10 December 2020

Emotional wellbeing: the benefits of regular financial advice

;)

At the start of the first UK lockdown in March almost half of UK adults reported suffering from average or high levels of anxiety. Instances of depression doubled from March to June compared to the same period in 2019.

According to the Office for National Statistics, those who needed to borrow money or use credit were twice as likely to report high anxiety. For those worried about their pension, the figure was 1.7 times.

The link between financial stability and emotional and mental wellbeing is well understood. Back in 2019, Salary Finance found that 40% of us are concerned about money. Those with financial worries, according to the 2018/19 survey, are:

- 3 times more likely to suffer from anxiety and panic attacks

- 4 times more likely to be depressed

Royal London has researched the link between financial advice and emotional wellbeing. It also looked at the benefits of receiving regular rather than one-off advice.

Here’s what their research found.

Those receiving financial advice have improved emotional wellbeing

According to the Royal London report, receiving financial advice can improve your emotional wellbeing.

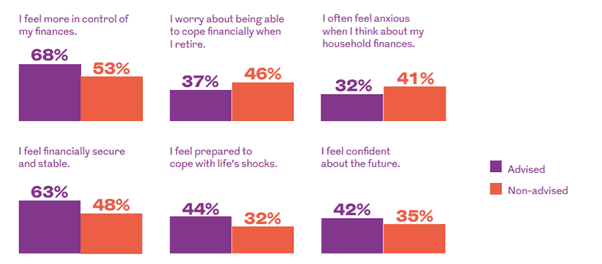

The survey asked participants a series of questions about their finances, including how in control they felt, how confident they were about their financial future, and whether household finances made them feel anxious.

The results show that those who seek financial advice have fewer concerns and feel more in control than those who don’t seek advice.

Source: Royal London

Building a strong relationship and taking regular advice from an adviser you know well, can be even more beneficial.

The survey suggests that by receiving regular financial advice you could see improvements in your overall emotional wellbeing in three key areas:

1. Having more confidence in your financial decisions

The Royal London survey found that those who sought advice had more confidence in their financial decisions and felt more ‘financially resilient.’ Those who saw their adviser more often, and therefore had regular access to financial expertise, felt even more confident.

Source: Royal London

With many decades of combined experience and financial expertise to draw from, HA&W can help you with all aspects of your financial position.

Speaking to us regularly can improve your knowledge of financial products. You can have confidence that the recommendations we make are based on achieving your long-term goals, whether they are for retirement, your investment portfolio, or for passing your wealth onto the next generation.

Having put a plan in place, our regular reviews will give you the peace of mind that you are on track. Get in touch with us now to book your review.

2. Feeling more in control of your future

There are many ways in which speaking to us can put you more in control of your finances.

The added confidence that comes from a boost in your finances will help, but we can also help you plan for the future through protection policies and insurance.

Planning for the unexpected and knowing that you and your family will be cared for should the worst happen is one way to put yourself back in control.’

Source: Royal London

Through regular reviews, you can keep us updated about your changing circumstances, aspirations, and priorities. Having regular input can increase your engagement in financial matters and improve your financial knowledge.

Advised clients are twice as likely to have protection.

If you have dependents reliant on your income, speak to us now. We can check what protection and life cover policies you currently have and build a plan to plug the gaps to ensure you and your family are all protected.

3. Peace of mind

Feeling confident in your own financial knowledge, and in control of your financial future, leads to peace of mind.

Regular financial advice means:

- Knowing that you have a plan in place to meet your financial goals

- Receiving regular reviews to check-in and make sure that your plan is still on track

- Knowing that your loved ones are financially protected

You can relax and enjoy the present, knowing that your future is covered, whatever it brings.

Get in touch

2020 has been an unprecedented year. As we emerge from a second England-wide lockdown into a tier-system and an uncertain start to 2021, keeping on top of your mental health and emotional wellbeing will be more important than ever.

Money worries can affect us all. Here at HA&W, we understand the benefits of holistic financial advice and will take all of your finances and personal circumstances into account to help build a realistic and attainable long-term plan to meet your goals.

Please contact us if you’d like to discuss any aspect of your finances or to find out how why we can put a long-term plan in place for you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Category: News, Personal finance, Wellbeing