12 February 2018

Meet the team

We are here to walk your financial journey with you.

;)

Investment Review

January was a flat month for investors. However, things changed at the start of February (see ‘Stop press’ below) as the US suffered a sharp fall which sent markets globally into a tail spin.

The UK market was down nearly 2.0% in January and was hit by the strength of Sterling, which steadily appreciated against both the US$ and the Euro. Whilst a strong GB Pound may have some benefits it depresses the value of overseas earnings enjoyed by British companies and thus is a negative factor for share prices.

Globally, markets made reasonable progress, but once again the strength of Sterling took its toll. So, a near 5.0% increase in the S&P 500 index (the US market) and a 2.5% increase in the value of the Eurostoxx50 index translated into a meagre gain of +0.4% in the Sterling based FT World Index.

Markets generally enjoyed good cheer in January, especially in the US, as Trump’s reduction in Corporation Tax became law. This will have the effect of boosting company profitability in the country.

In the fixed income markets valuations weakened significantly, as concerns emerged (especially in the US) that growth was too strong and this could result in the return of inflation.

In the UK commercial property market capital values increased gently as demand for office and distribution space remained strong.

Stop press

You will, no doubt, be aware of the major sell-off in markets that commenced just before the end of the month. This has entered official “correction” territory now, with both the UK and US markets falling by around 10%.

The markets were spooked by the monthly employment trends survey issued by the department of labour in the US. This indicated record levels of employment combined with a sudden increase in pay rates. As the cost of workers is a significant part any company’s overhead costs an increase in wages usually feeds through to inflation, which is deemed to be a bad thing – as the corrective action to subdue price rises is higher interest rates, something that reduces economic activity and hence company profitability.

Currently, most economies enjoy boom conditions, but even here in the UK, where economic growth has slowed significantly, the Governor of the Bank of England has had to warn of higher interest rates to keep inflation in check.

Another factor that caused the large sell-off, was simply that markets (and especially the US market) had risen very quickly – maybe too quickly – and was trading at elevated levels. Its not surprising that investors were quick to take profits.

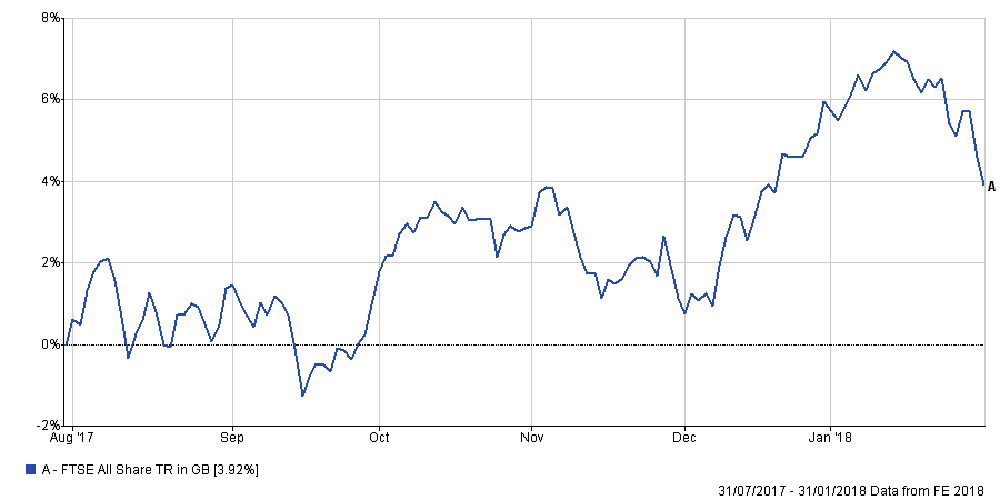

Here is a chart of the FTSE 100 share Index for the last six months:

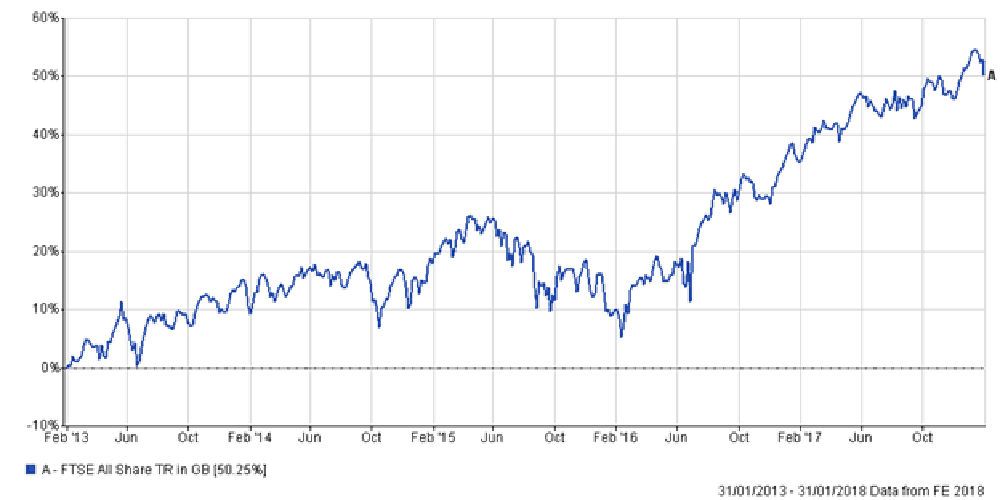

…and the last five years, which puts this into perspective:

Portfolio performances

I enclose tables showing the performance of all portfolios over various time periods to the end of January 2018.

Short-term performance

| Parmenion Portfolio/Index | Once month Performance to 31 January 2018 |

One year Performance to to 31 January 2018 |

|---|---|---|

| Cautious Portfolio | -0.7% | +7.3% |

| Average Mixed Investment fund (20-60% shares) | 0.0% | +6.7% |

| Balanced Portfolio | -0.2% | +12.3% |

| Average Mixed Investment fund (40-85% shares) | 0.0% | +9.4% |

| Adventurous Portfolio | -0.1% | +14.5% |

| Average Flexible Investment Fund | +0.6% | +10.7% |

| FTSE all share index | -1.9% | +11.2% |

| FTSE world index exUK (£) | +0.4% | +12.9% |

| IBOX Gilt Index | -2.0% | +1.6% |

Long term performance

| Parmenion Portfolio/Index | Three year performance to 31 January 2018 |

Five year performance to to 31 January 2018 |

|---|---|---|

| Cautious Portfolio | +16.0% | +40.4% |

| Average Mixed Investment fund (20-60% shares) | +16.9% | +32.4% |

| Balanced Portfolio | +26.8% | +52.6% |

| Average Mixed Investment fund (40-85% shares) | +24.5% | +46.1% |

| Adventurous Portfolio | +39.5% | +71.4% |

| Average Flexible Investment Fund | +26.8% | +47.9% |

| FTSE all share index | +17.4% | +50.2% |

| FTSE world index exUK (£) | +52.5% | +99.8% |

| IBOX Gilt Index | +5.6% | +24.3% |

Portfolio review

All portfolios lost a little value in January as the Strength of Sterling wiped out stock market gains in the overseas markets and the UK market was weak.

Cautious Portfolio

The Cautious Portfolio lost -0.7% in January under-performing the its benchmark (the average mixed investment (20-60% shares) fund) which was flat with no change.

All our UK equity funds lost around -1.5% over the month, but modest gains in overseas markets helped to offset this.

No changes were made to the portfolio this month.

Balanced Portfolio

The Balanced Portfolio lost -0.2% in January under-performing its benchmark (the average mixed investment (40-80% shares) fund) which was flat with no change.

Some of our UK equity funds lost around -1.5% over the month, although one fund (Marlborough Special Situations) turned in a profit. Modest gains in some overseas markets help offset these losses.

No changes were made to the portfolio this month.

Adventurous Portfolio

The Adventurous Portfolio lost -0.1% in January under-performing its benchmark (the average Flexible fund) which gained +0.6%.

Some of our UK equity funds lost around -1.5% over the month, although one fund (Marlborough Special Situations) turned in a profit. Overseas investment returns were very variable with no obvious trend. Some markets gained in value and others fell.

No changes were made to the portfolio this month.

Outlook

Globally, economic growth is strong and corporate profitability is improving – in some industries surging. This has created a favourable back-drop to the markets during 2016 and 2017.

The recent fall in markets world-wide indicate that investors are easily spooked, and the latest inflation scare might indicate the end of the long bull run in equities. So far one set of US earnings data has caused concern – but sufficient concern to push market interest rates up significantly. This scenario is usually bad for equity markets, as we have seen.

Its impossible to say whether we have seen the end of the current period of turmoil. In 2015 there was a similar “taper tantrum” – a market correction based on concerns that the era of easy money was going to be tapered away. This quickly passed and the upward movement of markets continued.

The future direction of markets all depends on whether inflation really is building in the US economy (and elsewhere) or not – and the jury is out on that issue.

Category: Investment Report, News

Join our team

Our vibrant culture starts with our people. We are looking for talented individuals to join our firm and become part of a team that does things differently. Learn more about the opportunities available to graduates or those wishing to develop their careers further.