26 October 2021

How to track down your lost pensions – and why you should

;)

This year, 31 October marks not only Halloween but the UK’s inaugural National Pension Tracing Day. Launched to coincide with the clocks going back, you’ll be urged to use the extra hour to trace your lost pensions.

And there are plenty out there, with an estimated value of more than £19 billion.

If you’ve had more than one job during your career, you’re likely to have more than one pension and you may well have lost track of some of the older ones. Around 1.6 million pensions are said to be “lost”, with an average pension pot of around £13,000.

Keep reading to find out how you can track down your pensions, plus why you should.

The Pension Tracing Service allows you to track down lost pensions

Interactive Investor’s Great British Retirement Survey 2021 gathered more than 10,000 responses to questions covering the coronavirus pandemic, the complexity of pension and tax rules, and views on ethical investing.

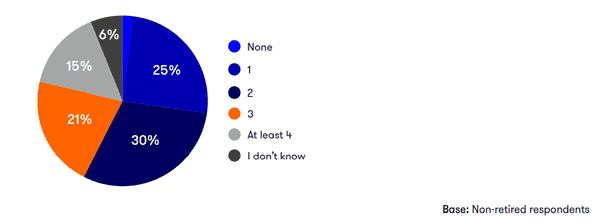

They found that two-thirds (66%) of non-retired respondents had more than one pension, while 6% didn’t know how many they held.

Source: Great British Retirement Survey 2021

If you aren’t sure how many pensions you hold, use National Pension Tracing Day to find out.

First, dig out any pension paperwork you have and think about the previous jobs you have held. You likely had a workplace pension and if you did you might still be able to trace it, even if you can’t find the relevant paperwork.

The government’s Pension Tracing Service can help you track down lost pensions. All you need is the name of your former employer or the company you set a personal pension up with.

The online portal will help you find up-to-date contact details for your provider, allowing you to get back in touch, reuniting you with your lost pension.

5 reasons why you should track down your lost pensions

1. It’s your money

Some older workplace pensions may have specific rules that mean you no longer have a pension entitlement. Leaving a particular employer might have extinguished your rights under that scheme, for example.

Where you do hold a pension entitlement, that money belongs to you and it’s important that you find it, even if you don’t immediately use it.

2. It will help you to keep track in the future

Putting the effort in now will save time and effort as your pension date approaches.

Tracking down your pension providers now means that you can file their contact details, request valuations, and re-engage with your lost pots. This should make you less likely to lose track of future pensions, even if you change jobs again.

3. Older plans might have higher charges, fewer fund choices, or poorer performance

Only when you find your old plans will you be in a position to see how well they are or aren’t doing. You might find that your old plans have high charges, are less flexible, or that they are failing to match the performance of other plans you hold.

Once you know this, you can consider moving the fund to a new scheme or even consolidating your smaller plans into your best-performing scheme, or the one with the lowest charges.

You’ll need to check for transfer fees before you make this decision, as a high transfer fee could negate the benefits of moving.

4. It’s easier to make sound retirement decisions when you have all the available information

If you are approaching retirement, you might be wondering if you can retire on your chosen date, or whether you’ll be able to afford the lifestyle you dream of.

You can only truly answer this question if you have all the available information. The extra value held in your lost pots could make all the difference between achieving your dream retirement on your chosen date or needing to work for longer.

5. You put yourself back in control

Knowing where all your pensions are means you have an idea of your overall pot and can begin to make realistic plans for your future, aligned with your long-term goals.

You might consider consolidating your plans into one pot to make them easier to keep track of. Equally, you might keep hold of smaller pots to take tax-efficiently later on or to leave untouched. Unused pensions are outside of your estate for Inheritance Tax purposes so the pensions you don’t touch could be passed on to a beneficiary on death, tax-free in some circumstances.

Whatever you choose to do, you will have regained control. And if you need advice before deciding on the best course of action for you, be sure to get in touch.

Get in touch

With vast sums currently held in lost pensions, this National Pension Tracing Day is a great time for you to dig out your old paperwork and take back control of your retirement.

Once you have, contact us to find out how our Chartered Financial Planners can help you put a retirement plan in place that is aligned with your goals.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

Category: News