +10.7% | +55.3% |

| Adventurous Portfolio | +25.5% | +84.0% |

| Average Flexible Investment Fund | +10.4% | +53.0% |

| FTSE all share index | +2.8% | +118.2% |

| FTSE world index ex UK (£) | +45.3% | +213.6% |

| IBOX Gilt Index | +27.5% | +73.1% |

PORTFOLIO REVIEW

Cautious Portfolio

The Cautious Portfolio lost -8.6% over the first quarter out-performing its benchmark (the average mixed investment (20-60% shares) fund) which lost -12.6%.

Markets plunged during the quarter due to the CV19 Pandemic. Most of our funds performed very well during a very difficult time with our Environmental, Social & Governance fund run by Liontrust holding up very well. The Gilts we purchased in December last year rallied and supported the portfolio value. A long-term favourite; BNY Mellon Global Income (this was Newton Income) held up well also as did Miton Multicap Income where the manager shrewdly held a “Footsie put” which helped mitigate the fall in the markets.

No changes were made to the portfolio this quarter although it was rebalanced in March. This meant we would have sold some of the investments that had risen, buying cheap shares.

Balanced Portfolio

The Balanced Portfolio lost -14.5% over the first quarter, out-performing its benchmark (the average mixed investment (40-80% shares) fund) which lost – 15.4%.

Markets plunged during the quarter due to the CV19 Pandemic. Most of our funds performed very well during a very difficult time with our Environmental, Social & Governance fund run by Liontrust holding up very well. The Gilts we purchased in December last year rallied and supported the portfolio value. Miton Multicap Income, where the manager shrewdly held a “Footsie put” out-performed. Our holdings in Europe, Asia and Emerging markets all with Fidelity performed relatively well (ie they lost less money than their respective benchmarks).

International investments all were supported by Sterling which weakened by 10% in March.

No changes were made to the portfolio this quarter although it was rebalanced in March. This meant we would have sold some of the investments that had risen buying cheap shares.

Adventurous Portfolio

The Adventurous Portfolio lost -16.2% over the first quarter, underperforming its benchmark (the average Flexible fund) which lost -15.5%. Our relatively high exposure to smaller companies hurt performance, although this was reduced during the quarter.

International investments were supported by Sterling which weakened by 10% in March. Our holding in Liontrust SF Global Growth (an Environmental, Social and Governance fund) held up very well in the sell-off as did our Asian, Emerging Market and European investments managed by Fidelity.

In February we sold a long-term holding; Marlborough Special Situations and bought the FTSE All share index. We got this at a good price as it had fallen far more in the sell-off than the fund we sold.

OUTLOOK

The short-term outlook is dire; companies will pass their dividends and many have zero turnover. It’s all about survival. Most businesses will survive but it will probably take over a year to fully return to normal.

There is a possibility that markets suffer another leg down as America finally wakes up to the severe impact of C’19.

By our nature man is resilient and inventive. So are many businesses. I do expect a significant recovery, but things may get worse before they get better.

Jim Aitkenhead BA(Hons)Econ FCII APFS ACSI

Chartered Financial Planner