22 February 2021

4 reasons not to hold too much cash

;)

Last year the coronavirus pandemic led to market uncertainty and a tricky time for investors. Meanwhile, many found their ability to save increased as lockdowns limited the opportunity for spending. Amid a global crisis, cash remained king.

There are good reasons to hold money in cash. It’s easily accessible, making it great for an emergency fund and the Financial Services Compensation Scheme (FSCS) will protect your cash savings – up to a set amount – if a financial institution fails.

But there are reasons to be wary of holding money in cash too. Here are four of the most important:

1. The impact of inflation

Interest rates on savings have been low since the 2008 financial crisis. After two drops to the Bank of England base rate in March 2020, banks have now been told to prepare for negative interest rates. More on this later.

Low interest rates don’t just mean you receive a small return on your savings. Your money could actually be losing money in real terms. This is due to inflation.

The Bank of England’s inflation calculator shows the effective drop in the value of your savings in real terms.

If you held £10,000 in savings in 2010, you could have used that amount to purchase goods and services to the value of £10,000. Within just ten years, though, with average inflation of 2.7%, those same goods and services would now cost you £13,112.60.

Your savings account interest rate is unlikely to have been 2.7% over that period. The £3,112.60, minus any interest you did earn, has been effectively lost.

2. We could see negative rates

Covid-19 has led to massive government borrowing and sent the UK economy into recession. The Office for National Statistics reports gross domestic product (GDP) fell by 9.9% in 2020.

Worries over job security, the threat of business closures, and months of lockdowns have seen us all reduce our spending.

Now the Bank of England has told banks to prepare for negative interest rates in the next six months. At the same time, they were quick to confirm that this doesn’t signal that a drop to negative rates is on the way.

Negative rates make it more expensive to hold money. Although you would normally expect to receive interest from your bank, if negative rates come into force, your bank could theoretically charge you for holding your cash with them.

In reality, even if negative rates were brought in, it is unlikely that your bank would pass them onto you. But the bank itself would face charges for keeping money with the central bank.

Negative rates have already been employed in Japan, Switzerland, and Denmark.

If you are holding a lot of your savings in cash, now might be an appropriate time to think about the other available options for your cash.

3. Investments statistically outperform cash holdings in the long term

Investment should always be a long-term proposition with a specific goal in mind. Whether you’re investing to supplement a pension in retirement or to help a grandchild through university, an investment will statistically see a better return than money held in cash.

Source: IG

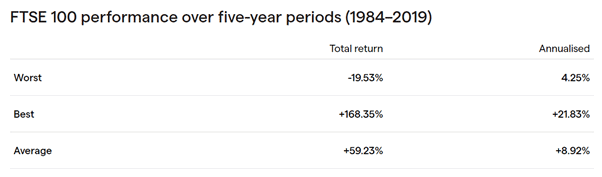

These figures from IG show returns on investments in the FTSE 100 over five-year periods between 1984 and 2019.

We know that the trend of the stock market is a generally upward one. A long-term investment allows time for your funds to recover from short-term periods of market volatility, such as those seen in the wake of the pandemic’s arrival in March 2020.

With interest rates low, the biggest risk you could take might be taking no risk at all. An investment in the markets could see a healthier return on your money than holding it in savings and prevent you from losing money in real terms.

4. It’s important to have an emergency fund but you could be taxed on interest

It’s important to have an emergency fund held in cash. It will be easily accessible and there when you need it. We would recommend you keep between 3 to 6 months net income as a “rainy day” fund. With average monthly earnings in the UK around £2,000, that could be an emergency fund of £12,000 or more.

Your cash savings are protected by the FSCS up to £85,000. If you hold more than this amount and the financial institution holding your funds fails, you could lose everything over this threshold amount.

Large cash savings can also attract tax on the interest you make. Your Personal Savings Allowance is based on the rate of Income Tax you pay.

| Income Tax band | Personal Savings Allowance |

| Basic rate | £1,000 |

| Higher rate | £500 |

| Additional rate | £0 |

Source: Gov.uk

If you are in the basic-rate Income Tax band, you’ll pay tax on interest over £1,000. The threshold is £500 for higher-rate taxpayers.

Get in touch

Funds held in cash are great for emergencies but could lose value in real terms if they don’t keep pace with inflation.

Please contact us if you’d like to discuss investing for the first time, rebalancing an existing portfolio, or any other aspect of your long-term financial plans.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of, and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Category: News, Personal finance, Savings